The US dollar held its ground as Q3 reached its end. The first week of the last quarter features the all-important US Non-Farm Payrolls with a full buildup this time. In addition, we have a rate decision in Australia, a jobs report in Canada and more Here are the highlights for the upcoming week.

- US ISM Manufacturing PMI: Monday, 14:00. A small slide to 57.9 is expected now.

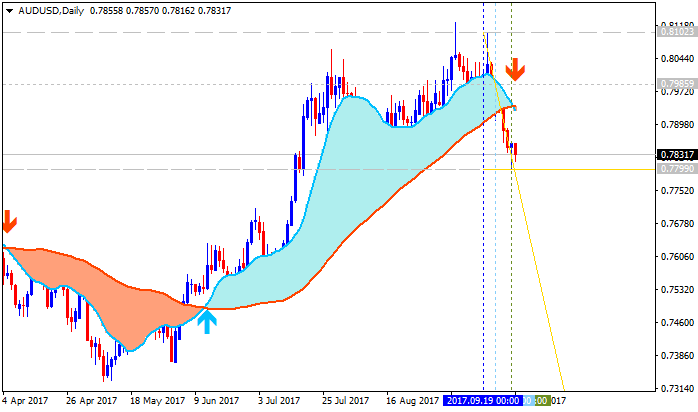

- Australian rate decision: Tuesday, 3:30. The Reserve Bank of Australia is firmly in “neutral”. In a recent public appearance by RBA Governor Phillip Lowe, he reiterated that interest rates are set to remain stable for the time being. The language about the Australian dollar will be interesting to watch in the statement. The RBA has complained about the exchange rate but not in an aggressive manner. Will it change now?

- UK Services PMI: Wednesday, 8:30. It is now projected to tick up to 53.3.

- ADP Non-Farm Payrolls: Wednesday, 12:15. A much lower number is forecast now: only 151K.

- ISM Non-Manufacturing PMI: Wednesday, 14:00. A similar figure is estimated for September: 55.5 points. The employment component is specifically eyed as a hint towards the NFP.

- Janet Yellen talks: Wednesday, 19:15. The Chair of the Fed delivers opening remarks at a conference in Saint Louis. She is not set to address monetary policy but any reflection on the latest data such as the drop in the core PCE, could move markets. In her latest speech in Cleveland, Yellen managed to strike a fine balance and did not add much onto what she said in the recent rate decision.

- ECB Meeting minutes: Thursday, 11:30. In its recent decision, the European Central Bank told us that it will probably make a decision in October. The minutes from that September meeting are released now, as we near the October meeting. Any details about the anticipated decision about QE tapering will move markets. A slower tapering will hurt the euro while a quicker end will boost it.

- US Non-Farm Payrolls: Friday, 12:30. The unemployment rate rose to 4.4% and no change is expected. Wage growth is no less important than the gain in jobs. The Fed still intends to raise rates in December, but if the data is not supportive, they could certainly change their minds.

- Canadian jobs report: Friday, 12:30. The Canadian jobs market is looking good in 2017. Back in August, the economy gained 22.2K jobs and the unemployment rate dropped to 6.2%. We could see some stability in job growth now.

- Bill Dudley talks: Friday, 16:15. The President of the New York Fed is often seen as No. 3. With the imminent retirement of No 2, Vice Chair Stanley Fischer, Dudley’s words become even more important. He used to be a dove, but in general, toes the line. Any hints about the timing of the next hike could move markets.

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks