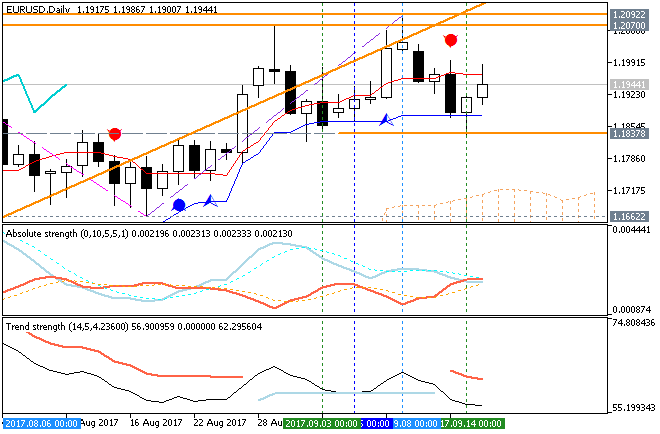

The US dollar staged an impressive recovery, based on better data, political calm and more. Is this a correction or a total change of trend? The highly anticipated Fed decision is easily the most important event.

- US housing data: Tuesday, 12:30. Housing starts were somewhat lower, at 1.16 million and are now projected to rise to 1.18 million.

- US Existing Home Sales: Wednesday, 14:00. They are expected to increase to 5.46 million now.

- Fed decision: Wednesday, 18:00, press conference at 18:30. The Fed is expected to announce the beginning of Quantitative Tightening or the beginning of reducing its 4.5 trillion dollar balance sheet. Fed Chair Janet Yellen said it will be akin to “watching paint dry” and in any case, that will not be a surprise after the Fed talked about it for long months. The focus will be on the timing of the next interest rate hike. Will it happen in December, completing three hikes in 2017? Or has recently weak inflation undermined the chances? This is the big question for skeptical markets and the US dollar. The Fed will also release updated forecasts for growth, employment, and inflation. The biggest focus will be on the interest rate forecast, which will contain hints about future moves. Yellen will begin speaking at 18:30. Reporters will likely press her on the next rate hikes. The usual phrase about the Fed being “data dependent” will probably be heard more than once, but the general stance about the economy will set the tone. Other topics of interest will be comments about the stock market, the global economy, and oil prices. Markets could freeze just before the publication and go wild afterward.

- New Zealand GDP: Wednesday, 22:45.

- Japanese rate decision: Thursday, early morning, the exact time is unavailable.

- US jobless claims: Thursday, 12:30. At 284K last week, it is now expected to rise to 300K.

- Canadian inflation data: Friday, 12:30.

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks