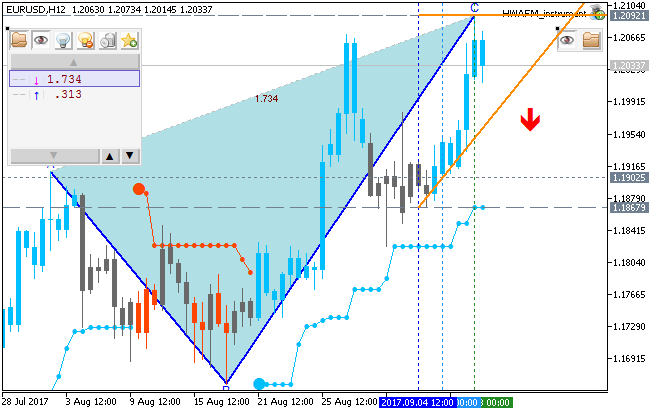

Looking ahead to the coming week, we do not have any major news from the Eurozone but we have the PPI and the CPI data from the US which should tell us about the inflation in the US and give us a hint of when the next rate hike from the Fed would be. With the pair closing the week above 1.20, we believe that the uptrend is still intact but the moves could be much slower than usual as the ECB is clearly uncomfortable with the euro being at these levels and the traders seem to be biding their time for a turnaround in the dollar strength. So, in the coming week, we could see the EURUSD make its way towards the 1.21 and then 1.22 region provided the US data is not too strong. Else, we could see the pair correct towards 1.18.

read more here

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks