The US dollar was under pressure but managed to stage a comeback. The upcoming week features rate decisions in Australia, Canada, and the euro-zone, as well as other events. Here are the highlights for the upcoming week.

- Australian rate decision: Tuesday, 4:30. Will they try to talk down the currency now?

- UK Services PMI: Tuesday, 8:30. The publication has a significant impact on the pound.

- Australian GDP: Wednesday, 1:30.

- US ISM Non-Manufacturing PMI: Wednesday, 14:00.

- Canadian rate decision: Wednesday, 14:00. This time, no change is expected, but the accompanying statement will be closely watched for hints about a hike in October. All the options are on the table.

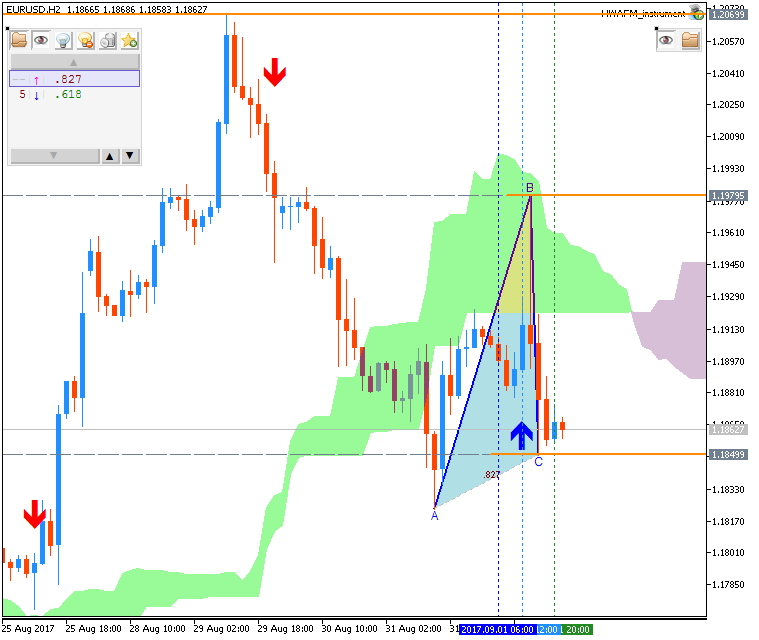

- ECB rate decision: Thursday, 11:45, press conference at 12:30. Will the ECB announce QE tapering? And what will the scale be? These are open questions that keep EUR/USD on the edge.

- Japanese GDP (final): Thursday, 23:50. Japanese GDP reads see significant revisions.

- Canadian jobs report: Friday, 12:30. The OK result was not as impressive as most reports so far in 2017. The unemployment rate stood at 6.3%.

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks