Weekly Outlook: 2017, July 02 - July 09

The US dollar and the Japanese yen were on the back foot as optimism gripped markets Will the party continue? The first week of the second half features a full build up to the all-important Non-Farm Payrolls as well as other top-tier figures.

- Chinese Caixin Manufacturing PMI: Monday, 1:45. Any figure under 50 represents contraction. A similar score is expected now: 49.9.

- US ISM Manufacturing PMI: Monday, 14:00. Expectations stand at 55 points.

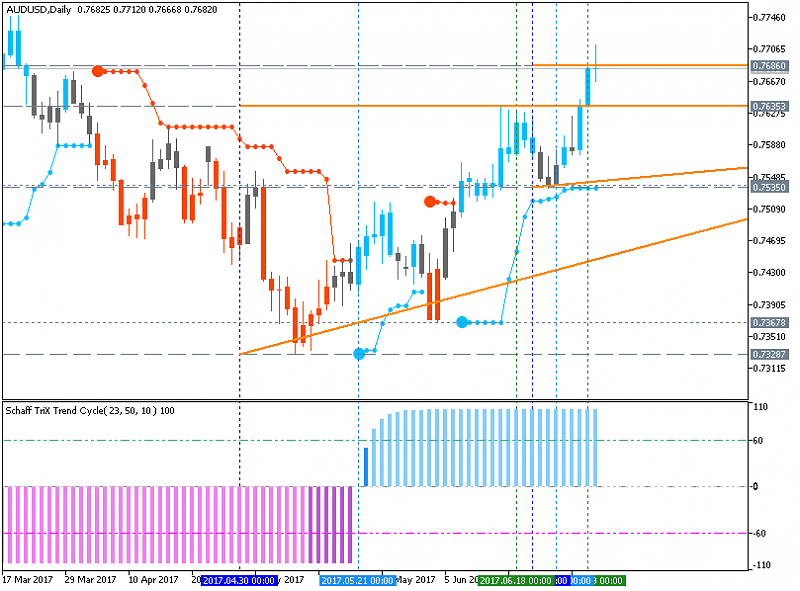

- Australian rate decision: Tuesday, 4:30. The Reserve Bank of Australia kept its interest rate unchanged since lowering it to 1.5% in August last year. No change is expected now. The focus is on the accompanying statement. Given the recent rise in the Aussie, Governor Lowe and his colleagues could try to talk down the currency.

- UK Services PMI: Wednesday, 8:30. A small slide to 53.5 is on the cards.

- US FOMC Meeting Minutes: Wednesday, 18:00. These are the minutes from the June decision, which resulted in a hawkish hike. Yellen expressed optimism about the economy, jobs and even shrugged off inflation on “one off” figures. Since then, some members have expressed concerns over slowing inflation. Will these concerns be repeated now? It is important to remember that the document is edited until the very last moment.

- US ADP Non-Farm Payrolls: Thursday, 12:15. A gain of 181K jobs is on the cards.

- US jobless claims: Thursday, 12:30. A small rise from 244K to 245K is predicted.

- ISM Non-Manufacturing PMI: Thursday, 14:00. A drop from 56.9 to 56.6 is predicted.

- Crude Oil Inventories: Thursday, 14:30.

- US Non-Farm Payrolls: Friday, 12:30. This time, a gain of 175K jobs is expected. Wage growth is forecast to rise by 0.3% m/m after 0.2% last time. The unemployment rate carries expectations to repeat the 4.3% level seen last month.

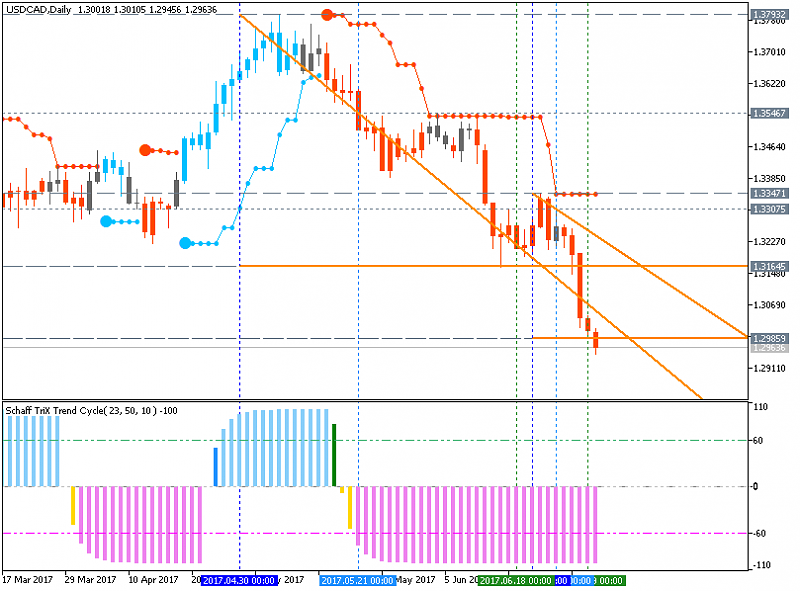

- Canadian jobs report Friday, 12:30. The unemployment rate stood at 6.8%.

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks