Forex Weekly Outlook May 16-20

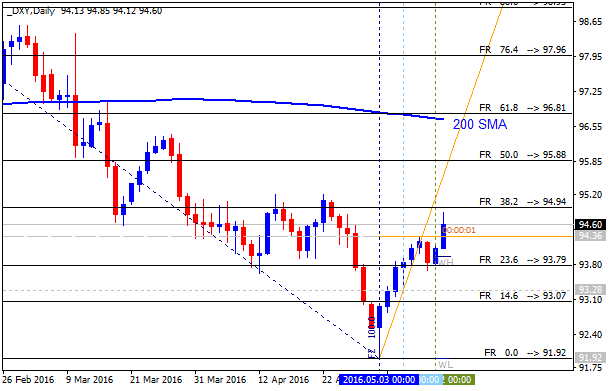

The US dollar had another positive week, enjoying some good data. UK and US inflation data, housing figures and most importantly the FOMC Meeting Minutes stand out. These are the highlights of this week.

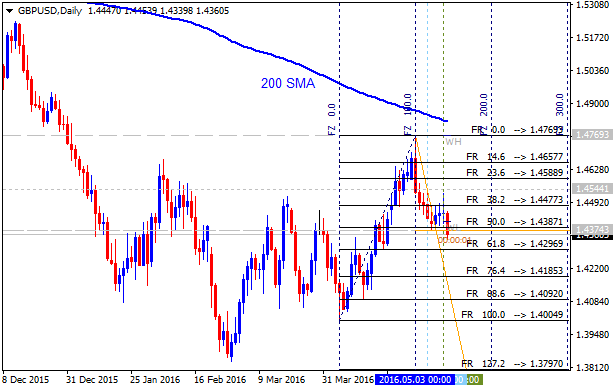

- UK inflation data: Tuesday, 8:30. CPI in the UK is expected to rise by 0.5% in April.

- US Building Permits: Tuesday, 12:30. The number of building permits is expected to rise to 1.13 million-unit pace.

- US inflation data: Tuesday, 12:30. CPI is forecasted to rise 0.4% while core prices are estimated to climb 0.2% this time.

- UK employment data: Wednesday, 8:30. The amount of people receiving jobless benefits is expected to rise by 4,100 in April.

- US Crude Oil Inventories: Wednesday, 14:30. The EIA expects Brent to trade at $76 a barrel in the next year on continued increase in demand.

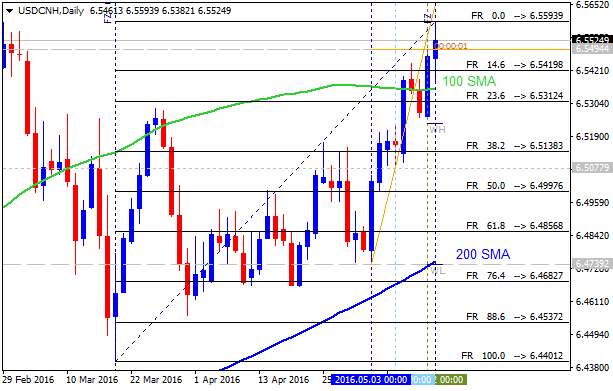

- US FOMC Meeting Minutes: Wednesday, 18:00. These are the meeting minutes from the April decision, in which the Fed left policy unchanged, acknowledged some improvement but did provide any hike hints. The chances for a rate hike in June dropped after that meeting but since then, data has improved. So, this is an opportunity for the Fed to hint about raising rates in June, if this is indeed the case, and it’s quite unclear that this a real option for the doves that control the Fed. It is important to remember that the minutes are edited until the last moment, allowing the Fed to sharpen any message.

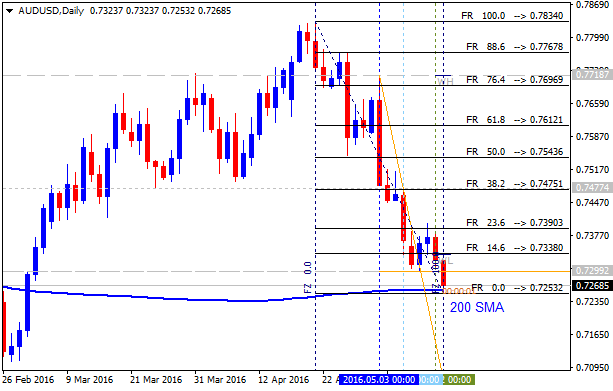

- Australian employment data: Thursday, 1:30. Australia’s job market is expected to register 12,300 jobs addition, while the unemployment rate is expected to rise to 5.8% this time.

- US Philly Fed Manufacturing Index: Friday, 12:30. Jobless claims are estimated to reach 276,000 this week.

- US Existing Home Sales: Friday, 14:00.

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks