Dollar Index Technical Analysis - daily ranging bearish, weekly ranging near reversal

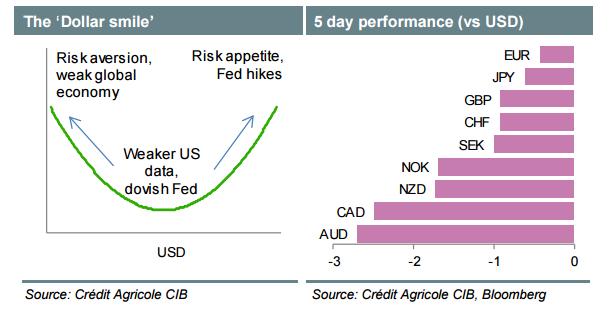

- "The USD is stuck at the bottom of the so-called ‘dollar smile’, which links its path to the performance of the US and global economy as well as the risk sentiment of investors."

- "We therefore expect USD to appreciate again against G10 commodity currencies as investors start questioning the Fed's ability to fall further behind the curve and the sustainability of the commodity-price rally in the presence of persistent downside risks to the global recovery. EUR and JPY should also remain more resilient against this background."

- "Among the key events next week will be the BoE’s May inflation report. Investors will want to know whether the MPC sees the latest economic slowdown as temporary, driven by Brexit fears, or persistent and thus likely to affect the policy outlook. With the EU referendum approaching, the MPC should stress the asymmetric risks to the outlook. This coupled with more evidence that the support for Brexit remains unabated should keep GBP on the defensive across the board."

Daily price is located below SMA with period 100 (100 SMA) and SMA with the period 200 (200 SMA) for the bearish market condition: the price is ranging within 91.92 support level and 94.81 resistance level with RSI indicator estimating the ranging bearish trend to be continuing in the near future. Bullish reversal resistance level is 96.40, and if the price breaks this level to above so the reversal of the price movement to the primary bullish market condition will be started.

- If the price will break 94.81 resistance level so we may see the local uptrend as the bear market rally.

- If price will break 91.92 support so the bearish trend will be continuing.

- If not so the price will be ranging within the levels.

Resistance Support 94.81 91.92 96.40 N/A

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks