Week Ahead: USD Upside Risk Into Payrolls, Sell AUD Rallies

USD – Next week’s business activity and payrolls data should keep Fed rate expectations and the USD supported.

EUR – We do not expect incoming inflation data to have any meaningful impact on rate expectations and the EUR.

CAD – Growth data is unlikely to trigger bigger changes to rate expectations and the CAD. We expect oil price developments to remain key.

CHF – The franc should be driven still by external factors such as risk sentiment rather than domestic data like the KOF leading indicator. However, low safe haven appeal may keep it an underperformer against the JPY

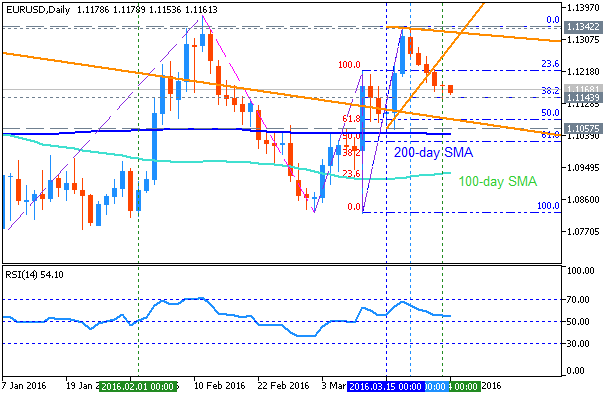

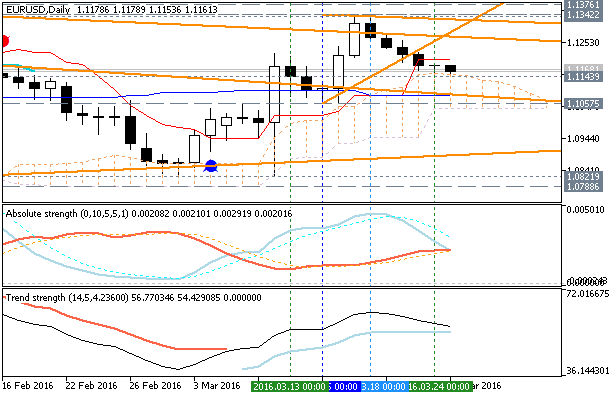

EUR/USD: correction to bearish reversal. Daily price is on the secondary correction within the primary bullish market condition: the price is located near and above Ichimoku cloud and Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart. If the price breaks 1.1143 key support level on the daily close bar so the bearish reversal will be started with the secondary ranging: the price will be located inside Ichimoku cloud. If the price breaks 1.1342 resistance level so the bullish trend will be continuing. Chinkou Span line is located near and above the price to be ready to break it to below for the good possible bearish breakdown.

There are the following news events which will be affected on EUR/USD price movement for the week:

- 2016-03-28 12:30 GMT | [USD - Core PCE Price Index]

- 2016-03-29 14:00 GMT | [USD - CB Consumer Confidence]

- 2016-03-29 15:30 GMT | [USD - Fed Chair Yellen Speaks]

- 2016-03-30 12:15 GMT | [USD - ADP Non-Farm Employment Change]

- 2016-04-01 12:30 GMT | [USD - Non-Farm Employment Change]

- 2016-04-01 14:00 GMT | [USD - ISM Manufacturing PMI]

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks