Trade Ideas For EUR/USD, USD/JPY, AUD/USD, USD/CAD - UBS

EUR/USD: "We think the move lower will continue and any disappointment in today's US data would provide an opportunity to add to shorts towards 1.0820/30."

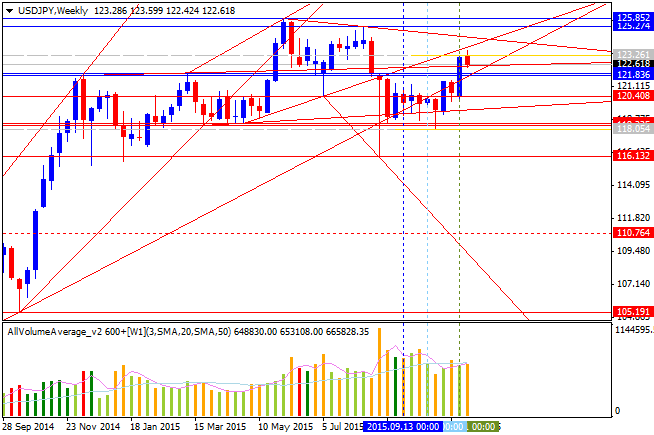

USD/JPY: "The pair will be a risk play today so follow whatever equities do. As it is Friday, some market participants may want to take positions off of the table. Look to sell USDJPY ahead of 123.00, with a stop at 123.30."

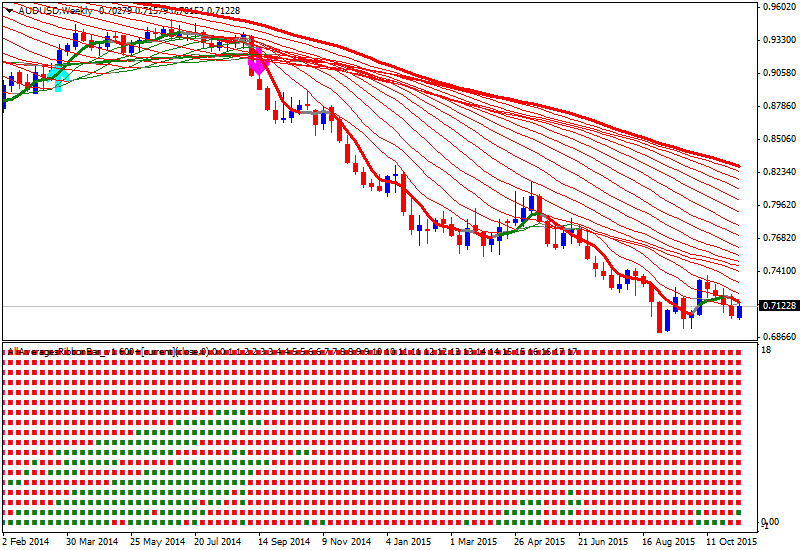

AUD/USD: "We think the pair remains a sell on rallies. There is good short-term resistance between 0.7150 and 0.7180 and the key pivot is the downtrend line that comes in around 0.7270. As long as this stays intact, we prefer playing the pair from the short side."

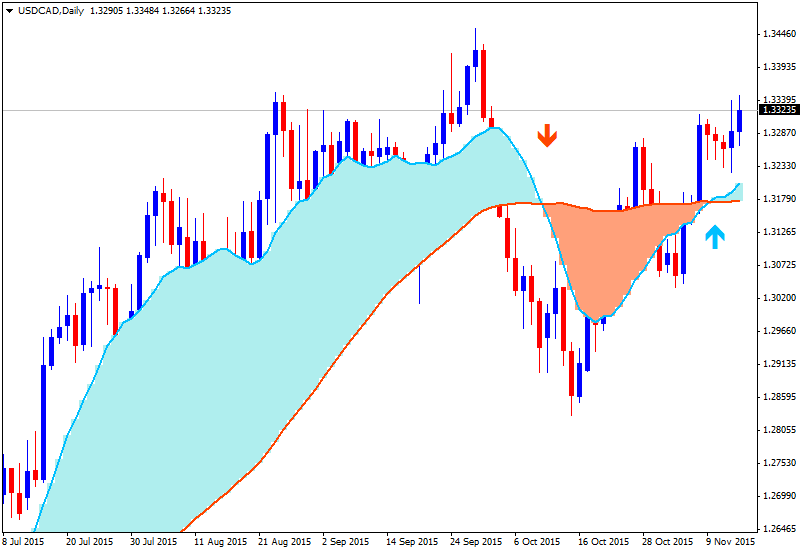

USD/CAD: "We prefer buying dips, ideally between 1.3230 and 1.3200, with a stop through 1.3150."

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks