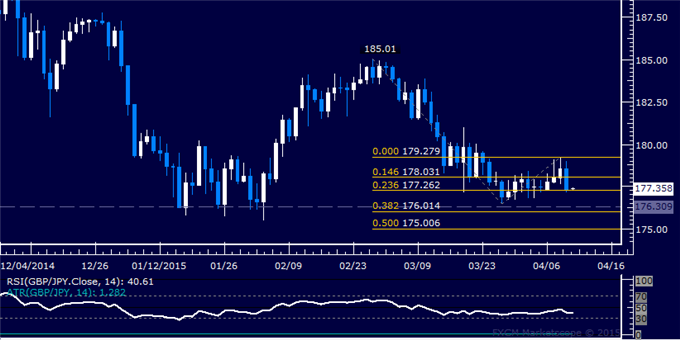

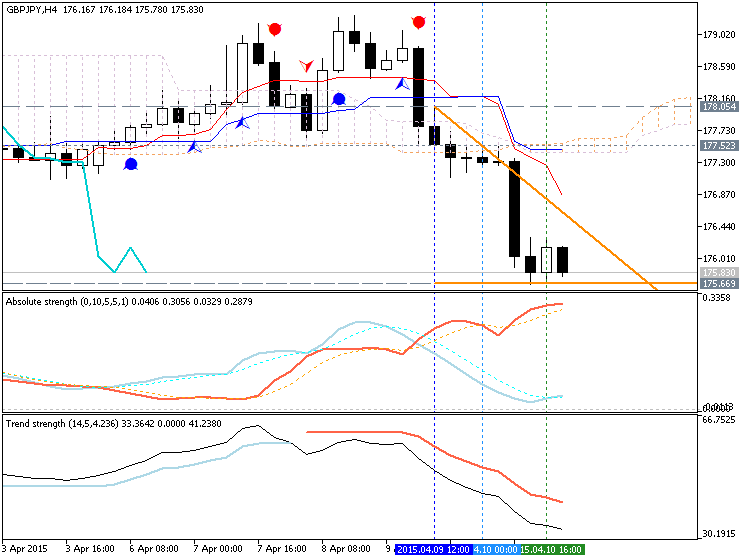

GBP/JPY Technical Analysis: Resistance Found Below 180.00

Talking Points:

- GBP/JPY Technical Strategy: Flat

- Support: 177.26, 176.01, 175.01

- Resistance: 178.03, 179.28, 180.56

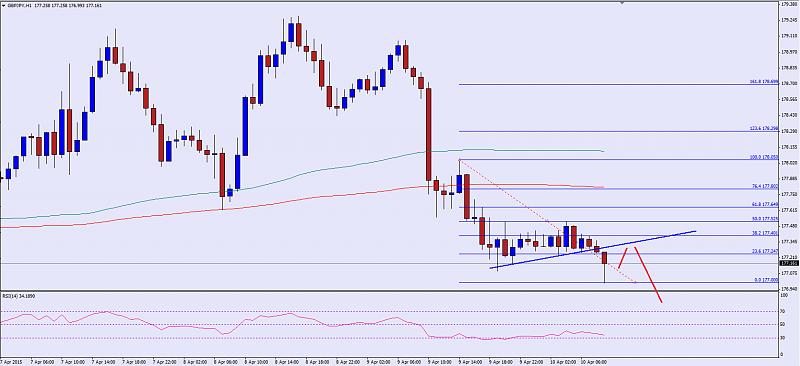

The British Pound turned lower anew against the Japanese Yen, recoiling from resistance below the 180.00 figure. A daily close below the 23.6% Fibonacci expansion at 177.26 exposes the 176.01-31 area (38.2% level, triple bottom). Alternatively, a reversal above the 14.6% Fib at 178.03 opens the door for a test of the April 8 high at 179.28.

Prices are too close to support to justify entering short from a risk/reward perspective. On the other hand, the absence of a defined bullish reversal signal suggests that taking up the long side is premature. With that in mind, we will remain flat for now.

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks