Markets Stunned as SNB Abandons Exchange Rate Cap

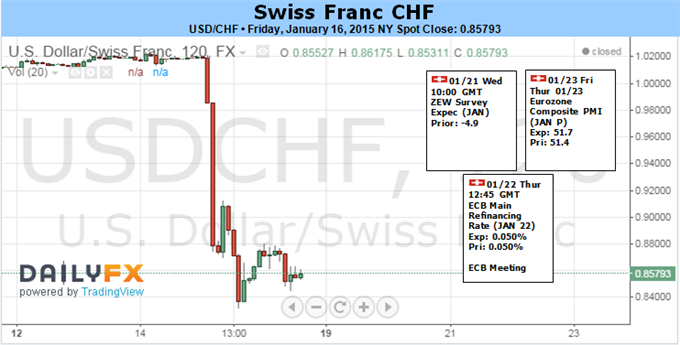

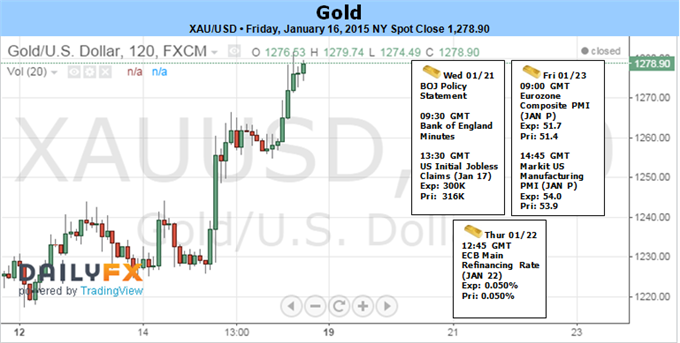

Global markets are reeling today as the Swiss National Bank abandoned the franc’s exchange rate cap against the euro. At one point, the franc was trading nearly 38% higher against the dollar and the euro, as major currencies reacted differently to this very surprising decision. The euro fell nearly 2% against the dollar but has since taken back most of those losses. In Asia, the Indian rupee advanced following a surprise interest rate cut and the Australian dollar was stronger following the December jobs report. As North American trading commenced, all eyes were on US weekly jobless claims, coming in higher than expected at +316k, but the Swiss remain the story of the day.

Today’s move by the Swiss National Bank comes as a big surprise following an interview just two days ago when SNB Vice President Jean-Pierre Danthine said officials were “convinced that the cap on the franc must remain the pillar of our monetary policy.” No doubt Swiss retailers will be feeling the pain this morning as Swatch CEO Nick Hayek was quoted, “Today’s SNB action is a tsunami, for the export industry and for tourism.” Although Switzerland remains a neutral enclave amidst the European continent, this instability cannot be a welcome sight to policy makers in Brussels, weighing the prospect of large scale asset purchases. The EUR/CHF cap, which had been holding firm above 1.2000 for years, was as low as 1.0300 this morning.

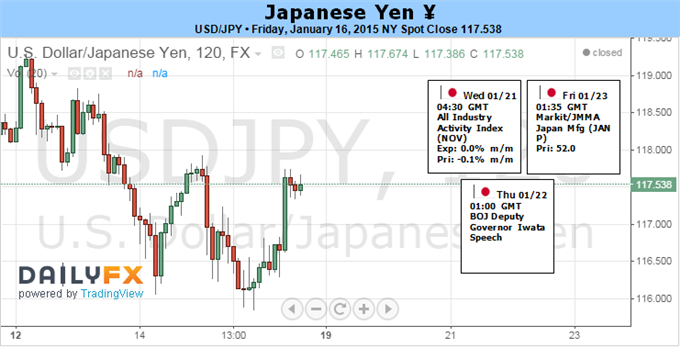

During Asian hours, it was Australian jobs numbers that paced markets. For November and December of 2014, employers added the most new workers in any two-month period over the past eight years. The number of people employed increased by 37k in December after a revised 45k increase in November. Thinking about this another way, the American population is roughly 14 times larger than Australia, those increases in the States would read 514k and 626k, respectively. The Australian dollar has risen nearly 1% in today’s trading as a result, but still remains on the lows of the year, depressed by falling commodity prices. Copper prices slumped nearly 8% this week, leaving a heavy burden on the AUD and NZD dollars.

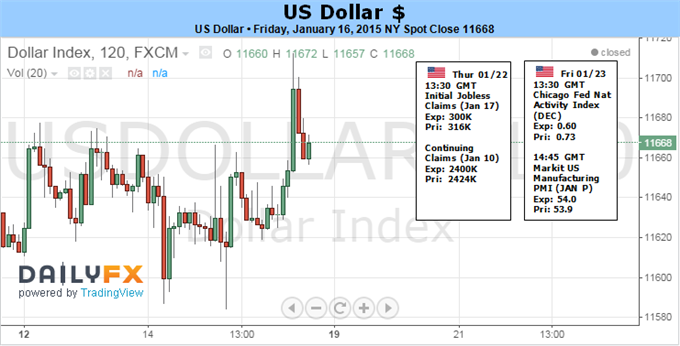

Turning to North America, there is nothing of note coming out of Canada this week. The Bank of Canada will convene next Wednesday for the policy meeting, one day before the ECB convenes for a hotly anticipated meeting. No change to rates is expected in Canada as the Loonie took a brief look above $1.20 this week before coming off over 1% in the wake of the SNB’s actions overnight. The FOMC released its “Beige Book” yesterday, expressing that most regions saw “modest” or “moderate” economic growth. Stronger employment and cheaper gasoline are spurning consumer spending, helping the US stand out as the one strength as European and Asian growth wanes into the new year. On the data calendar today it was US weekly jobless claims pacing trading as more American workers claimed first time unemployment benefits since the beginning of December. The dollar was unaffected. Closing out the week tomorrow with US inflation for the month of December, a 1.3% increase over the same period in 2013 is expected.

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks