Forex Weekly Outlook November 3-7

US ISM Manufacturing PMI, rate decision in Australia, the UK and the Eurozone, Employment figures from New Zealand, Australia, Canada as well as important jobs data from the US with the all-important NFP report. These are the major market movers planned for this week. Check out these events on our weekly outlook.

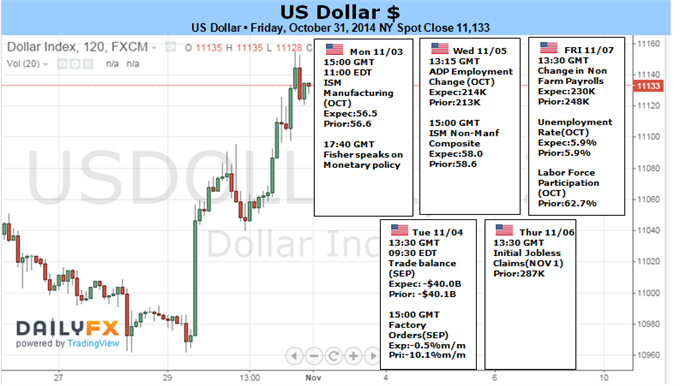

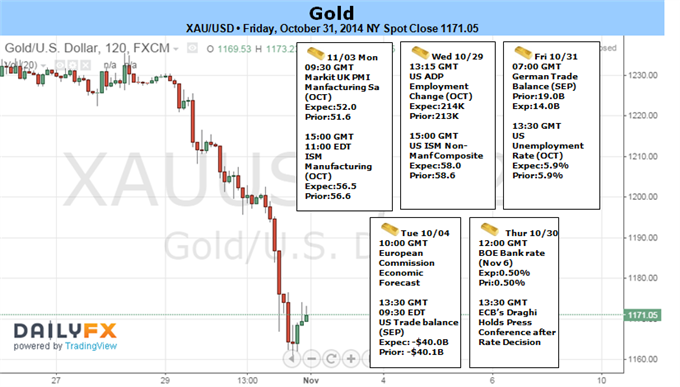

Last week, The Federal Reserve ended its QE3 program with a vote of confidence in the US economic recovery. The ongoing improvement in the labor market, the economic expansion and the satisfactory inflation rate has made the decision to end the bond-buying program as almost foregone. Furthermore the advance GDP data released a day later showed the economy grew 3.5% in Q3 slightly better than forecasted, suggesting the US economy is marching forward. Will this trend continue in Q4?

- US ISM Manufacturing PMI: Monday, 14:00. The Manufacturing PMI declined to 56.6 in September after posting 59 points in August. The reading reached the lowest level since June and analysts expected a higher figure of 58.6.The New Orders Index fell short by 6.7 from the 66.7 release in August, still indicating growth in new orders. The Production Index reached 64.6, rising 0.1 above the August reading. The Employment Index expanded for the 15th consecutive month, registering 54.6, declining 3.5 points below the August reading. Overall the general trend remained positive. Another mild drop to 56.5 is expected this time.

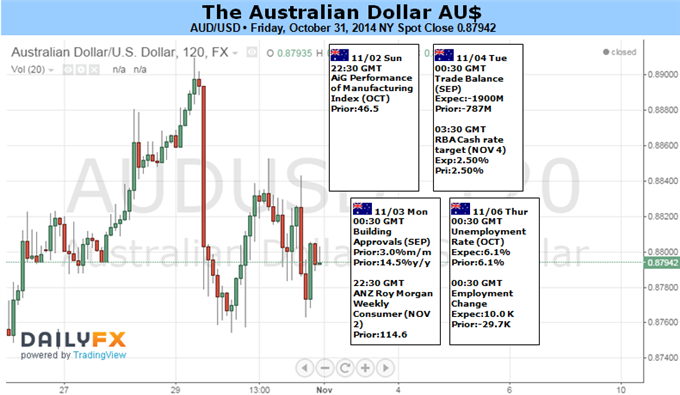

- Australian rate decision: Tuesday, 2:30. The Reserve Bank of Australia kept the cash rate unchanged at 2.5%, in line with market forecast, but warned against weakening in the housing sector driven by the overpriced housing market. Global growth continued in a moderate pace, despite a recent slowdown in China’s growth. The Bank also cautioned against the strength of the Australian dollar, offering less assistance than would normally be expected in achieving balanced growth in the economy. However the general trend pointed to moderate growth in the coming quarters. No change in rates is anticipated.

- US Trade Balance: Tuesday, 12:30. The U.S. trade balance narrowed unexpectedly in August to $40.1 billion, reaching its smallest level in seven months. Economists expected a higher deficit of $41 billion. Exports rose by 0.2% to $198.5 billion in August, and imports gained 0.1% to $238.6 billion. Petroleum imports were weak but imports of capital goods soared to their highest on record. The U.S. trade balance is expected to reach $40.1 billion this time.

- NZ employment data: Tuesday, 20:45. Unemployment in New Zealand declined to its lowest level in more than five years, reaching 5.6% in the second quarter from 5.9% in the first three months of 2014. The reading was better than the 5.8% forecasted by analysts, however the participation rate declined to 68.9% from 69.3% in the first quarter. Nevertheless, the job market continues to grow rising 0.4% in the second quarter after expanding 0.9% in the previous quarter. The figures suggest that New Zealand’s job market is no longer a key concern for the country. New Zealand job market is expected to increase by 0.6% while the unemployment rate is expected to narrow again to 5.5%

- BOJ Governor Haruhiko Kuroda: Wednesday, 1:30. BOJ Governor Haruhiko Kuroda will speak in Tokyo. Japan’s inflation reached to its lowest pace in half a year, drifting further away from the Central Bank’s 2% target. Kuroda may give further explanations on the reasons behind the new stimulus measures issued at the end of October, earlier than expected.

- US ADP Non-Farm Employment Change: Wednesday, 12:15. U.S. Private-sector employers increased hiring in September, adding 213,000 jobs, according to ADP payrolls processor. The 11,000 climb was better than the 207,000 rise predicted by economists. 88,000 jobs were created from small businesses, 48,000 jobs were created from medium sized businesses and 77,000 jobs were created from large businesses. The slowdown in August proved to be temporary after the NFP release posted strong gains. Us private sector is expected to add 214,000 jobs in October.

- US ISM Non-Manufacturing PMI: Wednesday. 14:00. Non-manufacturing Purchasing Managers Index declined to 58.6 in September, following 59.6 registered in August. The reading was broadly in line with market forecast, indicating that he service sector is advancing more rapidly than the manufacturing sector. Respondents commented that business activity cooled mildly in the past few months after posting strong growth, but they remain positive about the general trend of the economy. Non-Manufacturing PMI is predicted to reach 58.2 this time.

- Australian employment data: Thursday, 23:30. Australia’s Unemployment rate increased mildly in September amid an unexpected decline in. Australian job market contracted 29,700 jobs mainly in part-time work, lifting unemployment to 6.1% from 6.0% in August. The slowdown in employment coincides with the sharp drop in mining investment. The Reserve Bank of Australia faces a tough challenge whether to raise interest rates from a record low of 2.5% to help reduce rising house prices. However, such a move may increase interest rates could undermine growth and cause unemployment to rise. Australian job market is expected to gain 10,300 positions while the unemployment rate is expected to remain unchanged at 6.1%.

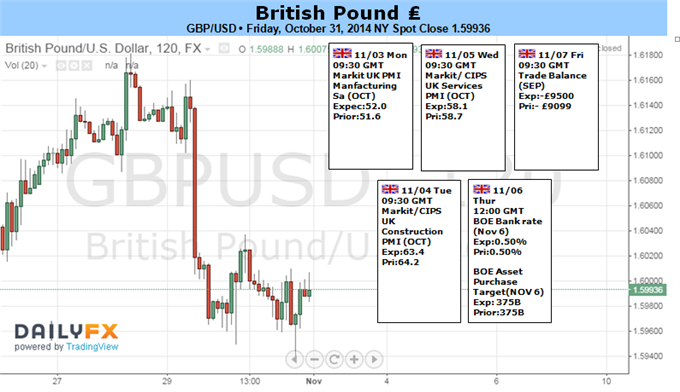

- UK rate decision: Thursday, 11:00. The Bank of England nine-member Monetary Policy Committee voted to maintain rates at 0.5%, despite rising calls for a rate hike. The BOE’s next move will be strongly dependent on the Eurozone central bank call. The current slowdown in Europe postposes all rate hike plans. Economists expect soft demand from Europe will keep the central bank on hold until 2015. Rates are expected to remain at 0.5% this time.

- Eurozone rate decision: Thursday, 11:45. The European Central Bank kept its benchmark interest rate at 0.05% at its October meeting, following a 10 bps cut in the previous month. Furthermore, the Bank Policymakers decided to reveal their plan to buy asset-backed securities and covered bonds. These new moves are intended to stimulate financing bodies to expand loans to all sectors of the economy. The ECB also decided to increase its monetary policy accommodation to spur growth.

- US Unemployment claims: Thursday, 12:30. The number of new claims for unemployment benefits declined again last week, reaffirming the growth trend in the US job market. The 1,000 decline from the previous week was better than forecasted and the four-week moving average, fell again to 287,750, the lowest level since February 2006. Analysts have noted that claims have rarely remained low for such a long period. If the pace of firings will remain low, and hiring will continue, wage is expected to grow in the fourth quarter. The number of new jobless claims is expected to reach 285,000 this week.

- Canadian employment data: Friday, 12:30. Canadian private sector surged in September amid a job gain of 74,000 positions, the majority in full-time employment. The unexpected increase pushed the unemployment rate down two 6.8% from 7.0%, the lowest level in nearly six years. Economists expected a job addition of 18,700 with an unchanged unemployment rate. The rebound in full time positions indicates a positive trend in the Canadian job market. Canadian private labor market is expected to increase by 400 positions while the unemployment rate is predicted to remain at 6.8%.

- US Non-Farm Employment Change and Unemployment rate: Friday, 12:30. U.S. employers increased hiring in September with a job gain of 248,000, pushing the jobless rate to a six-year low of 5.9%. The strong figures suggest the US economy is advancing with a steady job growth and fewer layoffs. Economists expected a smaller gain of 216,000 and no changes in the unemployment rate. The employment was broad based but the participation rate dropped to 62.7, the lowest level since 1978 and weak wage growth is another concern the Fed has to address. US job market is expected to gain 229,000 in October with no change in the unemployment rate.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks