The GBP/NZD pair has recorded new highs and a correction wave is expected.

This month the British Pound rose by more than 800 pips against the New Zealand Dollar from 1.8520 to 1.9332. We took around 405 pips when we bought the pair at 1.8455, as we mentioned in our last report on October 3rd when our target was at 1.8860. Today we will take another look at the chart to discover a new profitable opportunity.

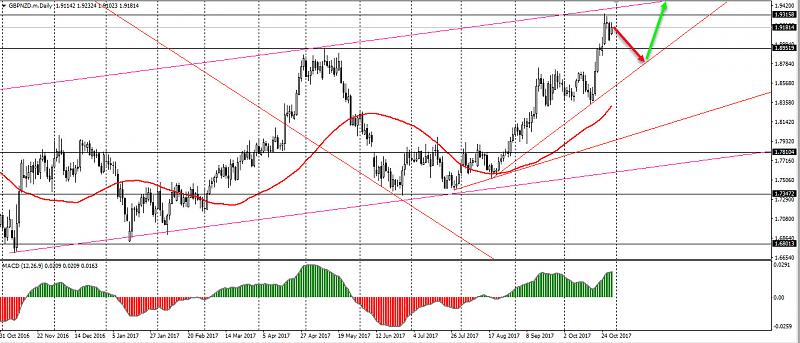

The pair has been trading inside a price channel for a year and the prices nearly reached its upper limit. In addition, around the same levels 1.9315-1.9350 there is a resistance area, so that the pair declined more last Friday. Itís expected that the prices will decline to the support level 1.8950, but the main direction is still up; that is in case the pair is still trading inside the price channel, above the trendline and the MACD bars are above the zero level.

The Next Few Days

After we saw that the pair couldnít break the resistance level 1.9315 we can sell the pair now at 1.9190 and take our profit at 1.8970. Then we have to wait for the breaking down or rising again after touching the support level but we expect that the prices will break the support level to test the trendline around 1.8650 and go up to make new highs.

This week we have much hot news from the UK and New Zealand, so we have to focus on the news results that will affect the market. On Tuesday we have the Unemployment Rate from New Zealand, as well as the PMIís data and official bank rate from the United Kingdom on Wednesday, Thursday and Friday, respectively.

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks