General analysis USDJPY for 16.05.2022

Current Dynamics

Japan's current account surplus decreased by 22.3%. Net profit of Japanese companies from the top list of the Tokyo Stock Exchange increased by 35.6% by the result of the year. Bank of Japan does not plan to change its monetary policy.

According to The Ministry of Finance of Japan's preliminary fiscal year 2021 fiscal year ending March 31, the current account surplus decreased by 22.3% to 12.64 trillion yen ($97.6 billion). The decrease was caused by a record rise in imports, which increased 35% to a record 87.15 trillion yen ($672 billion). Most of the growth in imports was due to higher energy prices, with the cost of purchasing liquefied natural gas up 58%. In addition, the recovery of the global economy affected the trade balance after the shutdown caused by the measures against the spread of COVID-19.

At the same time, the Japanese Ministry of Finance recorded a record 25.1% growth in exports, which reached 85.50 trillion yen ($659 billion). The supply of equipment largely influenced this for the production of chips.

It should be noted that the net profit of leading Japanese companies from the top list of the Tokyo Stock Exchange at fiscal year 2021 increased by 35.6% to 33.5 trillion yen (more than $275 billion), and the annual revenue of these companies on average grew by almost 8% to 500.4 trillion yen (about $3.9 trillion). This increase in profitability was due in large part to the weaker yen, boosting revenues of operating companies overseas when translated into local currencies.

On the back of this, Haruhiko Kuroda, governor of the Bank of Japan, said that the BOJ has no plans to change its monetary policy. Kuroda rejected the idea that the Bank of Japan may switch to a policy of tightening monetary policy following the example of the U.S. Federal Reserve and the European Central Bank. Kuroda also noted that Japan's economy is in the process of recovery from a major setback caused by the spread of COVID-19. The BOJ is considering keeping its current policy aimed at keeping the 10-year Japanese government bond yield near zero and leaving a space of 0.25% for a maneuver.

We can conclude that Japan is not going to change its monetary policy and the yen will continue to weaken in the near term.

Japan Producer Price Index released today was better than experts' expectations. So in year-to-year the index went up by 10% when the forecasted growth was 9.4%, and in monthly - by 1.2% when the forecasted growth was 0.8%.

Today at 08:00 (GMT+2) the machine tool orders for April will be published. Later in this day at 22:00 (GMT+2), there will be data on TIC Purchases of Long-Term Securities in the U.S. for March.

Support and resistance levels.

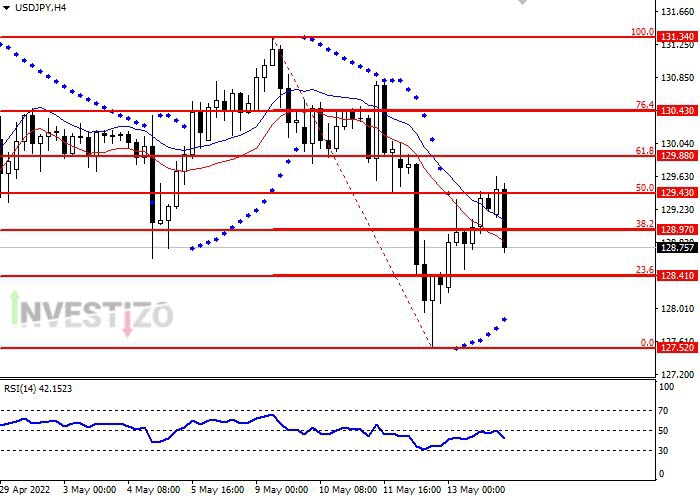

USD/JPY opened with a sharp move, breaking through the key Fibonacci 50 level, but failed to hold above. The current trend is upward. The RSI oscillator is near the 50 level in the lower part.

✔️ Support levels: 128.41, 127.52

✔️ Resistance levels: 128.97, 129.43, 129.88, 130.43, 131.34

Trading scenarios

✔️ Long positions can be opened above the level of 128.97 with target 129.88 and stop-loss 128.41: Implementation Period: 2-4 days

✔️ Short positions can be opened below the level of 128.41 with target 127.52 and stop-loss 128.97: Implementation Period: 2-4 days

Analytical department investizo.com

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks