Date: 20th March 2024.

Market Recap – All eyes on FED.

Economic Indicators & Central Banks:

* Treasury yields are sinking as bonds await the FOMC’s results. The market is recovering slightly from this month’s selloff that has taken rates to the highest levels since late November.

* Stock markets traded mixed overnight, while Bonds have been in demand as the FOMC announcement comes into view.

* German producer prices fell -4.1% y/y in February. PPI has bottomed out, but so far is still firmly in negative territory, largely thanks to a -10.1% y/y drop in energy prices. Developments are backing the ECB’s assessment that things are moving in the right direction. Services price inflation though, which is more driven by wage growth than goods prices, remains stubbornly high for now.

* UK inflation continues to decelerate adding support to the bond market. The data confirms that inflation is moving in the right direction, but also that it remains far too high, which will justify a dovish hold from the BoE tomorrow.

* FOMC Checklist: The FOMC will issue its post-meeting statement today. Expectations are for no policy change at this meeting, but verbiage will be closely monitored for hints regarding the rate path in the remainder of 2024. The SEP was last updated in December, and is due for another update at this March meeting.

Market Trends:

* A mixed open on Wall Street with some weakness on profit taking after further AI inspired gains. The Dow climbed 0.83%, with the S&P500 (US500) advancing 0.56%, while the NASDAQ (US100) was up 0.39%.

* ASX paring some of Tuesday’s gains, while China bourses nudged higher.

* Nvidia (+1.07%) debuts next-generation Blackwell AI chip at GTC 2024.

* Microsoft hires DeepMind founder to lead new AI shift.

* Apple is in talks with Alphabet’s Google to potentially incorporate Google’s “Gemini” generative AI engine into its iPhones.

Financial Markets Performance:

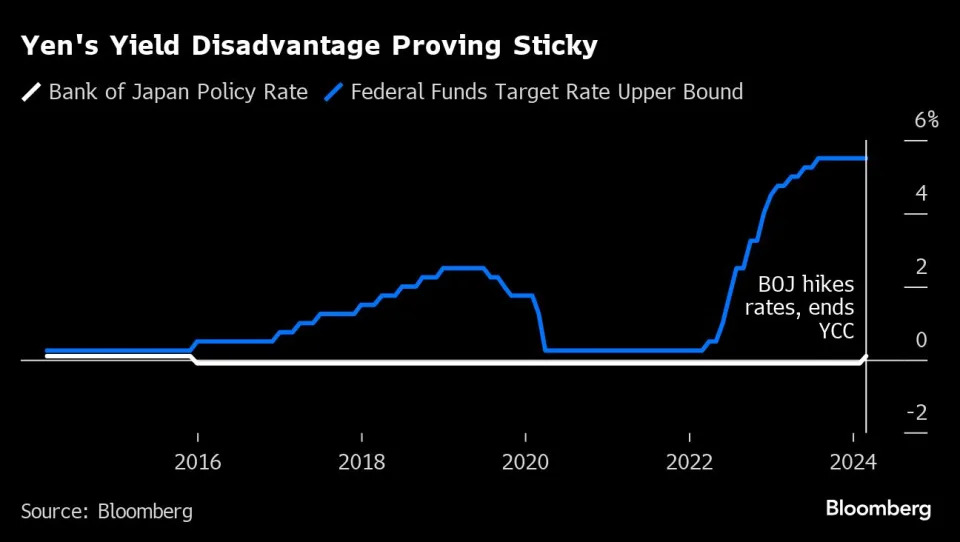

* The USDIndex found a bid too after the BoJ’s dovish hike. It tested 104.06 but slid to 103.82 at the close.

* USDJPY is at 151.57 spiking to 4-month highs while EURJPY spiked to a 16-year peak after the Bank of Japan ended negative interest rates without clear guidance on further hikes.

* A stronger than expected German ZEW investor confidence reading failed to boost the Euro significantly. Cable is holding slightly below the 1.27 mark.

* Gold flattened for a 3rd day in a row and USOIL fell to $82.24 from $83.

* Bitcoin continued to pull back from its recent record high, falling over 5% at one point. Shares of crypto-linked companies Coinbase (COIN) and Marathon Digital (MARA) lost ground alongside the token.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks