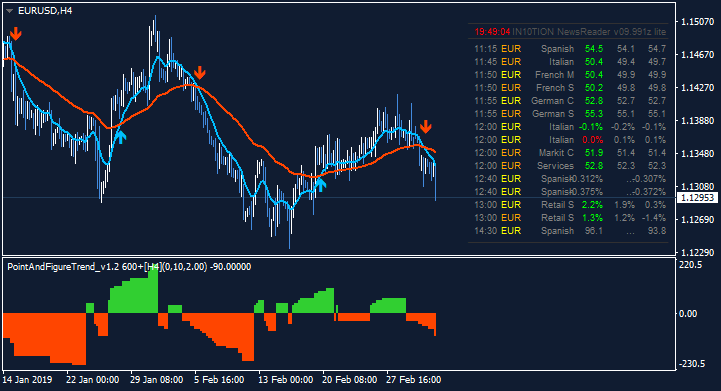

EURUSD TECHNICAL HIGHLIGHTS:

Euro daily key-reversal, 4-hr pattern counsel complaint

Expectations remain low for price interest, but that will fine-space

EURO DAILY KEY-REVERSAL, 4-HR PATTERN SUGGEST WEAKNESS

On Thursday, EURUSD abruptly reversed, creating a key-reversal very approximately the subject of the daily chart very close trend-descent resistance. Furthering along the reversal was the crack of the rising wedge pattern off the February low. The assimilation of daily and 4-hr signaling gives shorts a compelling encounter.

Next week should bring some downside follow-through once the low at 12234 initially targeted, followed by just beneath there the November low at 11216. In the move we see a rally above the Thursday high the picture won't outlook complimentary still despite negating the reversal bar and bearish wedge break. Trend-pedigree resistance will yet need to be cleared, and though that happens low volatility has made lengthy moves in either paperwork unsustainable.

EXPECTATIONS REMAIN LOW FOR PRICE MOVEMENT, BUT THAT WILL CHANGE

Volatility continues to be low and expectations for out-sized moves in the near-term remains tempered. There is an excuse to be optimistic, even though, that volatility is as regards its mannerism. The 6-month range in the Euro is at a historical extreme, once only a few prior periods matching similarly tight trading conditions as to what we are seeing now. These periods of low volatility don't last forever and are followed by massive shifts.

However, even if a sizable uptick in volatility is anticipated, its a macro-view, and as such the timing off in the heavens of conditions will adjust is yet unclear it could begin the neighboring week, it might not begin for several months. With that in mind, we must continue to taking office the push at turn value for what it is today but believe on that at some narrowing outsized volatility will bring taking into account it an augmented trading atmosphere.

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks