Indicators Signal Caution Ahead of EURUSD

Introduction to EUR-USD

The EURUSD currency pair, often referred to simply as "Euro-Dollar," represents the exchange rate between the Euro (EUR) and the US Dollar (USD). As the most traded currency pair in the world, EURUSD serves as a benchmark for global forex markets and reflects the relative economic performance and monetary policies of the Eurozone and the United States. Known for its high liquidity and tight spreads, the pair is closely watched by traders, investors, and policymakers alike, as it reacts strongly to geopolitical developments, interest rate decisions, and macroeconomic data from both regions.

EUR/USD Market Overview

Currently, EURUSD is showing cautious bullish tendencies as it navigates through key technical zones, supported by mixed but largely optimistic economic data from the Eurozone. Early in the day, German Import Prices dropped more than expected at -1.4%, potentially signaling easing inflation pressures, while French Consumer Spending rebounded strongly with a 0.8% increase, reversing last month’s sharp decline. Stable readings in French Private Payrolls and GDP further reflect economic resilience within the region. Meanwhile, a sharper-than-expected rise in German Unemployment Change (+12K vs. 4K forecast) has tempered some of the bullish sentiment, highlighting underlying labor market challenges. On the U.S. side, attention is focused on upcoming events that may shape USD direction. Federal Reserve Bank of Minneapolis President Neel Kashkari’s speech and the release of FOMC Meeting Minutes are highly anticipated, especially for clues on future monetary policy. Additionally, a slightly better-than-expected Richmond Manufacturing Index may provide modest support to the USD.

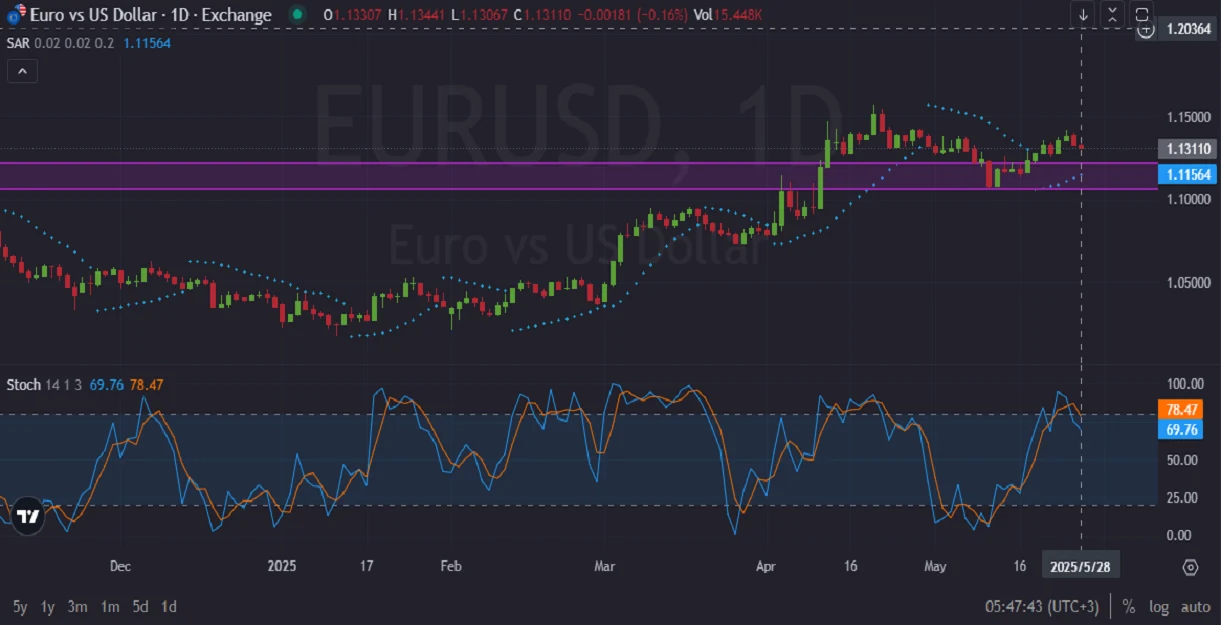

EURUSD Technical Analysis

Technically, EUR/USD is currently exhibiting signs of bullish consolidation after a strong upward move earlier this month. The pair has held above a key support zone between 1.11564 and 1.13110, which has previously acted as a strong demand area. This zone is now serving as a critical pivot, with price action showing resilience above it despite minor pullbacks. The Parabolic SAR dots remain below the price, confirming continued bullish momentum, although they are beginning to flatten, which could indicate a potential pause or short-term correction. Meanwhile, the Stochastic Oscillator shows a reading of 78.47 and 69.76, suggesting the pair is approaching overbought territory. This raises the likelihood of a near-term pullback or consolidation phase before any renewed push higher. Should EUR/USD sustain momentum above 1.13110, the next major resistance lies around 1.1500, followed by the psychological 1.2000 zone. However, a breakdown below 1.11564 could open the door to deeper retracements. Overall, technical indicators point to a bullish bias, but with caution warranted as overbought conditions begin to emerge.

Final Words about EUR vs USD

In summary, the EUR/USD currency pair remains at a critical juncture, shaped by a combination of encouraging Eurozone data and looming U.S. monetary policy developments. While recent economic releases suggest underlying strength in the Euro area, particularly in consumer activity and GDP stability, concerns such as rising German unemployment and anticipated Fed commentary introduce an element of uncertainty. Technically, the pair maintains a bullish structure above key support, though overbought signals on the Stochastic Oscillator and flattening Parabolic SAR suggest the potential for a short-term pause or correction. As markets await further direction from upcoming U.S. policy statements, traders should remain vigilant, balancing the current bullish outlook with the possibility of near-term volatility.

05.28.2025

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks