USD/CAD Daily Technical and Fundamental Analysis

Introduction to USD/CAD

The USD/CAD pair, also known as the "Loonie," represents the exchange rate between the US Dollar (USD) and the Canadian Dollar (CAD). This currency pair is highly influenced by oil prices, economic policies, and trade relationships between the United States and Canada. As one of the most liquid pairs in the forex market, USDCAD offers ample opportunities for traders, especially during high-impact economic events. Today’s trading action is closely tied to developments from the Bank of Canada (BoC) and key US economic data.

USDCAD Market Overview

The USD/CAD pair is in focus as traders brace for significant events influencing both currencies. The Bank of Canada is expected to announce its monetary policy decision today, with the overnight rate anticipated to remain unchanged at 3.00%. Alongside the rate decision, the BoC Monetary Policy Report and subsequent press conference will provide key insights into the central bank's outlook on inflation and economic growth. Meanwhile, the US is set to release Durable Goods Orders, Consumer Confidence data, and the Richmond Manufacturing Index. These releases could provide critical clues about the health of the US economy.

The pair recently experienced bullish momentum, fueled by strong US economic data and weaker oil prices, which often weigh on the CAD. However, with the BoC's decision and US releases on tap, volatility is expected to remain elevated in the near term. Tomorrow's data flow and potential developments in crude oil prices will also play a significant role in determining the pair's direction.

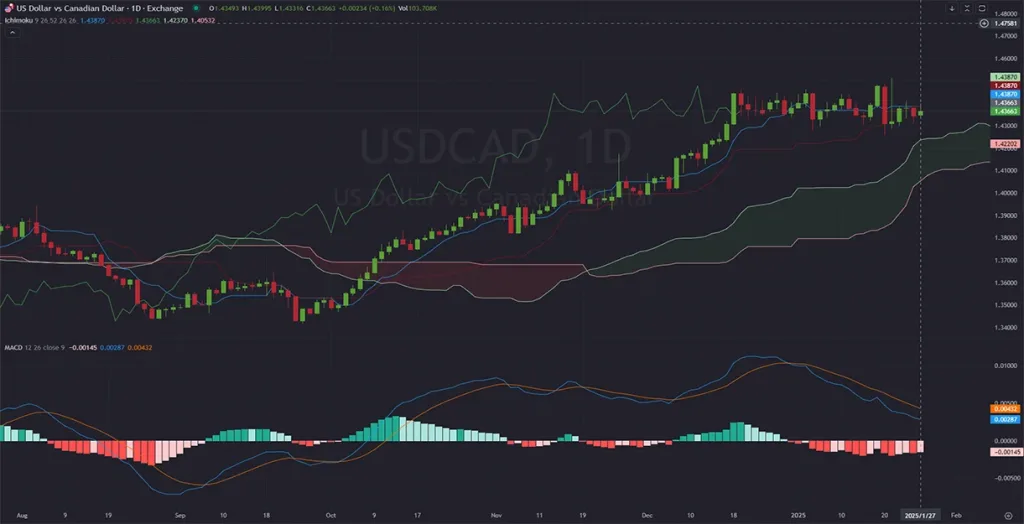

USD CAD Technical Analysis

The USD/CAD daily chart shows that the pair has been in a bullish phase but is beginning to lose strength. Price action remains above the Ichimoku cloud, signaling that the bulls are still in control, but the momentum is weakening. The MACD indicator is showing signs of a potential bearish wave, with the histogram declining and the MACD line approaching the signal line for a possible crossover. Key resistance levels are located at 1.3450, 1.3500, and 1.3550, where recent price action has stalled. On the downside, immediate support levels are seen at 1.3375, 1.3320, and 1.3280, which align with previous consolidation zones. The weakening bullish momentum, combined with bearish signals from the MACD, suggests a potential correction phase for USD/CAD. Traders should watch for a break below support levels to confirm a shift in trend.

Final Words on USD vs CAD

The USD/CAD pair is at a pivotal moment, with significant events on both sides of the border influencing price action. While recent bullish momentum has dominated the pair, weakening technical indicators and looming central bank decisions point to increased volatility. Traders should monitor the Bank of Canada's rate statement and press conference for guidance on CAD movement, as well as US economic releases for insight into USD strength.

Although the pair remains above key support levels, the potential for a bearish correction is growing, especially if the BoC takes a more hawkish tone or if US data disappoints. Risk management is crucial, as USD CAD is likely to experience sharp moves during these high-impact events. Keeping an eye on oil prices, which are closely correlated with the CAD, will also provide additional context for trading decisions.

01.28.2025

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks