Week Ahead: High volatility, limited GBP downside, the JPY lower, and more

What we’re watching:

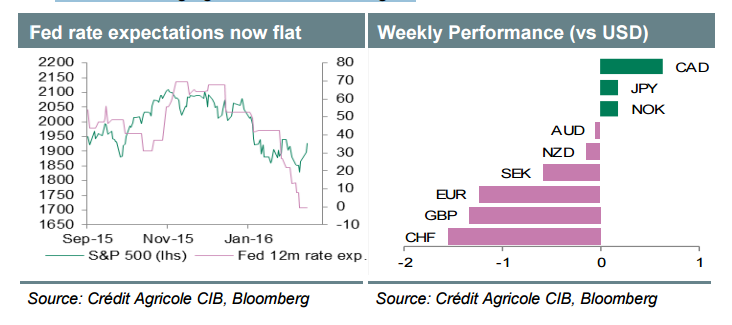

USD – Next week’s PCE data will be key. Only a considerably weaker than expected outcome may lower rate expectations further.

GBP – Growth data should become a more important currency driver anew. Hence next week’s GDP data will be closely watched. We see limited GBP downside risk from the current levels.

JPY – It remains to be seen if weaker inflation data will drive the JPY lower. This is due to increased uncertainty about the BoJ’s policy stance being efficient in bringing inflation back to target.

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks