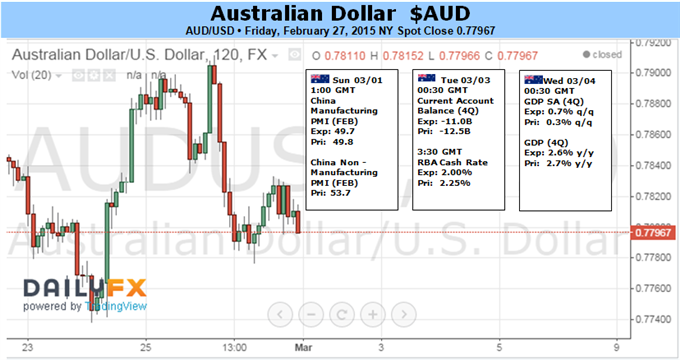

Latest Bloomberg survey - 16 of 27 economists survey see RBA cut in March

Bloomberg's latest survey of 27 economists has 16 of them forecasting an Reserve Bank of Australia rate cut on March 3

- Of 25 bps

- So, from 2.25% tp 2%

- Market pricing has the probability of a cut at around 65%

- The other 11 have the RBA on hold on Tuesday

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks