Price Patterns for EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/JPY, USD/CAD and USD/CHF - EURUSD weekly reversal

by

, 12-13-2014 at 04:49 AM (1331 Views)

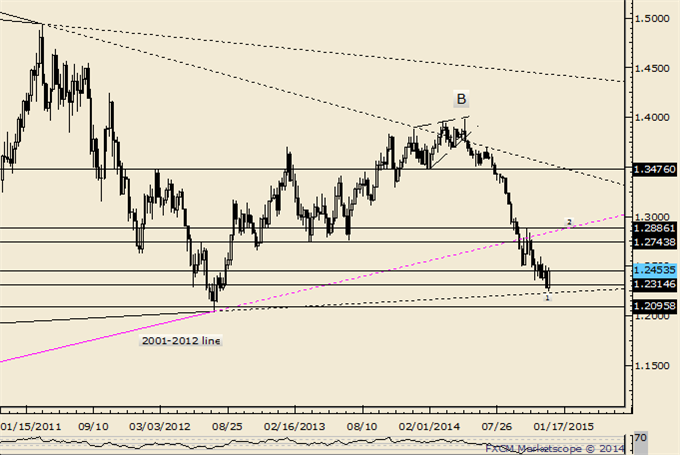

Weekly

-BIG picture, monthly RSI has broken out of a triangle pattern. Sometimes, a pattern breakout in momentum (or OBV) precedes the breakout in price. The development’s implications are obviously significant.

-“After following through on the 11/7 reversal and exceeding the 11/4 high, it appeared that EURUSD was going to make an attempt at an important 1.2665/85 Fib zone before selling returned. That all changed in the course of a few hours on Friday. Still, the monthly is displayed in order to highlight the importance of the area just below. The line from the 2010 and 2012 lows is near 1.2230 next week whilst the 2008 low looms at 1.2330.”

-This combination of this week’s low at 1.2445 and the weekly reversal should not be ignored. The slope that had influenced prices for the entirety of the downtrend (at highs and lows) failed to do so last night. Establishing over 1.2500 would set the stage for a run higher.

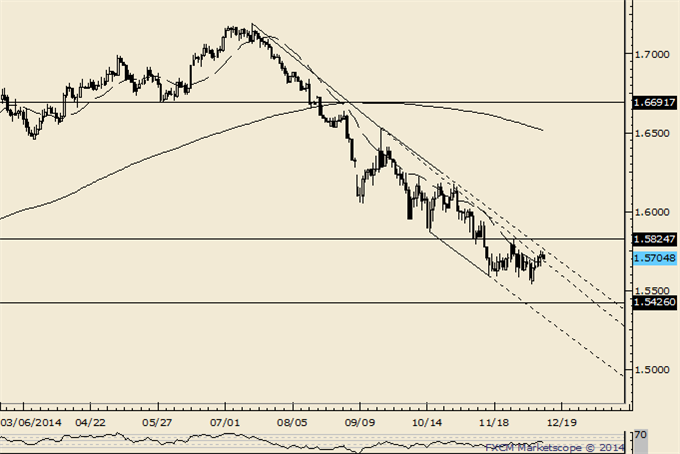

GBP/USD

Daily

-“A period of congestion may be in order as price has bounced from near the 50% retracement of the advance from the 2013 low but the drop under 1.6050 produces a pivot high on 9/19 and allows one to draw a downward sloping channel. The channel is now in focus as resistance.”

-GBPUSD turned lower from mentioned channel resistance. Look lower as long as price is under 1.5825.

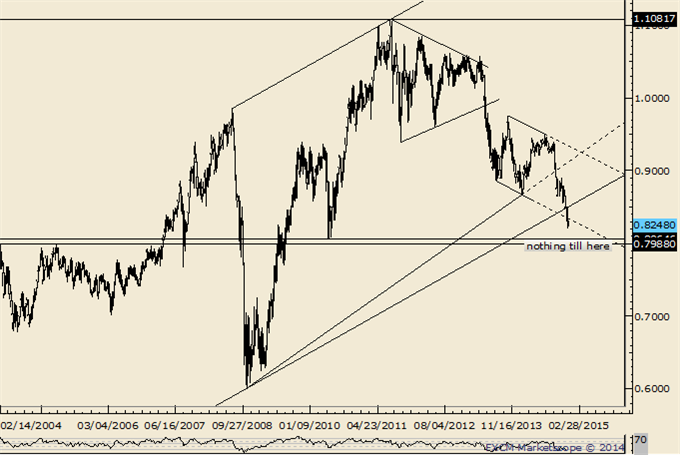

AUD/USD

Weekly

-“Weakness has extended below the line that extends off of the 2008 and 2014 lows, warning of something much more significant on the downside. The 10/29 outside day reversal keeps me looking lower. A new low would expose expansion objectives at .8476 and .8373.”

-AUDUSD was unable to hold a long term parallel. The risk is for lower prices with the May 2010 low at .8067 and the 2005 high at .7986 of interest as suppors.

NZD/USD

Weekly

-“NZDUSD traded to the 61.8% retracement of its 3 year range today (.7929) and the next level of interest probably isn’t until the 2013 Labor Day gap at .7722. One can’t help but notice that an epic double top is possible with a target of .5898. That would trigger on a drop below .7370 but this week’s high at .8169 is the pivot now.”

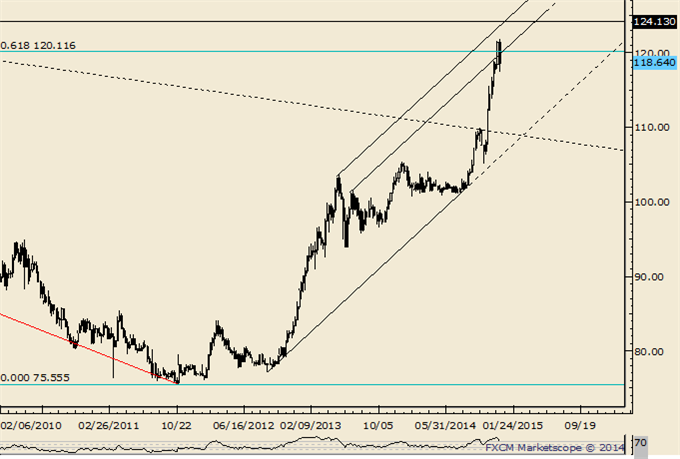

USD/JPY

Weekly

-“USDJPY has reached touched its 20 DMA for the first time since late October. Conditions are much more extreme than they were last year at this time but the 20 DMA propelled USDJPY higher last December before the big January decline.”

-The ‘snap back’ rally is nearing the retracement zone of 119.64-120.16. Rejection within this zone would warn of another leg lower towards 115.44 or 113.85.

USD/CAD

Weekly

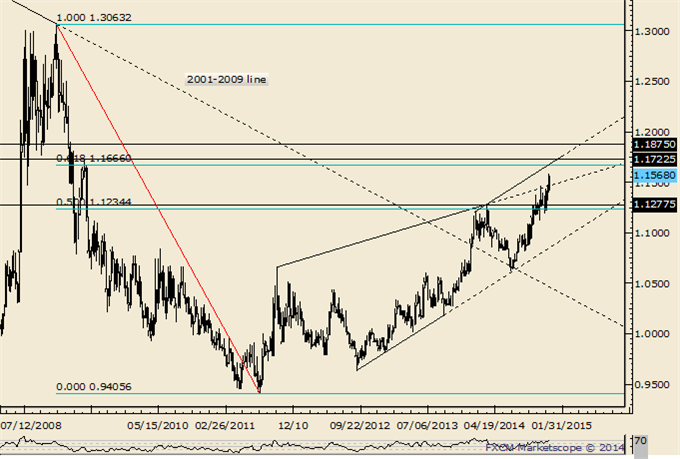

-USDCAD has propelled higher and is probably headed into upper parallels. Levels of interest on the upside are 1.1666 (Fibonacci) and 1.1723 (June 2009 high).

USD/CHF

Weekly

-“USDCHF has traded into median line support and former congestion (.9300-.9430). Start looking higher again. .9580 is resistance within the range and .9400/30 is support. A target level in the event of a new high is .9750.”

-“USDCHF exceeded its .9750 objective but drastic divergence with RSI on the daily along with a possible wedge formation from .9359 warn of a vulnerable market and topping process.”

More...

Email Blog Entry

Email Blog Entry