Pattern Analysis -Crude Oil Drop Pauses, Gold Breaks Five-Month Down Trend

by

, 12-11-2014 at 02:58 AM (1059 Views)

US DOLLAR TECHNICAL ANALYSIS – Prices may be preparing for a pullback having put in a bearish Evening Star candlestick pattern below a five-year high. A daily close below the 14.6% Fibonacci retracement at 11434 exposes the 23.6% level at 11379. Alternatively, a turn above the 23.6% Fib expansion at 11528 opens the door for a challenge of the 38.2% threshold at 11616.

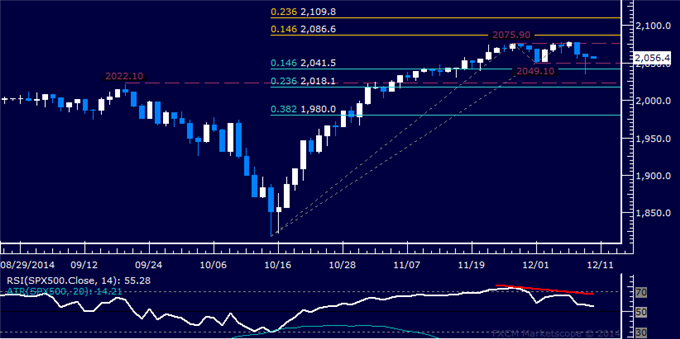

S&P 500 TECHNICAL ANALYSIS – Prices began to turn lower as expected. A drop below the 2041.50-49.10 area marked by the 14.6% Fibonacci retracement and the December 1 low exposes the 2018.10-22.10 zone (23.6% level, September 19 high). Alternatively, a move above the 2075.90-86.60 region (November 26 high, 14.6% Fib expansion) targets the 23.6% expansion at 2109.80.

GOLD TECHNICAL ANALYSIS – Prices overcome resistance at a falling trend line set from early July, exposing the 50% Fibonacci retracement at 1237.59. A break above this barrier on a daily closing basis exposes the 61.8% level at 1262.96. Alternatively, a turn back below the intersection of the trend line and the 38.2% Fib at 1212.23 targets the 23.6% retracement at 1180.84.

CRUDE OIL TECHNICAL ANALYSIS – Prices paused to consolidate losses after five consecutive days of downward momentum. A break below the 50% Fibonacci expansion at 65.96 exposes the 61.8% level at 64.30. Alternatively, a move above the 38.2% Fib at 67.63 targets the 23.6% expansion at 69.68.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

More...

Email Blog Entry

Email Blog Entry