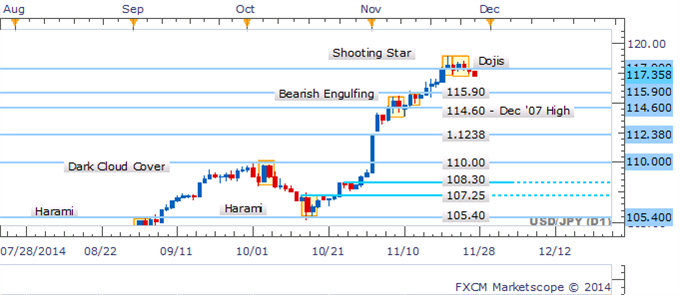

USD/JPY Price Pattern Analysis - Flat, Pending Long On Bullish Signal Near 115.90

by

, 11-27-2014 at 11:09 PM (1155 Views)

- Strategy: Flat, Pending Long On Bullish Signal Near 115.90

- Dojis Indicated Reluctance From The Bulls Near 117.90

- Intraday Trade Reveals Reluctance From Traders

USD/JPY has slipped below the 117.90 support level after a string of Dojis suggested hesitation from traders to lead the pair higher. While key reversal patterns are lacking the next level of buying interest rests at the 115.90 mark - suggesting some scope for a shallow pullback. The emergence of a bullish signal at the barrier would be seen as an opportunity to re-initiate longs.

Dojis Suggest Bulls Running Low On Fuel

The four hour chart tells a similar story to the daily with a snaking series of short-body candles suggesting caution in intraday trade. An absence of clearer cues from candlesticks leaves a more constructive setup desired before re-initiating longs.

String of Short-Body Candles and Dojis Endures

By David de Ferranti, Currency Analyst, DailyFX

More...

Email Blog Entry

Email Blog Entry