Pivot Points for Risk Management

by

, 08-07-2014 at 03:24 AM (1327 Views)

Talking Points

- Pivots Can Identify Changes in Trading Conditions

- Stops Should Be Used When a Trade Idea is Invalidated

- Traders Should Look for a 1:2 Risk/Reward Ratio or Better

Managing risk is a concept all traders need to come to grips with when creating an active trading plan. This is especially important when trading a scalping or day trading based strategy. Market conditions can change rapidly, and when the market is moving against you, it is better to already have a plan to exit losing positions. This way you know exactly when and at what price you wish to close your trades before the market gets to that point. Today we will continue our look at camarilla pivots by learning how to manage risk in both range and breakout price reversal scenarios.

Let’s get started!

GBPJPY Breakout

Risk and Breakouts

For traders implementing a breakout strategy, a false breakout is always a major concern. A false breakout consists of a trade which is entered on price moving through a value of support or resistance, and then moving immediately back through this value. While there is no way to prevent a false breakout, traders can set stops to exit the market in the event breakout conditions end.

Above we can see an example of how risk can be contained in the event of a breakout. Stop orders can be set inside of the previously identified trading range using camarilla pivots. This area has been selected for stop order placement, because it identifies an area where market conditions are changing. When the market is ranging, traders should not be holding onto breakout positions. This means in the event price drops back below the R3 value, any existing breakout positions should be closed.

GBPNZD Range

Risk and Ranges

Traders using camarilla pivots also have the ability to identify and trade daily ranges. Just like our breakout example, risk should be monitored and contained through the use of a stop loss. While breakout traders look for breaches of support and resistance, range traders look for price to stay inside of these pre identified price levels. In the event of a price breakout, traders should be able to identify the changing market conditions and again manage risk on any existing positions.

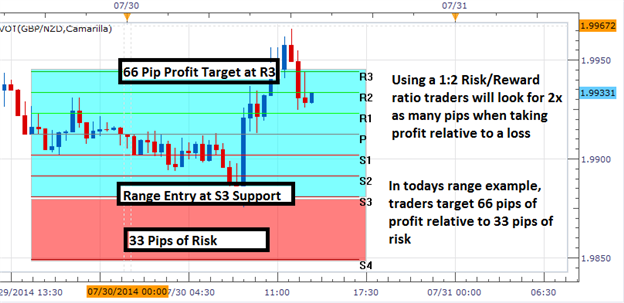

Above we can see a range reversal playing out on the GBPNZD. Price is continuing to ping between values of support and resistance. While price targets can be set at the opposing side of a range, positions should be exited in the event of a breakout. Traders can use the S4 and R4 camarilla pivots for this task. Stops can be set at these values and if price makes a higher high or lower low, any existing range trades can be closed.

Risk and Reward

The next step to managing risk is understanding Risk/Reward ratios. A Risk/Reward ratio simply compares the amount of pips your risk on a trade, relative to your profit target in pips. For instance in the example above, traders would be risking 33 pips while looking for a 66 pip profit target on the GBPNZD. When we ultimately look at the ratio, it creates a 1:2 Risk/Reward ratio. This means we were looking for 2x as many pips in profit for every pip placed at risk.

More...

Email Blog Entry

Email Blog Entry