Trading Intraday Market Reversals

by

, 08-10-2014 at 02:30 AM (1493 Views)

Talking Points

- Lack of volatility can provide range trading opportunities

- Traders can look for market turns at support & resistance values

- Traders can use an oscillator, like CCI, to time market entries

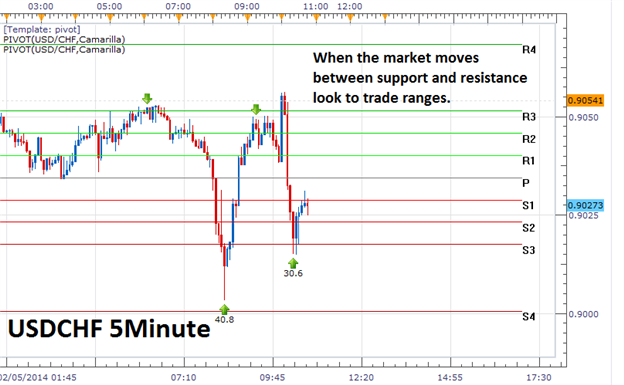

The idea of trading short term market reversals is a popular one, especially in low volatility environments. Traders that are aware of the current market conditions can take advantage of the absence of any distinguishable trend by first identifying key levels of support and resistance and then trading accordingly. Today, we will review how to scalp intraday reversals and ranges using Camarilla pivot points.

Learn Forex – USDCHF Pricing Range

Find Support & Resistance

Markets are prone to turn at existing points of support and resistance, so identifying these points is critical. One easy way to identify support and resistance for scalping is with the use of Camarilla Pivot Points. Camarilla Pivots are calculated using percentages of the previous day’s trading range and when added to the graph creates a clear idea of where price may be supported or resisted.

As seen above, Camarilla Pivots label resistance lines R1-R4, and support lines S1-S4. R4 and S4 are considered extremities in price denoting a breakout in price. Traders looking for short term reversals should primarily focus on price moving between the S3 and R3 pivots. This is known as the trading range, and can afford traders short term day trading possibilities if price stays between these values. Let’s look at how a short term turn in the market can be traded.

Learn Forex – USDCHF Range Entry and Target

Trading Price Reversals

Now that support and resistance has been labeled on the chart, traders can begin planning their market entries. The key to trading price reversals is to sell the market as close to a value of resistance as possible. Conversely traders should look to buy the market as price approaches support. Traders can select to use market orders, entry orders, or even employ the use of oscillators to facilitate their entries. Regardless of the methodology employed, the key isto remember that the market can continue ranging and turning, as long as the R3 and S3 pivots remain valid.

Next, traders must plan to exit the market. Stop orders can be placed outside of the S4 and R4 values. Since price would be reaching a breakout at that point, traders should no longer be looking for price reversals at these points. Conversely, traders should also prepare to take profit. This can be done in accordance with traditional range trading strategy. Traders buying support can look to take profit at resistance and vice versa for a sell based position.

---Written by Walker England, Trading Instructor

More...

Email Blog Entry

Email Blog Entry