Difference Between Dow, Nasdaq, and S&P 500

by

, 08-06-2018 at 09:50 AM (1480 Views)

In the U.S., market participants focus the majority of their attention on three indices – S&P 500, Dow Jones Industrial Average, and Nasdaq 100. These indices are of course highly correlated to one another as they track companies impacted by the same business cycle and other important macroeconomic factors.

Additionally, there is some cross-over in the stocks that are included in the ‘big three’. For example, the technology giant Apple Inc. (AAPL) is a constituent included in all three. However, there are big differences between the Dow and Nasdaq and S&P 500 - such as the number and type of stocks included in each index and how index values are calculated.

How is the Dow Jones, Nasdaq, and S&P 500 Calculated?

The S&P 500, created by Standard & Poor’s in 1962, represents the broadest measure of the U.S. economy among the three major indices. The index value is calculated by weighting each company according to its market capitalization and then a divisor, which is set by S&P, is applied to produce the final value. The simple calculation is as such: sum of the market cap of all stocks included divided by the divisor, or total market cap / divisor.

The Dow Jones Industrial Average, often referred to in short as the ‘Dow’, is the oldest index, dating back to 1896 and is the most globally well known. The Dow represents 30 large cap stocks as determined by the Wall Street Journal. Unlike the S&P 500 and the Nasdaq 100, the weighting for each component in the Dow Jones Industrial Average is ranked by share price, and then a divisor applied to create the final value.

The Nasdaq 100 is the youngest of the three indices having begun trading in 1985. It represents the largest non-financial companies listed on the Nasdaq exchange and is generally regarded as a technology index given the heavy weighting given to tech-based companies. The Nasdaq 100 is based on the market capitalization of its components.

Trading Differences Between Dow Jones, S&P 500 and Nasdaq

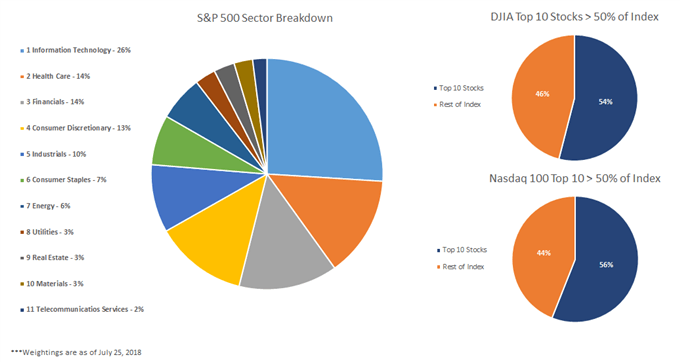

Despite the tight correlation between the major U.S. indices, they each have their own ‘personalities’ in how they trade due to the differing make-up for each index and importance of certain companies and groups of companies (sectors). The S&P 500 is the least impacted from day-to-day by any single one stock given it is comprised of so many names. With that said, there are a handful of sectors which have the most importance on the index.

Major Differences between Dow, Nasdaq and S&P 500: Breakdown of weightings

more...

Email Blog Entry

Email Blog Entry