Weekly Trading Forecast for Majors + Gold

by

, 08-25-2014 at 12:43 PM (1678 Views)

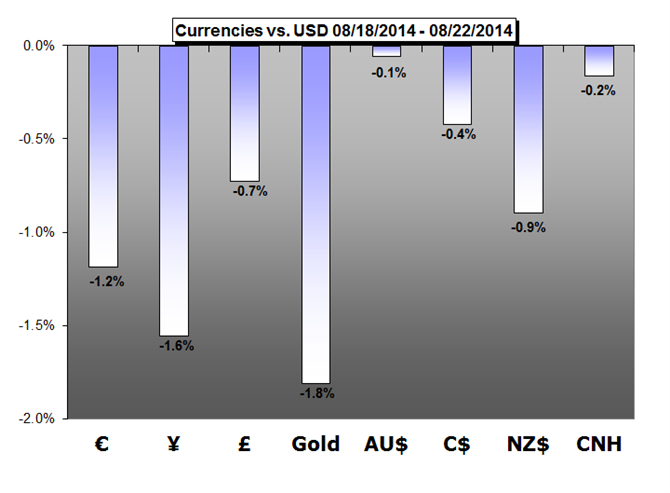

Dollarís Best Rally in 18 Months Will Stall Without Catalyst

Looking into the dollarís backdrop, there is little of the fundamental motivation we would normally expect the currency to advance on. Without a turn in speculative appetites, groundswell in the marketís rate forecasts or material drop in other majors; the dollarís rally is likely to stall.

Japanese Yen at Make-or-Break Levels Ahead of Key Data

The Japanese Yen tumbled towards yearly lows versus the US Dollar, and key data in the week ahead could decide whether the USDJPY makes a sustained break of its year-to-date trading range.

GBP/USD Remains Oversold Despite BoE Dissent- RSI in Focus

We may see the British Pound regain its footing ahead of the next interest rate decision on September 4 should the fundamental developments coming out of the U.K. further boost interest rate expectations.

AUD To Remain Resilient Amid Drive To Yield and Void of Local Data

Looking ahead, RBA policy bets as well as general market risk appetite remain the dominant themes to monitor for the Aussie. On the policy front; a void of local economic data is on the calendar heading into the end of the month. This is likely to leave the Ďperiod of stabilityí baseline scenario for rates intact. Which in turn could keep the currency supported via its yield spread over its major counterparts.

New Zealand Dollar Weakness to Persist as Fed Rates Outlook Firms

A lull in high-profile domestic news-flow puts external forces in the spotlight as the primary drivers of New Zealand Dollar price action in the week ahead. The central issue on this front continues to be the evolution of the expected time gap between the end of the Fedís QE3 asset purchases in October and the first subsequent interest rate hike.

Gold Tumbles to Fresh Two Month Lows on Fed Outlook- $1271 Support

Looking ahead to next week, traders will be closely eyeing the second print for 2Q GDP with consensus estimates calling for a slight downward revision to an annualized pace of 3.9% from 4% q/q. July durable goods orders, pending home sales, and the final read for the August University of Michigan Confidence survey are also on tap next week and weíll look for stronger data to broadly remain supportive of the dollar / limit gold advances.

Email Blog Entry

Email Blog Entry