Date: 7th November 2024.

Today’s Highlights & Analysis: Election, BoE & Fed Rate Decisions!

Trading Leveraged Products is risky

*The SNP500 saw its best post-election day in history. It rose 2.50% on Wednesday.

*Qualcomm beat earnings and revenue expectations adding to the bullish sentiment of the SNP500 and NASDAQ!

*The VIX drops to a 2-month low indicating a higher risk appetite but investors are monitoring higher bond yields which have risen to a 4-month high.

*The US Dollar Index retraces on Thursday morning after increasing to an 18-week high on Wednesday. Investors turn their attention to the Federal Reserve Chairman’s speech this evening.

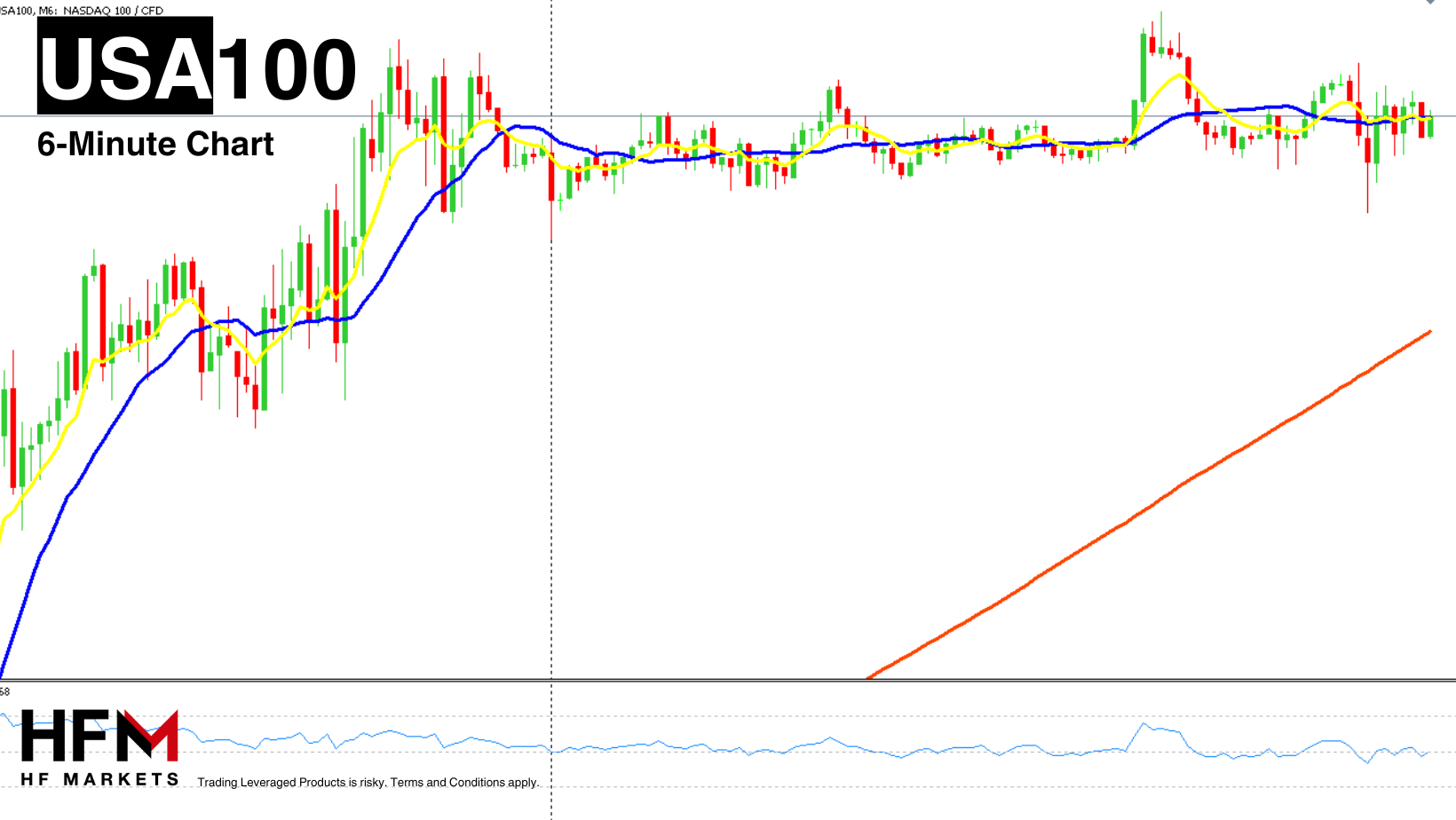

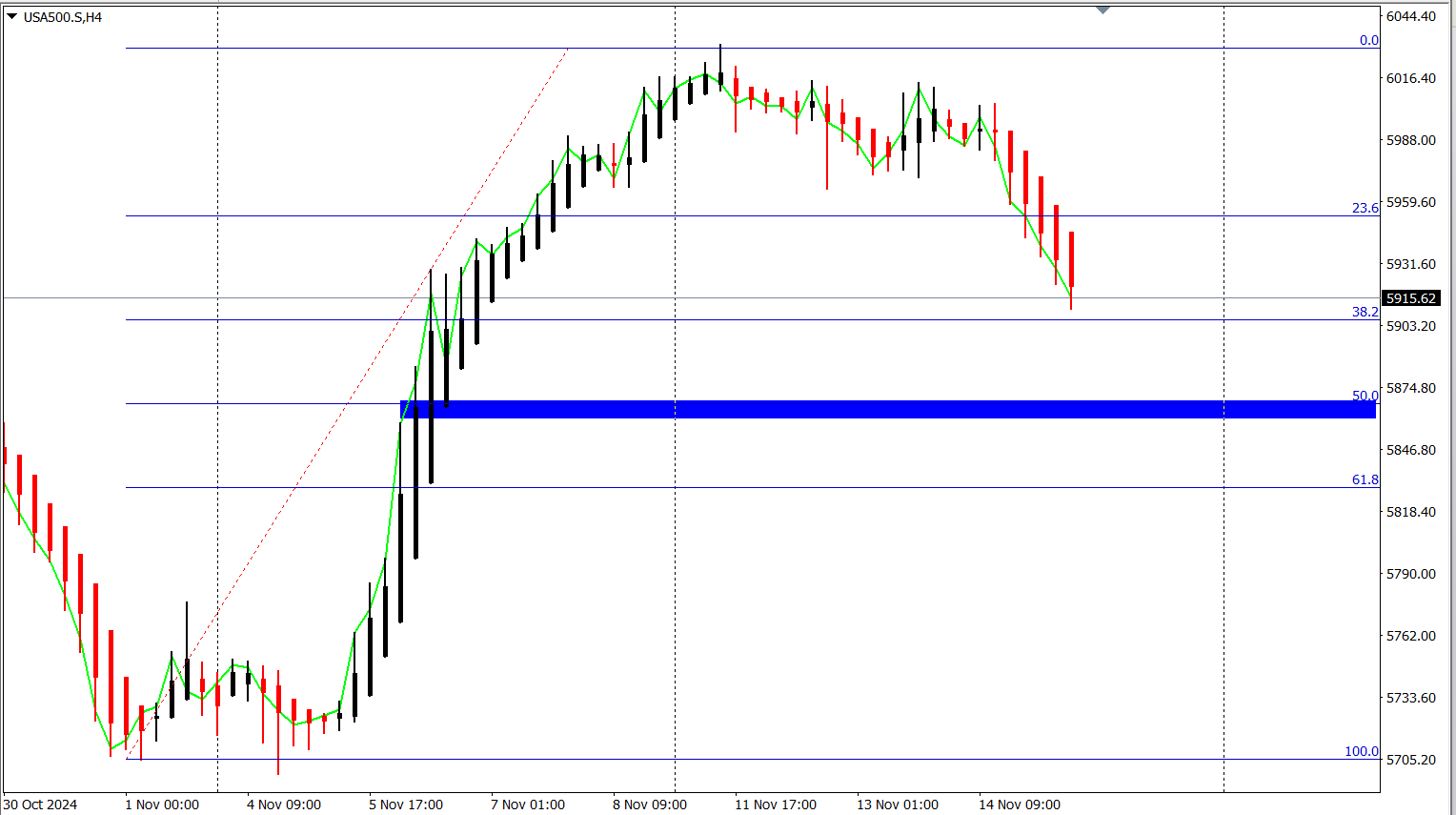

SNP500 – 2024 Is On Track To Be The Best Year Since 2019 For The SNP500!

The SNP500 continues to trade higher on Thursday as buyers maintain control and hold onto their positions. The SNP500 trades 0.14% higher during this morning’s Asian Session in addition to the 2.50% rise on Wednesday. The market is positively reacting to Trump’s Pro US stance and the fact that the Republicans are likely to hold the presidency, house and senate.

Economists have voiced concerns about a Trump presidency such as the Federal debt rising due to significant tax cuts to both business and citizens. Also in addition to this, tariffs and trade wars in China and Europe can significantly increase inflation. However, it is important to note that this is not what the market is currently pricing into the market. Investors will without doubt be scrutinizing comments from the Fed Chairman, Jerome Powell, and hoping for his opinion on the matter. Of course, these comments can create a ripple effect on the stock market.

Analysts expect the Federal Reserve to cut interest rates by 0.25% this evening and a further 0.25% in December. If the Chairman signals a different path, the stock market is likely to witness a higher level of volatility. If the Fed indicates a more hawkish stance there is a higher possibility the SNP500 can witness a large retracement downwards or a full correction back closer to $5800.

A positive indication for the SNP500 continues to be the VIX index which fell a further 0.90% this morning. The remarkably lower VIX index signals a higher risk appetite towards the stock market which increases demand. However, a potential problem is the bond market where yields have risen significantly. Higher bond yields trigger a higher cost of debt which can negatively influence consumer demand. This morning, the US 10-year bond yield fell 24 points which is another positive, but only if the yield continues to fall throughout the day.

Lastly, the quarterly earnings report from Qualcomm adds to the higher sentiment towards the SNP500. Qualcomm’s earnings per share beat expectations by 4.74% and revenue rose almost 900 million compared to the previous quarter. The stock rose more than 10.00% in the last 24-hours supporting the SNP500. Qualcomm’s stocks hold a weight of 0.38% and it is the 45th most influential stock from the SNP500’s 500 components.

Technical analysis continues to point towards a bullish trend due to strong momentum. However, on the 5-minute chart, the price is retracing slightly lower as we edge closer towards the European Cash Open. Therefore, ideally investors may wish for bullish momentum to be regained prior to speculating another buy trade. For example, if the price rises above $5,943.84.

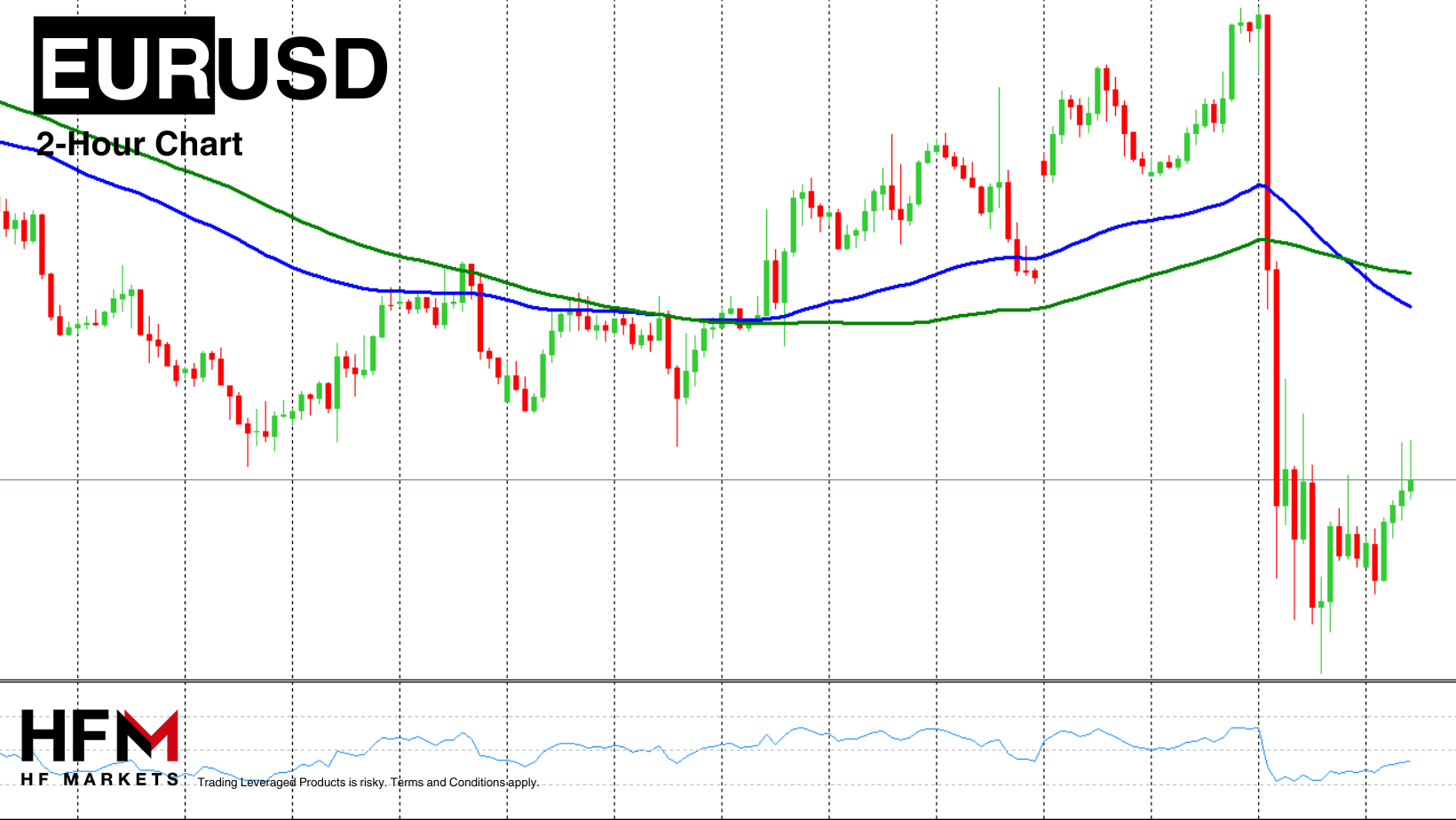

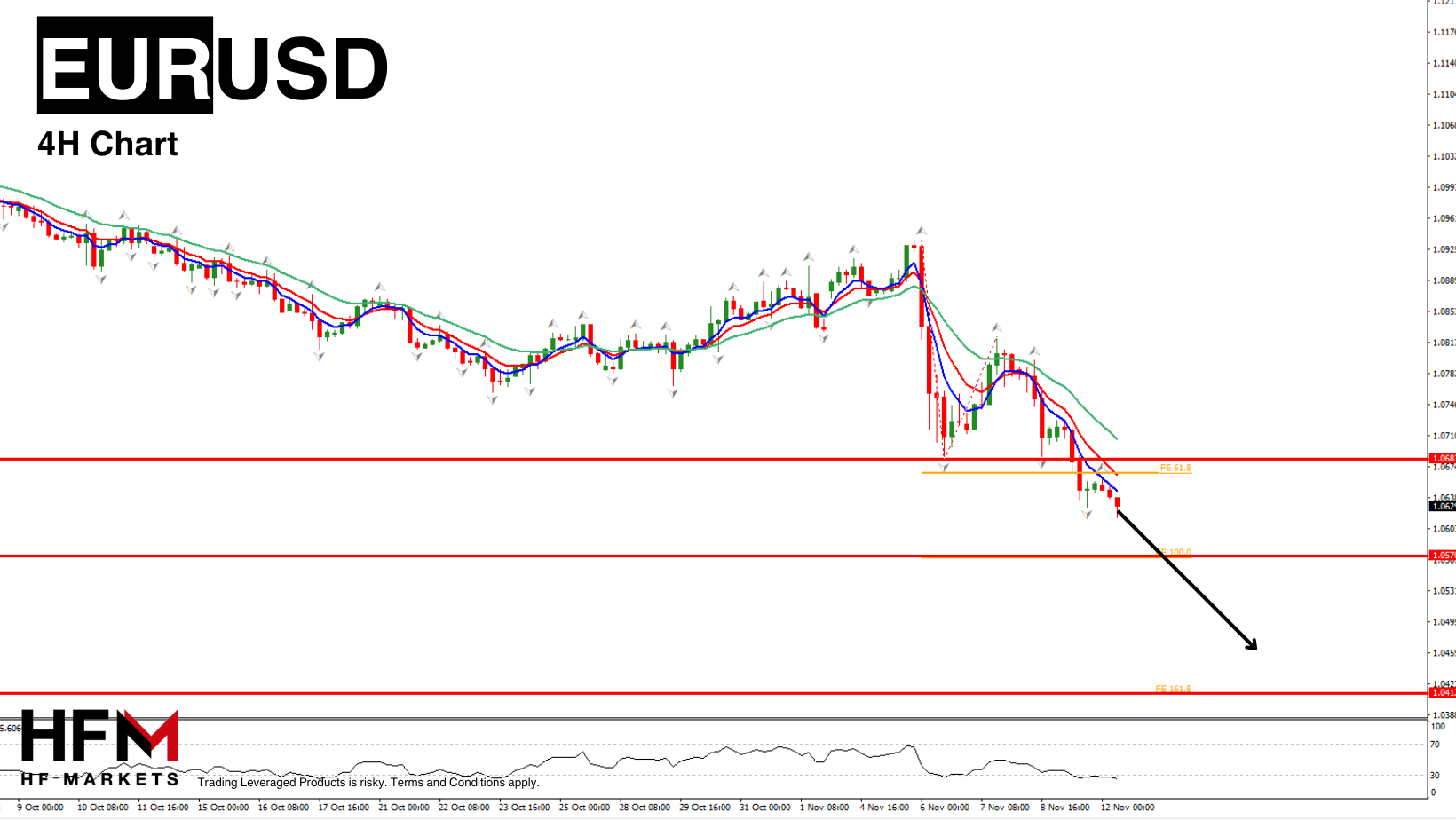

EURUSD – The Euro Continues To Struggle But The USD Retraces On Thursday!

The Euro continues to witness a lack of demand and is again one of the weakest currencies of the day. The Euro index is currently trading 0.20% higher which is only better than the US Dollar Index and Swiss Franc. The best performing currencies of the day are the New Zealand Dollar, Australian Dollar and Canadian Dollar.

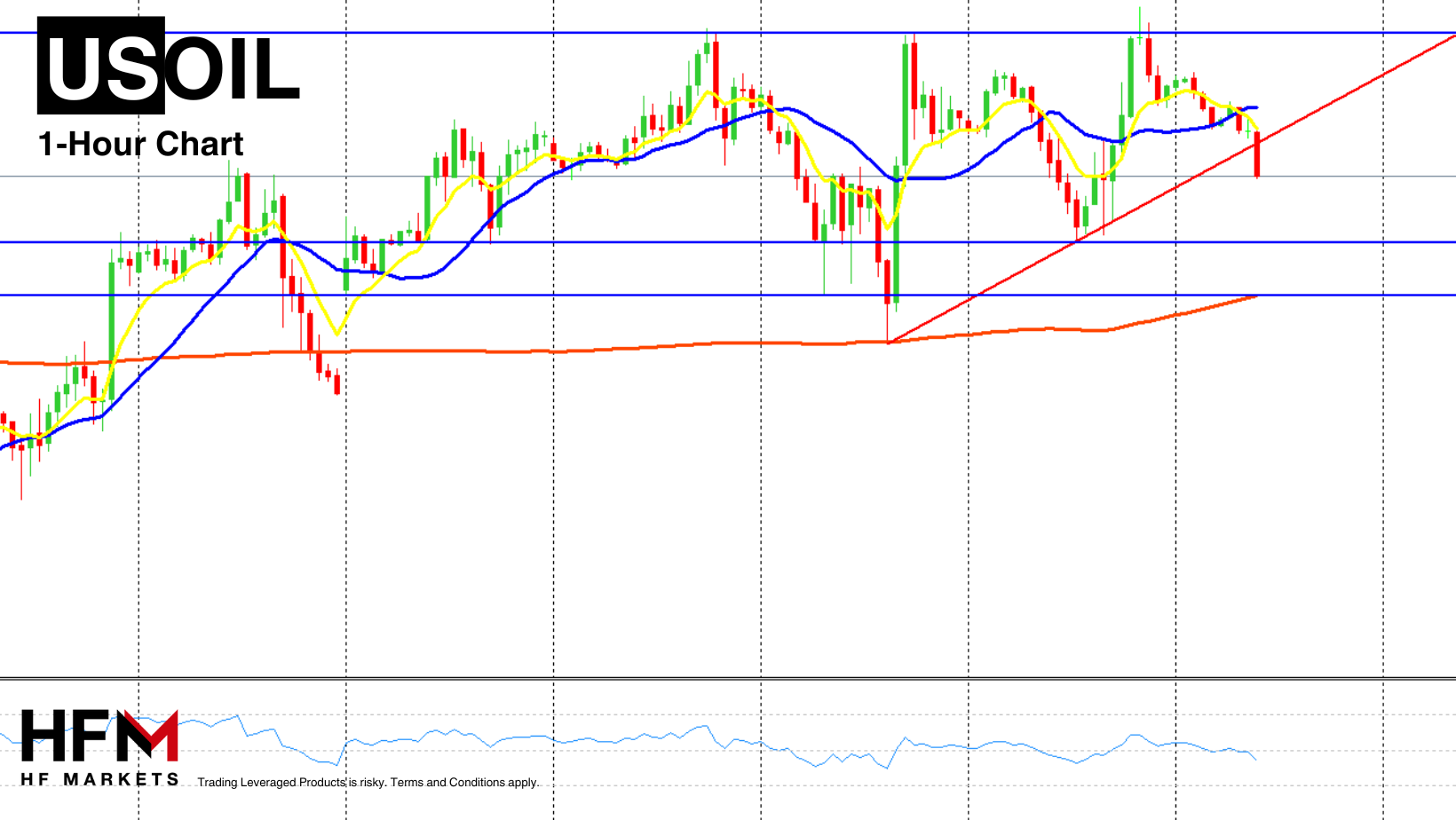

Investors are hoping the Federal Reserve chairman will comment on potential tariffs, tax cuts, deportations of migrant workers and a lower oil price. If the Federal Reserve advises the regulator to be more cautious about taking into consideration interest rate cuts in the future due to the above, investors may increase exposure to the US Dollar. However, this can negatively impact the stock market and the value of bonds.

The US Dollar Index is declining on Thursday forming a retracement measuring almost 0.50%. Therefore, investors should note that the volatility is also coming from the USD, not solely the Euro. The decline is understandable considering the strong rise in the US Dollar post election, which saw the currency rise a whopping 2.00%. A key factor for the US Dollar will now be the Chairman’s comments in tonight’s press conference and the impending rate cut in December. Thereafter, investors will focus on the US inflation rate and what it would mean for the monetary policy.

From the European side, the main developments are the political tensions from Europe’s largest economy. Germany’s government has fallen into turmoil after Chancellor Olaf Scholz unexpectedly dismissed his finance minister. Christian Lindner was ousted from the three-party coalition in a high-level government meeting on Wednesday evening, following months of intense internal conflicts that have fueled the administration’s declining popularity. Experts believe Germany will also announce snap elections due to the political turmoil.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks