AUD/USD Market Overview: Key Risks and Opportunities

Introduction to AUD-USD

The AUD/USD currency pair, commonly known as the "Aussie," represents the exchange rate between the Australian dollar and the US dollar, making it one of the most widely traded pairs in the forex market. It is closely followed by traders due to its strong correlation with global commodity prices, particularly gold and iron ore, which are major Australian exports. Movements in this pair are often influenced by economic data from Australia and the United States, as well as shifts in global risk appetite. The "Aussie" is favored by traders for its tendency to reflect broader market sentiment and its sensitivity to interest rate differentials between the two economies.

AUD/USD Market Overview

Currently, AUD/USD is trading with cautious sentiment as markets weigh upcoming economic releases from both the US and Australia. On the US side, traders are closely watching weekly crude oil inventory reports from the American Petroleum Institute (API) and the Energy Information Administration (EIA), which can influence the dollar through shifts in energy prices and overall risk sentiment. Additionally, remarks from Richmond Fed President Thomas Barkin, particularly if hawkish, could reinforce USD strength by hinting at tighter monetary policy. In Australia, focus turns to the Melbourne Institute’s Leading Index due mid-September, followed by the Consumer Price Index (CPI) later in the month, a key inflation gauge that could impact expectations for future Reserve Bank of Australia decisions. Looking further ahead, Construction Work Done data in November will provide additional insights into Australia’s growth outlook. Together, these events set the stage for potential volatility in the "Aussie," with traders balancing US policy signals against Australian inflation and growth indicators.

AUDUSD Technical Analysis

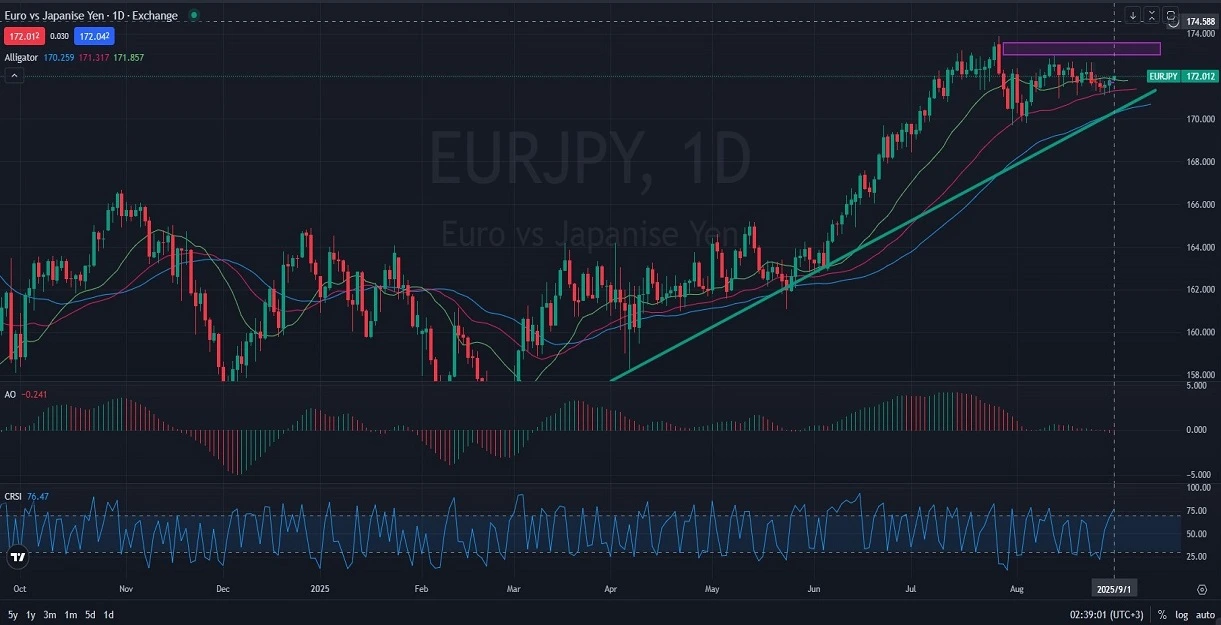

From a technical standpoint, AUD/USD has been trading within an upward channel since early 2025, though recent price action shows weakness as the pair tests the lower boundary of the channel. The Alligator indicator lines are currently converging, reflecting indecision and the potential for sideways movement in the short term. Immediate support is seen near 0.6485, a level that coincides with the channel floor, while resistance lies around 0.6650–0.6700, aligning with the channel’s upper boundary and the descending long-term trendline. A sustained break below 0.6485 could signal further downside pressure, while a rebound from this level would keep the broader upward bias intact. Traders should remain cautious as the pair consolidates, with upcoming fundamental catalysts likely to dictate the next directional move.

Final words about AUD vs USD

In conclusion, the AUD/USD remains at a critical juncture, caught between key technical levels and a series of important economic events from both Australia and the US. While the broader uptrend channel provides a supportive structure, the pair’s current consolidation highlights growing uncertainty. Traders will be watching closely for signals from upcoming inflation data, construction figures, and Federal Reserve commentary to determine the next decisive move. Whether the "Aussie" holds its ground above support or breaks lower will largely depend on the balance between commodity-driven Australian strength and the evolving outlook for US monetary policy.

Disclaimer: This AUDUSD analysis, provided by Unitedpips, is for informational purposes only and does not constitute trading advice. Always conduct your own Forex analysis before making any trading decisions.

08.27.2025

2Likes

2Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks