USD30 DowJones Price Action Outlook

USD30-DowJones, commonly known as “the Dow,” is a prime gauge of U.S. economic health and a favorite for daily chart technical and fundamental analysis. Today’s upcoming events, including Wards Auto data, Construction Spending figures, ISM Manufacturing surveys, S&P Global PMI, and a Federal Reserve speech, could significantly influence price action by reflecting consumer confidence, inflation pressures, and potential monetary policy shifts.

Chart Notes:

• Chart time-zone is UTC (+02:00)

• Candles’ time-frame is 4h.

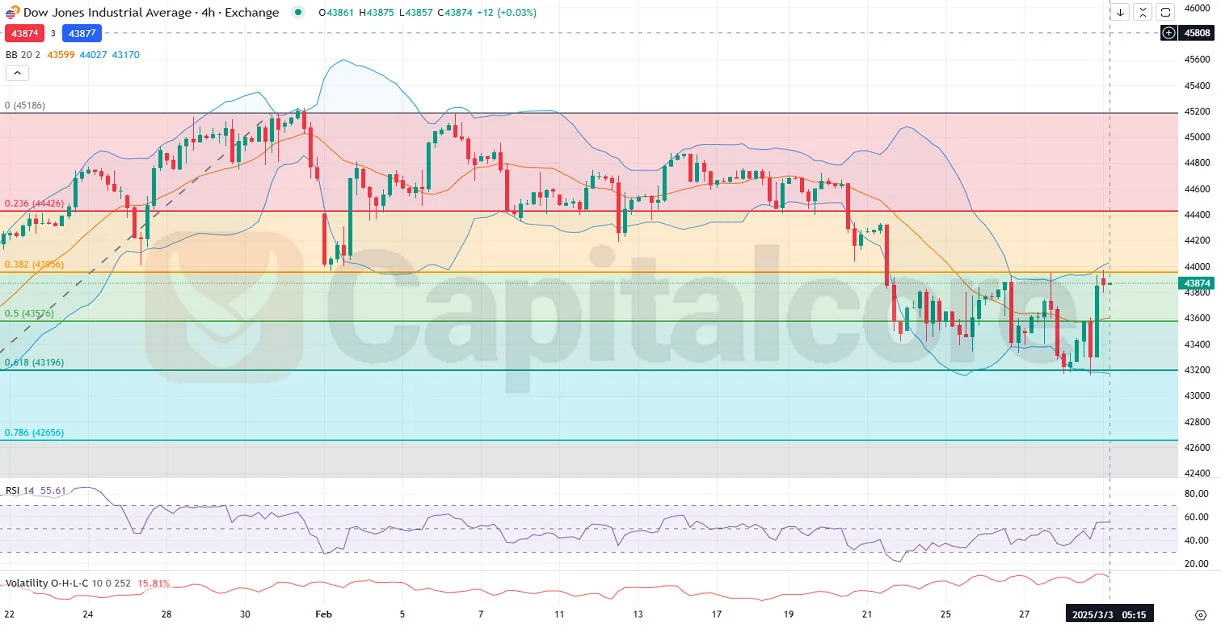

In the USD30-DowJones H4 chart, Bollinger Bands indicate that after a bearish trend, the index rebounded sharply off the lower band and pushed past the middle band. The RSI points to renewed buying momentum, while volatility and O.H.L.C. data suggest possible price swings in the near term. Currently, the price is near the 0.382 Fibonacci level and appears confined between the 0.618 and 0.382 levels, signaling that a decisive breakout or continued consolidation could shape the next phase of price action. Traders should watch for sustained closes above the middle band to confirm further upside potential. Conversely, a failure to hold above this mid-level could lead to another pullback, testing lower support areas and challenging bullish momentum.

• DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.

Capitalcore

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks