EUR/CAD Chart Patterns and Analysis

The EUR/CAD pair represents the exchange rate between the Euro and the Canadian Dollar, and its performance is influenced by various economic indicators and central bank policies from both the Eurozone and Canada. Currently, traders are focusing on recent economic data releases and upcoming speeches that could impact market sentiment. Recent economic indicators show a mixed outlook for the Canadian economy. The IPPI (Industrial Product Price Index) reported a monthly change of -0.4%, which is better than the anticipated -0.8%. However, the RMPI (Raw Materials Price Index) experienced a more significant drop of -1.7%, against the expected -3.1%. These figures suggest that while there might be some stability in product prices, raw material costs are under pressure, potentially signaling concerns about inflationary pressures in Canada. On the Eurozone side, attention is drawn to the speech by ECB President Christine Lagarde, scheduled for 8:15 PM. Her statements could provide insights into the ECB's stance on interest rates and monetary policy, which is crucial for the Euro's strength against the CAD.

Chart Notes:

• Chart time-zone is UTC (+03:00)

• Candles’ time-frame is 4h.

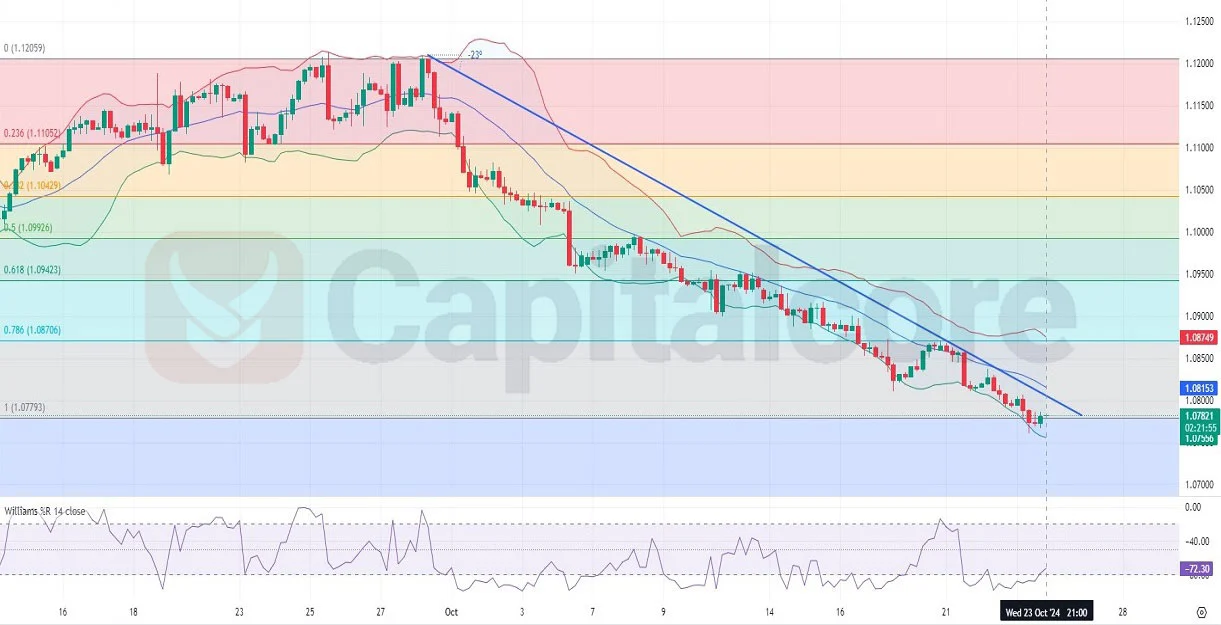

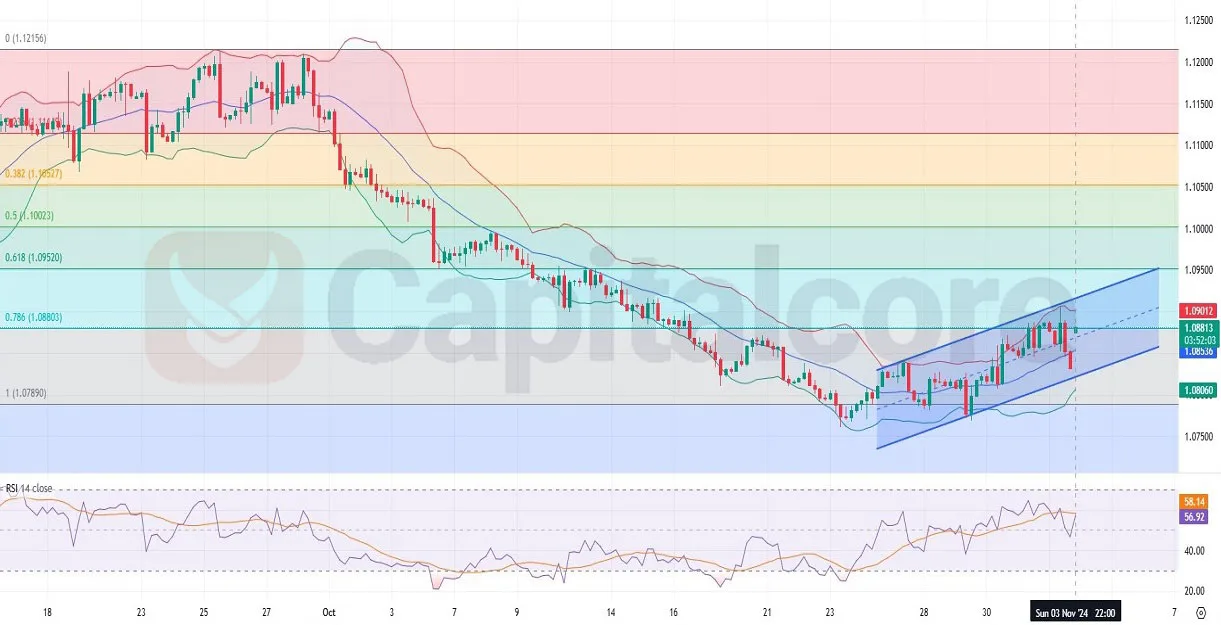

In the EUR/CAD H4 chart, the pair is currently navigating within a defined range, with strong support levels at 1.49270, 1.49000, and 1.48750, while resistance levels are positioned at 1.50000, 1.50380, and 1.50525. The Relative Strength Index (RSI) is currently at 44.36, indicating a neutral to slightly bearish momentum, while the Stochastic Oscillator shows values of 46.10 and 38, suggesting potential oversold conditions.

Recently, the pair has faced resistance near the 1.50000 level, where price action has shown a series of bearish candles. If the price fails to break above the resistance, it may consolidate or retest lower support levels. A bullish move, however, requires a decisive break above 1.50000, potentially leading to a challenge of the upper resistance levels.

The overall mixed economic data, coupled with Lagarde's upcoming speech, may lead to increased volatility in the EUR/CAD pair, as traders react to the guidance and potential shifts in monetary policy direction. A hawkish tone from Lagarde could strengthen the Euro against the CAD, while dovish comments could weaken it, leading to a test of the identified support levels.

DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.

Capitalcore

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks