EURGBP H4 Technical Analysis: Bearish Trend in Focus

The EURGBP currency pair, often referred to by traders as "Chunnel" or the "Euro-Pound," represents the exchange rate between the Euro and the British Pound. Euro-Pound price is influenced heavily by macroeconomic data from both the Eurozone and the United Kingdom. For today, Euro news includes the Producer Price Index (PPI) and Consumer Confidence Index, both serving as important indicators of inflation and economic sentiment. ECB President Christine Lagarde's speech at the Michel Camdessus Central Banking Lecture could also provide key insights into future monetary policy, which may influence the Euro. On the UK side, news surrounding consumer confidence and retail sales will be critical in shaping market sentiment. With both regions facing inflationary pressures, today's data releases and speeches are expected to heighten volatility in the EURGBP pair.

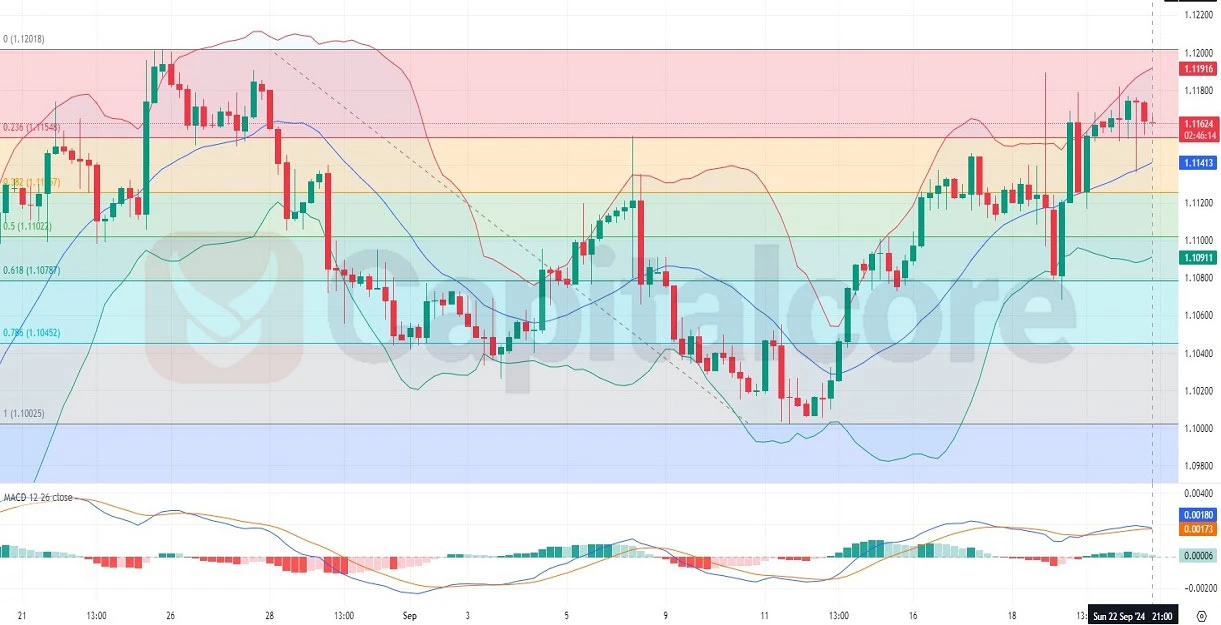

Chart Notes:

• Chart time-zone is UTC (+03:00)

• Candles’ time-frame is 4h.

Analyzing the EURGBP H4 chart, we can observe that the pair has been in a bearish trend, with four bullish candles out of the last eleven. The price has declined from the upper Bollinger Band to the middle band and touched the lower band, indicating increased volatility. After bouncing off the lower band, the last two candles have turned bullish, suggesting a potential short-term recovery. Currently, the Chunnel’s price is trading between the 1.0 Fibonacci level and the 0.786 level, highlighting a potential area of support. The RSI stands near the oversold zone, signaling that the bearish momentum may be weakening, and a bullish reversal could be imminent. Traders should watch for the price movement between these critical Fibonacci levels and observe the RSI for any divergence, which could provide further confirmation of a trend reversal.

• DISCLAIMER: Please note that the above analysis is not an investment suggestion by “Capitalcore LLC”. This post has been published only for educational purposes.

Capitalcore

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks