Weekly Trading Forecast

by

, 07-21-2014 at 06:58 AM (949 Views)

US Dollar Awaits Heavier Volatility, Rate Speculation Returns

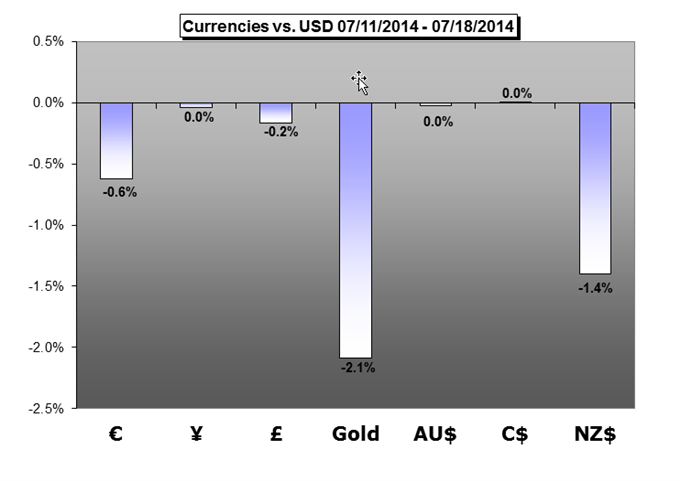

There was a considerable commotion in the financial markets this past week with sharp declines in global equities and sizable swells in volatility measures (the short-term equity-based measure increased nearly 60 percent on Thursday). Yet, a notable contrast to this chaos was the more moderate response from FX – and particularly the calm demeanor of the US Dollar. If the greenback is considered a safe haven, why did it not rally as other capital markets felt the effects of fear? What does this mean for the currency moving forward?

GBP/USD Needs Hawkish BoE Minutes, Upbeat 2Q GDP for Fresh Highs

The Bank of England (BoE) Minutes and the U.K.’s 2Q Gross Domestic Product (GDP) report is likely spark increased volatility in the GBP/USD as market participants continue weigh the outlook for monetary policy. The BoE policy statement may prop up the British Pound as a growing number of central bank officials show a greater willingness to normalize monetary policy sooner rather later, but we would need to see a greater dissent within the Monetary Policy Committee (MPC) to see fresh yearly highs in the GBP/USD as the pair retains the range-bound price action from earlier this month.

AUD Braces for Jawboning From Stevens And Quarterly Inflation Data

The Australian Dollar’s consolidation continued over the most recent week with AUD/USD remaining within its narrow range between 0.9210 and 0.9440. A status-quo set of Minutes from the RBA and positive Chinese second quarter growth figures failed to inspire the Aussie bulls. While a sell-off on heightened geopolitical tensions proved to be short-lived, with the currency bouncing back during Friday’s trading.

Gold Posts 2% Weekly Loss- $1324 Key Resistance ahead of US CPI

Gold prices are considerably lower on the week with the precious metal down more than 2.3% to trade at $1307 ahead of the New York close on Friday. The losses come amid a tumultuous week for markets with geopolitical tensions continuing to build both in Ukraine and Israel. A downed civilian airliner in Ukraine and an Israeli ground invasion of Gaza fueled a substantial rally in gold on Thursday as broader equity markets turned over.

More...

Email Blog Entry

Email Blog Entry