How To Trade Inside Bars - Inside Bars precede market breakouts

by

, 12-27-2014 at 10:35 AM (1242 Views)

Every trader should have a variety of strategies available to apply to the markets. Having multiple strategies may seem like a complication at first, but having choices can allow traders to react quickly and be able to trade a variety of market conditions. Today we will start a new strategy series by reviewing how to trade inside bars. Let’s get started!

What is an Inside bar?

Inside bars are easily identified pricing patterns that can be found on virtually any chart. The pattern itself requires some simple technical analysis, which includes identifying a series of highs and lows on a daily chart. The idea is that the current candle on the graph will not exceed the previous candles high or low, thus leaving it “inside”.

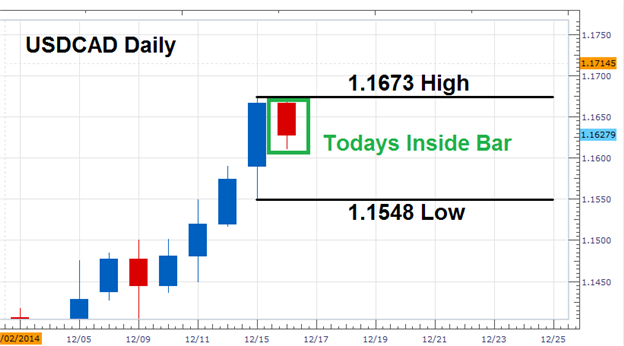

Let’s look at an example. Below we can see an example of an Inside Bar developing on a USDCAD Daily chart. Our analysis begins by pinpointing the previous bars high and low. Currently the high for the previous daily candle resides at 1.1673 while the low sits at 1.1548. It is important to remember both numbers as today’s price action should not exceed the denoted high or decline below the previous low.

If price remains inside both values, our inside bar will be confirmed!

Execution

So now that you have identified an inside bar, the next question is when and how to trade them. First off, trading inside bars lends itself to trading breakouts. The idea is that the identified highs and lows mentioned above, will also act as support and resistancevalues. If price breaks above resistance, traders will look to buy the market. Conversely if price falls below support, traders will look to sell.

Determining Risk and Reward

As the final step, setting stops and managing risk is one of the most important components of any working strategy. When it comes to trading inside bars, this process can be simplified by setting your stop between your orders. This means if your buy entry and sell entry are spaced 125 pips apart, as per our USDCAD example, you would set your risk at 62.5 pips.

Profit targets can also be formed in the same fashion. Traders opting to use a 1:2 Risk/Reward ratio can elect to target twice the amount of profit in pips relative to their risk. This means using the example above, a 125 pip profit target would be set.

Lastly, now that your risk in pips has been determined, you can use these values to help you determine your risk in terms of your account balance. To do this, you can use the risk management application available for Marketscope 2.0. It will take your risk in pips along with your selected trade size, and show you your net risk in terms of a percentage.

---Written by Walker England, Trading Instructor

More...

Email Blog Entry

Email Blog Entry