USDJPY Elliott Wave Analysis - clues to our location

by

, 11-23-2014 at 07:25 PM (1329 Views)

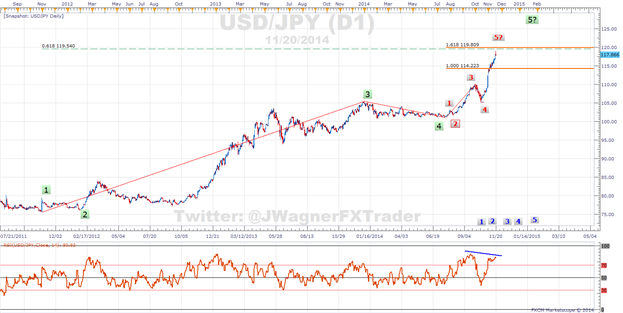

-Elliott Wave Theory can provide clues to our location within the USDJPY trend

- USDJPY continues climbing higher in 5th of 5th wave

-Daily chart shows wave relationships and reaction level in the 119 handle

USDJPY Daily

Fibonacci Wave Ratio Analysis

- Green wave 5 projects to 119.54 (green waves 1-3 times .618)

- Within green 5, red wave 5 projects to 119.81

- Intraday charts appear to be unwinding a series of wave 4 and 5’s (see video)

Bottom line, look for near term trends to finish off the larger picture wave 5 of 5. A shorter term trader can look to buy dips near 117.50-118.00 in anticipation of a smaller degree wave 5 towards 119.50

119.54-119.81 appears to be a point of attraction. This does not mean we want to short at those prices. This means the probability of a strong reaction lower is elevated if prices dig into the 119 handle.

If the longer term labeling is correct, then if a correction unfolds, dips could run for several weeks and retrace several hundred pips. The green 4th wave territory would provide longer term support should a dip develop that deep.

---Written by Jeremy Wagner, Head Trading Instructor, DailyFX EDU

More...

Email Blog Entry

Email Blog Entry