Trading Strategies Based on Volume, Part 2: Confirming Trends - Volume should increase during moves in the direction of a true trend

by

, 10-06-2014 at 03:44 PM (2239 Views)

Talking Points:

- Volume can help confirm a trend

- Volume should increase during moves in the direction of a true trend

- The EUR/USD is a current example of these principles

Trend trading is a staple in my Forex trading account; identifying the predominant direction a pair is heading and only looking for opportunities that trade in the same direction. But sometimes it is difficult to decipher whether a chart displays a trend or not. It can also be difficult to know when a trend has ended and price begins to reverse. The real volume indicator can help us in both of those respects.

Volume’s Appearance During a Trend

Just like we analyze price moves on a chart, we can also analyze volume in a similar manner. Trends are identified as a series of higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend), but volume can show a pattern during a trend as well.

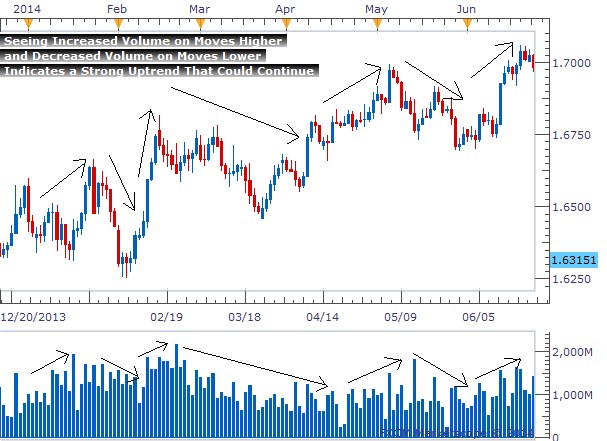

It is common to see volume increase during times where price is moving in the direction of the trend and decrease when price has a countertrend move. The market is showing more enthusiasm as price is moving in the direction of a trend. During times when price pulls back against the trend, volume then decreases as people show a lack of interest. In the chart below, we can see this explanation in a visual format.

Volume Increases with the Trend, Decreases During Countertrend Moves

This currency pair is clearly in an uptrend. Price is making higher highs and higher lows and I’ve taken the liberty of drawing arrows on the chart to mark the key moves up and down. Below price we can see real volume and learn how volume looks during an uptrend.

Volume increases each time there is a move in the direction of the trend. And volume decreases each time there is a counter-trend move. This lets us know that the trend is strong and could continue into the foreseeable future.

This chart was somewhat cherry picked to show a very clean example of the relationship between price trends and volume, however. So next I would like to look at a real world example going on right now.

A Current Example – The EUR/USD

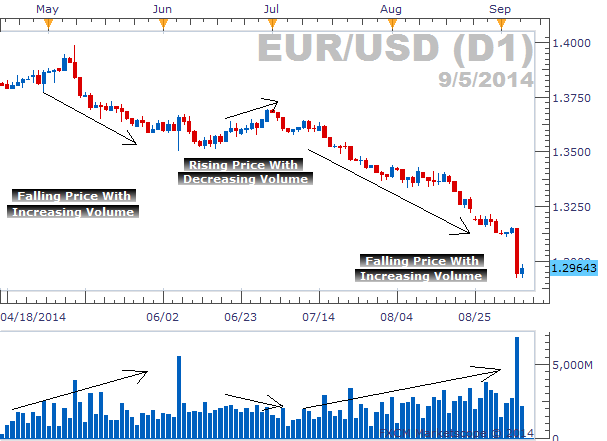

Yesterday’s enormous drop in the EUR/USD was hard to miss. The pair fell 200 pips in a single day and FXCM had its largest amount of volume traded on the EURUSD since February 29th, 2012. But before this massive move, volume was playing a role in signaling traders to continue to sell.

The EUR/USD downtrend began back in May when price peaked around 1.4000. Since that point, price has made lower lows and lowers highs with increasing amounts of volume with each leg down. And interestingly enough, when we did see a subtle pullback in the EUR/USD the second half of June, we saw volume decrease.

As we learned earlier, during a trend, volume will increase when price moves in the direction of the trend and volume will decrease when price moves counter to the trend. That is the exact circumstance we find ourselves in with the EUR/USD.

EUR/USD Trend and Volume

The chart above shows the initial downward move accompanied by increasing volume, followed by rising prices alongside decreasing volume, and then the current downward move we are participating in as volume has increased. This is a classic example of volume signaling the real strength of this trend.

In Conclusion

Volume can greatly enhance our ability to identify and act on a trending currency pair. As long as we see increasing volume during trend moves and decreasing volume during countertrend moves, the trend could continue for a while.

---Written by Rob Pasche

More...

Email Blog Entry

Email Blog Entry