3 Reasons AUDUSD Could Be Bearish for NOW

by

, 09-21-2014 at 01:43 PM (1699 Views)

Talking Points:

- AUD/USD short trade from last week triggered

- Sentiment still giving bearish signals

- Downtrend could continue towards 0.8700

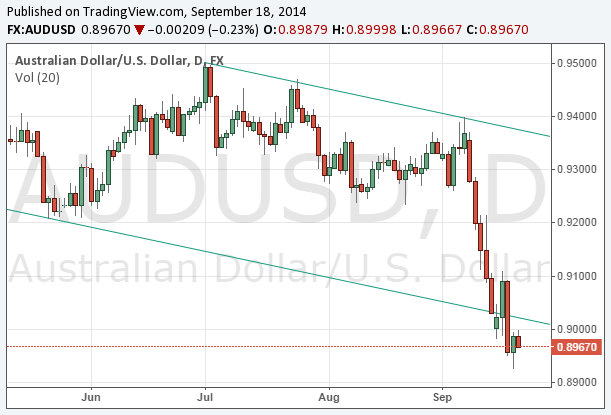

AUD/USD Support Broken - Bearish

The trend line support cited in last week's article has been broken. The chart below shows that over the weekend, the AUD/USD gapped below the trend line and closed for the day. We had said we would act on a trade if the closing price was below support. That was our trigger. After a short term rebound up to 0.9100, AUD/USD then fell and closed for the day below 0.9000.

AUD/USD Breaking Through Support

The AUD/USD has moved sideways ever since the break which is normal following an extended move in one direction. Once price breaks out of this consolidation pattern, it then could continue to move lower.

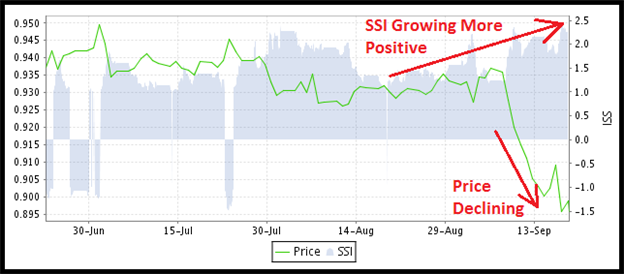

AUD/USD Sentiment Growing More Positive - Bearish

Sentiment for AUD/USD last week showed that 66% of traders were long. Currently, SSI is at +2.25, meaning 69% of traders are long. Normally, we want to look to do the opposite of the retail trading crowd, so seeing a positive sentiment would give us a bias towards selling. This is especially true when sentiment is becoming even more positive.

This could potentially be a sign that the Aussie could continue lower as sentiment increases in the positive direction.

AUD/USD Speculative Sentiment Index (SSI) - Positive

Exit Strategy

As a longer term trade, an appropriate target could be as far as 0.8700 (250 pips below the current market price). This was a previous low hit back in late January that supported price. It could act as support once more. Using a 1:2 risk:reward ratio, this would require a stop loss of 125 pips or less.

AUD/USD Support at 0.8700

In Conclusion

The AUD/USD is definitely a pair that I would consider "in play." There are several reasons to attempt to short but there are no guarantees in trading. Make sure you are using proper money management and perform your own due diligence before placing any trades on your own account.

Good trading!

---Written by Rob Pasche

More...

Email Blog Entry

Email Blog Entry