How to Trade a Double Bottom in Forex

by

, 09-08-2014 at 01:13 PM (1416 Views)

Talking Points:

- A Double Bottom is formed when price tests a previous low and bounces.

- Buy orders can be placed just above previous low.

- Limit orders can be set at most recent swing high, stop set 33% of limit distance.

With the Forex market showing low levels of volatility, there is a greater likelihood that prior support and resistance levels will hold when price tests those levels again. Because of this, trading a range bound strategy might yield better results, as breakouts are less likely to occur.

One way to trade ranges, is to look for the Double Bottom chart pattern. It occurs when price tests a previous low and fails, followed by price bouncing higher. This trade setup allows traders to place relatively tight stops and generous profit targets. So we are able to risk a little in an attempt to make a lot with a positive risk:reward ratio.

Today we learn how to identify these trading opportunities and effectively trade them.

Locating Re-Tests of Previous Lows

A Double Bottom pattern starts off with a swing low followed by a sudden rebound higher. In other words, price bouncing off of a fresh support level. At the low, we want to extend a horizontal line out into the future.

Low Being Made – Highlighted and Price Extended

The chart above gives us a clear example of price bouncing from a swing low and then moving higher. The low is highlighted in yellow with a black horizontal line extending into the future. We draw this line because we will use it to create our trade entry.

Setting Up Our Trade Entry

Double Bottoms can be tricky. They won’t always be perfect. There will be times when price will come down and hit the exact low price and bounce higher. But there will also be times when price bounces before reaching the previous low or will bounce after temporarily piercing the previous low. This is the reason why I recommend placing our entry order a few pips above the previous low. This will ensure we do not miss an entry but at a cost of getting a slightly worse entry.

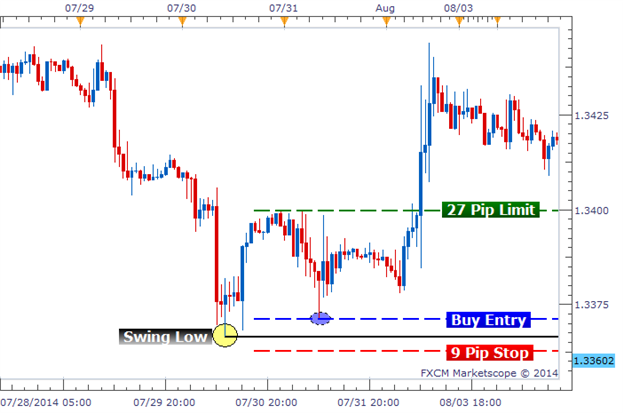

The chart below shows the previous low labeled with our buy entry order set a few pips above the previous low. We are buying at this level in anticipation of a bounce and the double bottom to be fulfilled. We then will need to setup our exit strategy while we wait.

Setting Buy Entry for Double Bottom Setup

Setting Up Our Trade Exit

So now that our Entry is set up, we need to focus on how we are going to exit our trade. We want to first set our profit target at the previous high that was made following the initial swing low that we highlighted before. The idea is that price will at least be able to have enough strength to test this swing high.

Once our limit is created, we then want to set our stop loss 33% of the limit’s distance. In our example, the distance between our entry and our limit was 27 pips. That means our stop loss will be set at 9 pips. This accomplishes two goals.

First, it will place our stop loss beyond the previous low, making it more difficult for price to reach it. And second, it will give us a juicy 1:3 risk:reward ratio. Money management is one of the Double Bottom’s greatest attributes. With a 1:3 risk:reward ratio, we only have to maintain a 25% win rate on our trades to break even. If we have higher than a 25% win rate, we should be profitable in the long run.

Double Bottom Entry with Stop and Limit Set

In Conclusion

The Double Bottom formation is a great opportunity to trade during range bound environments that have low levels of volatility. After identifying a swing low, we can set our buy entry a few pips above. We can then set our profit target at the most recent swing high and a stop order that is 33% of our limit distance. The positive risk:reward ratio allows us to be profitable if we can maintain a win rate above 25%.

Good trading!

---Written by Rob Pasche

Email Blog Entry

Email Blog Entry