The Two Ingredients for Profitable Trading

by

, 09-27-2014 at 11:28 PM (1730 Views)

Talking Points:

- Most beginner traders focus on their win percentage

- Educated traders focus on their Risk/Reward Ratio

- Veteran traders focus on how their win percentage and Risk/Reward work together

I work with traders that have a wide variety of skill levels, from people just starting out to traders trading their own money (and sometimes others') professionally. And it’s always interested me how similar the learning process is for most traders. We all start off learning the most basic forex terminology and tools and work our way up until we have carved out our own strategy, good or bad.

Something I frequently see evolve over time is a trader's understanding of win percentage and risk/reward ratio and the important relationship that they have. Today, we analyze this crucial concept.

The Win Percentage Fallacy

What if I told you I had a strategy that has a win percentage over 90%, would you be willing to use it? If you quickly responded, “yes,” you should think a bit longer about what a 90% win rate actually means. On average, my strategy will win 9 times out of 10, but how does this translate into actual dollars and cents?

The above example is a trap I see many traders fall into. Win percentage on its own does not create a winning strategy. We also need to know how much the strategy is winning and losing on the average trade to determine if it has an edge.

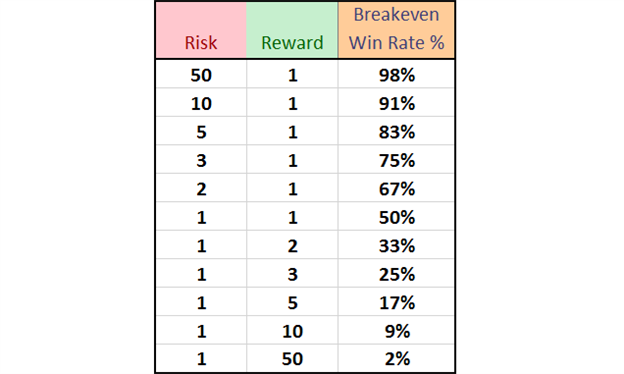

In reality, it’s easy to create a strategy with a high win rate. We simply set our profit target 1 pip away from our entry, and a stop loss 50 pips away. More than 90% of the time, our strategy will close out its trades as a winner because the profit target is so close to the current price and our stop loss a long way off. It doesn’t matter where or when we enter the trade, we should have an excellent win rate regardless.

The problem with this strategy is obvious, however. Our profit per trade is tiny compared to the loss we take when we are wrong. So all those profitable trades are completely offset by the rare but large losing trades. We would actually need a win rate greater than 98% to be profitable using this strategy, something nearly impossible.

Focusing on the Risk:Reward Ratio

Once traders realize that a high win rate won’t guarantee that their strategy will be profitable, they often turn to creating a strategy using a positive risk:reward ratio. This is good, because this corrects the number one mistake Forex traders make. A positive risk:reward ratio means that we set our profit target further than we set our stop loss. So our reward is greater than or potential risk on each trade.

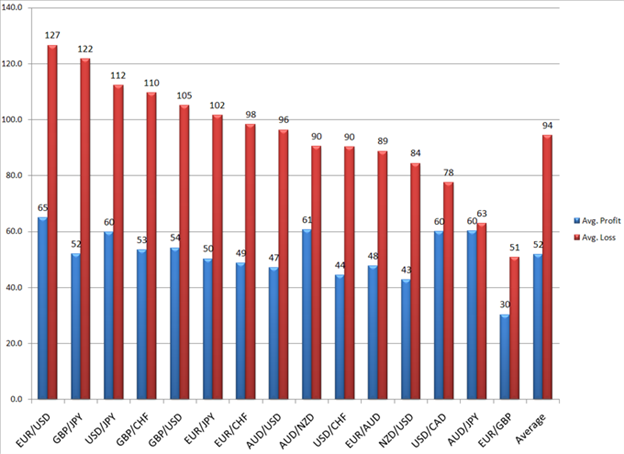

Most Traders Use a Negative Risk:Reward ratio

The key benefit to using a positive risk:reward ratio is that it takes pressure off of our strategy’s win rate. We know for certain that as long as we are correct at least 50% of the time, we should be profitable. In fact, our win rate doesn’t need to be that high. We can make money with a win rate much lower than 50% if our risk:reward ratio is strong enough.

Combining Win Rate and Risk:Reward Ratio

Bringing these two lessons together is what creates a profitable strategy. We need to have an edge when we take into account our win rate AND our risk:reward ratio. Neither attribute can make us profitable on their own. The chart below shows several risk:reward ratios and the win rate required to produce breakeven results. To be profitable, we need to have a win rate higher than the breakeven win rate next our preferred risk:reward ratio.

Risk: Reward Ratio and It’s Breakeven Win Rate Required

---Written by Rob Pasche

More...

Email Blog Entry

Email Blog Entry