It was a climactic weekend for UK politics, and we're now just months away from the summit with the European Union to decide on a final agreement for the UK divorce from the bloc. That meeting is set for October 18-19, and the proverbial plot has thickened as time draws closer to that looming date on the calendar. As we warned on Friday, a potentially contentious debate amongst PM Theresa May’s cabinet was on the cards for later in the afternoon. We weren't even really sure what was going to be debated until details started to flow late Friday night/early-Saturday morning; well after trading had closed for the week.

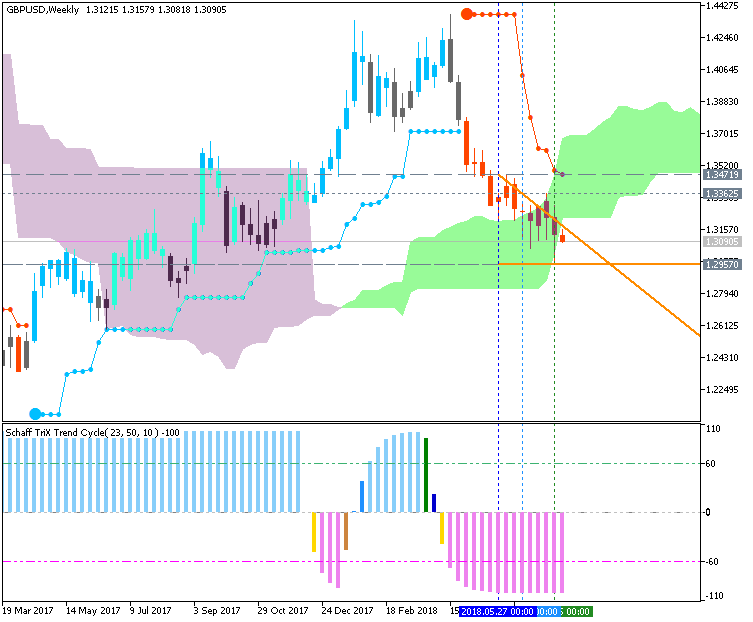

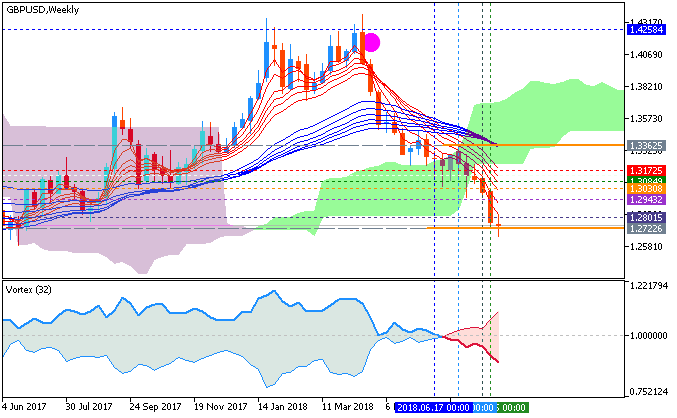

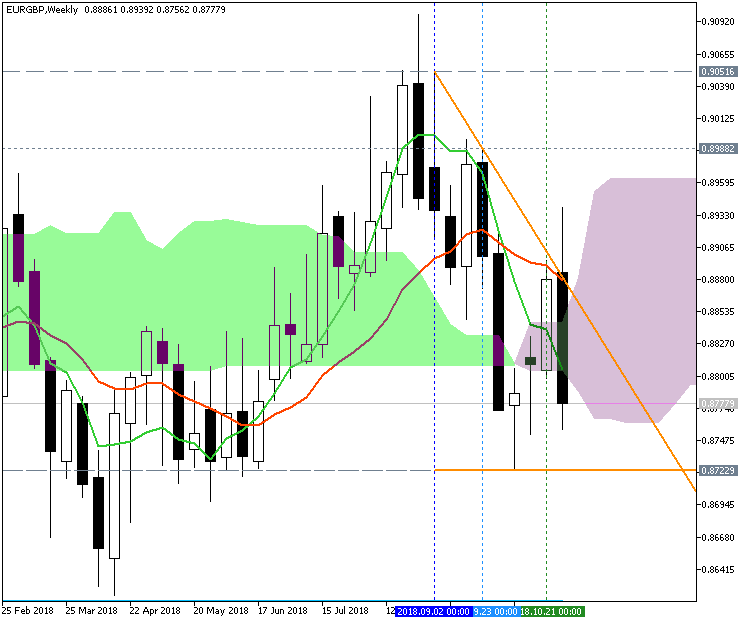

On a longer-term basis, the backdrop for continued weakness could be justified. But its noteworthy that we're basically in a digestion formation at this point: Prices broke-below the bullish trend-line that held the lows in the pair for the last nine months of 2017, and even helped to produce a support inflection in February. This bearish break of that bullish trend-line happened in May, and later in June, prices reflected off of the under-side of this trend-line projection. Since then, we haven't yet seen bears able to push down to fresh lows.

We've seen both lower-highs and higher-lows, indicating digestion after the earlier-year pick-up in volatility.

more...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks