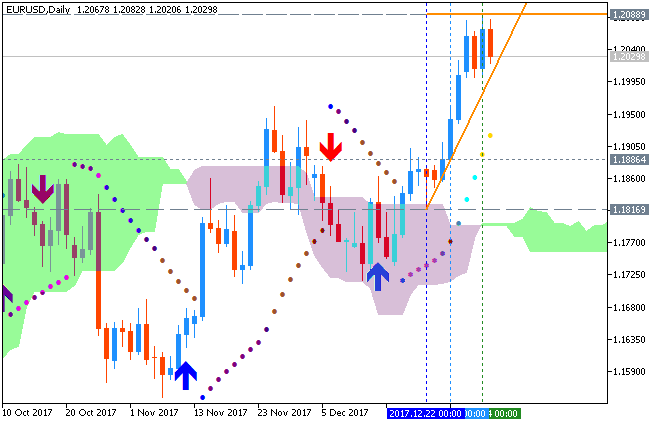

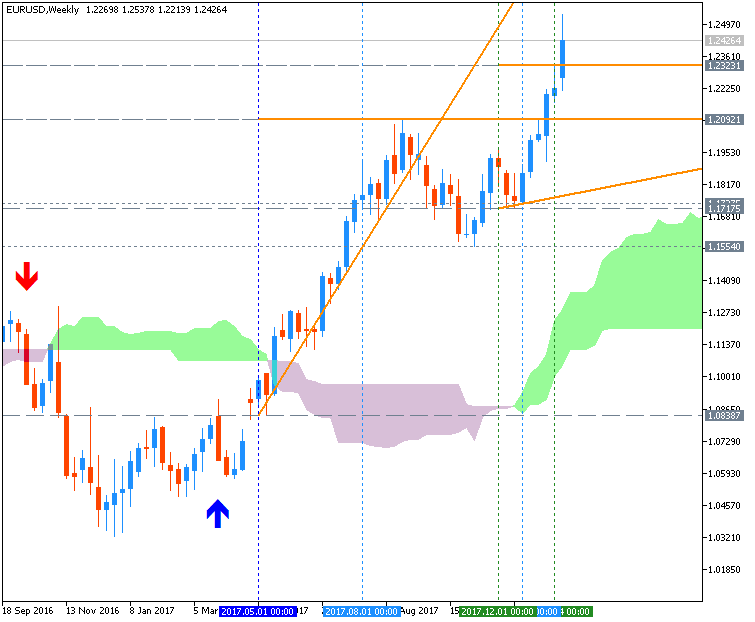

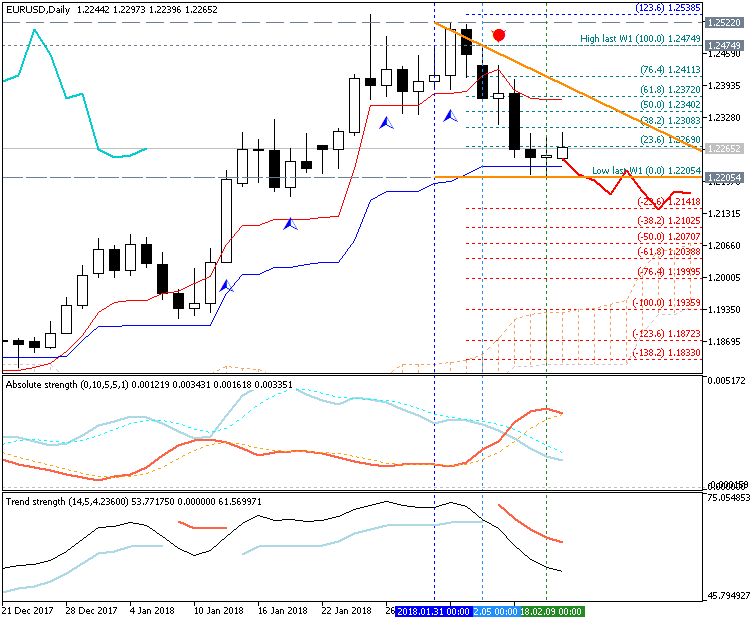

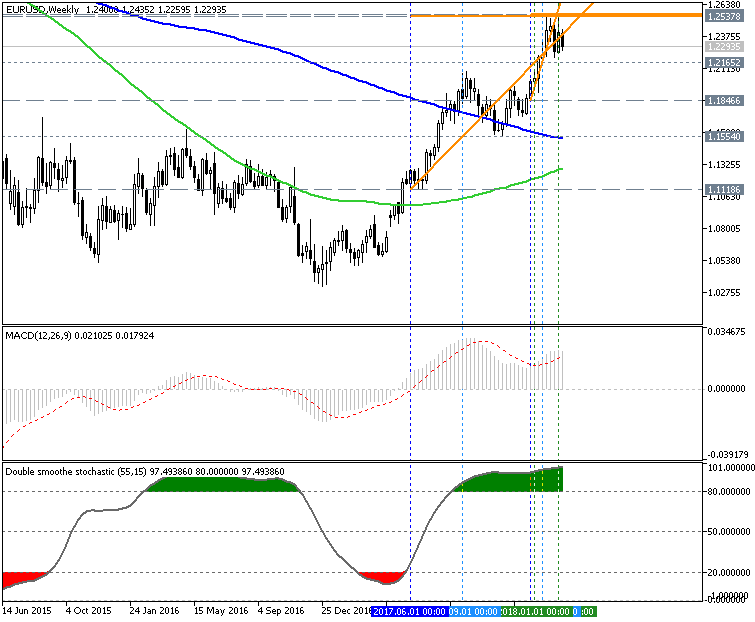

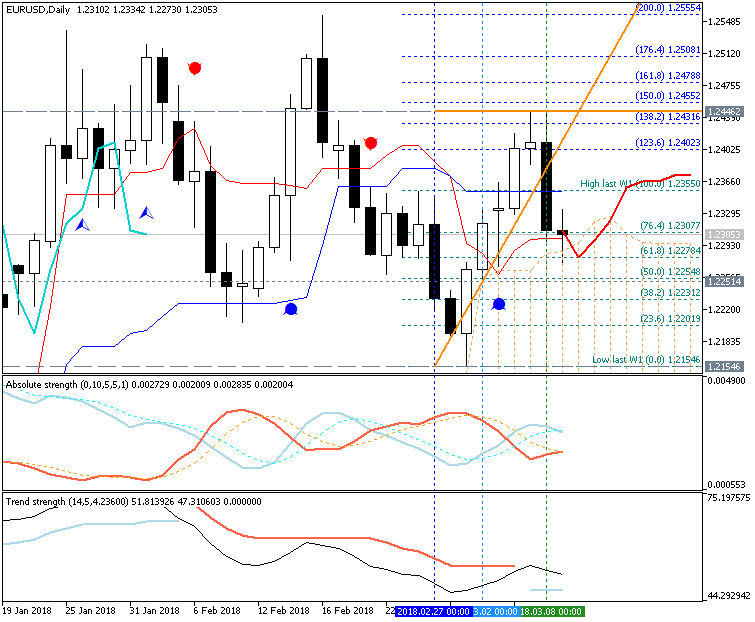

The euro concluded the first week of the year effectively where it started, with see-saw price action dominating trade. The indecision comes as no surprise given where it is currently trading. Last year’s high arriving around the 2012 low led to a fairly lengthy correction.

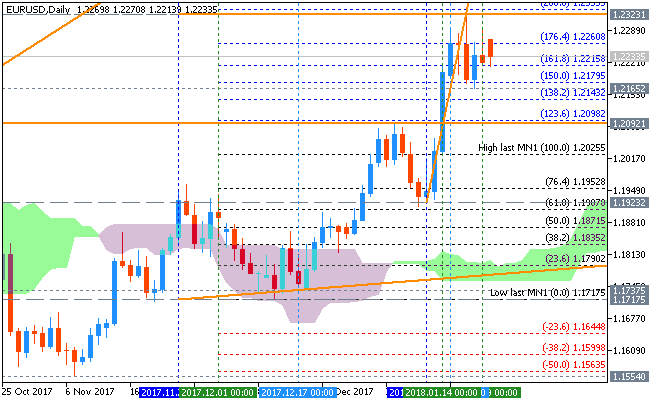

EUR/USD will need to break above 12092 to further along its move higher. The channel dating back to mid-December keeps the near-term bullish trend structure intact. As long as the lower parallel holds, then it shouldn’t be long before a breakout develops.

more...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks