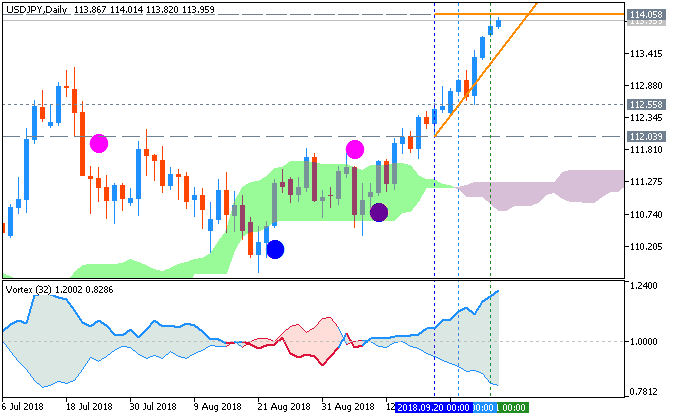

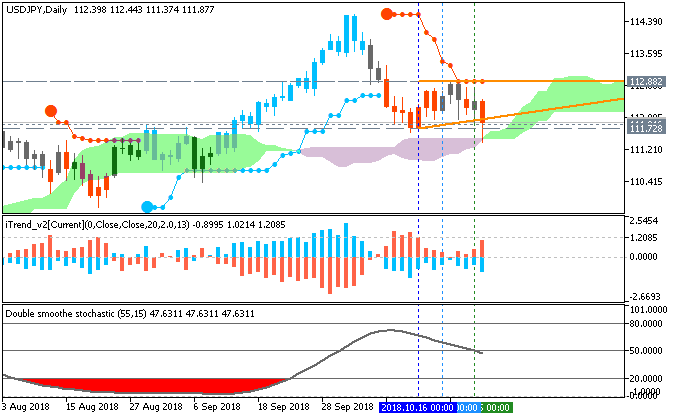

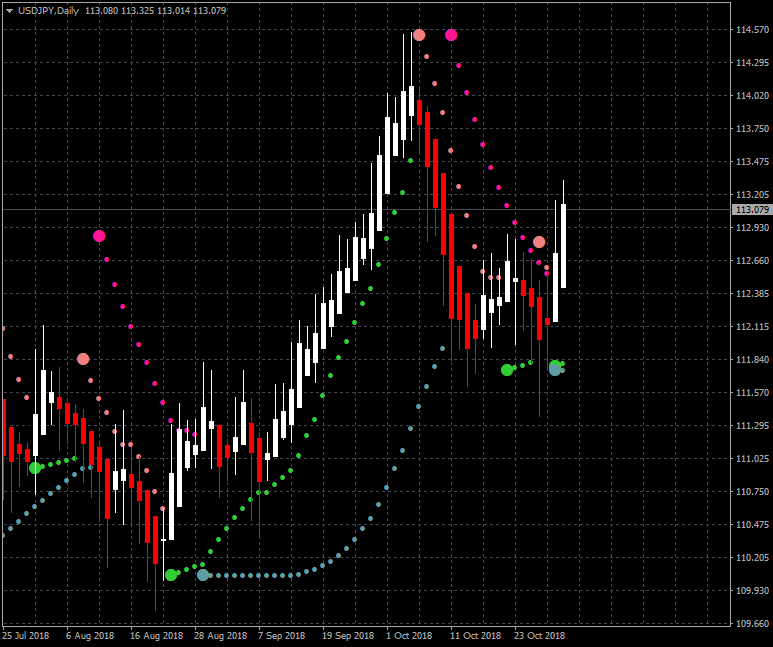

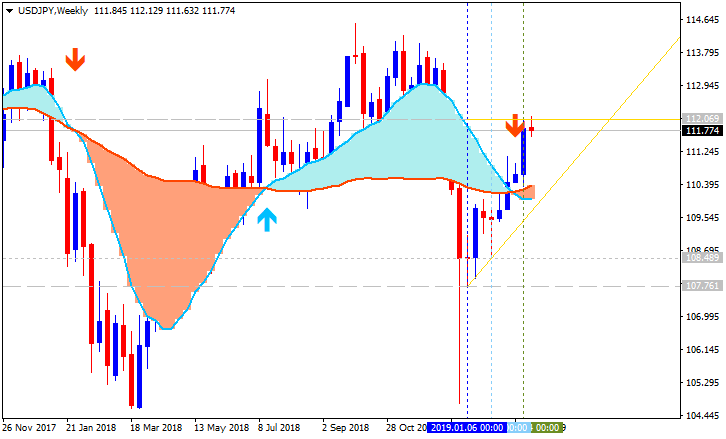

USDJPY: Retail trader data shows 34.9% of traders are net-long with the ratio of traders short to long at 1.87 to 1. In fact, traders have remained net-short since Sep 13 when USDJPY traded near 111.628; price has moved 2.1% higher since then. The number of traders net-long is 5.0% higher than yesterday and 10.3% lower from last week, while the number of traders net-short is 9.7% higher than yesterday and 32.5% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USDJPY prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USDJPY-bullish contrarian trading bias.

more...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks