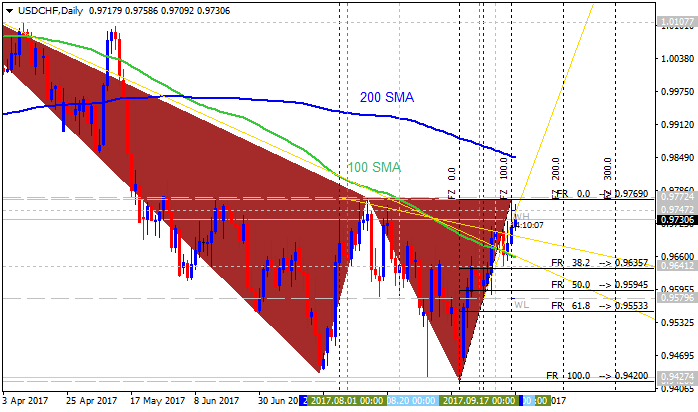

USD/CHF

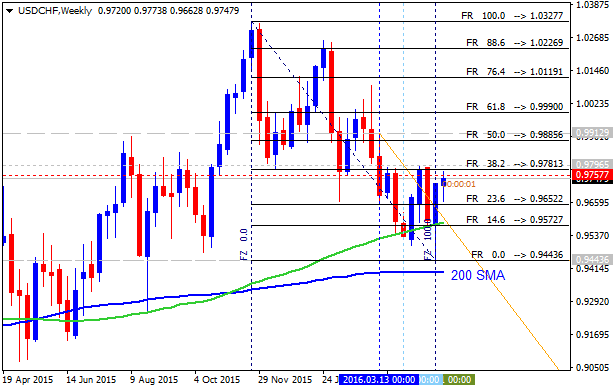

Weekly

-USD/CHF followed through on last week’s key reversal. The low is right at a 5 year trendline. In fact, this trendline crosses the lows from May 2014 and May 2015. As noted over at the daily section, “this week’s low is about as far as USD/CHF can go if price action from the November high is a wedge. Failure to hold here would risk weakness to the May 2015 low near .9070. Exceeding wedge resistance (currently mid-.9800s) would bolster bullish prospects.”

-Some extremely long term technical considerations are worthy of note when looking at USD/CHF.

more...

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks