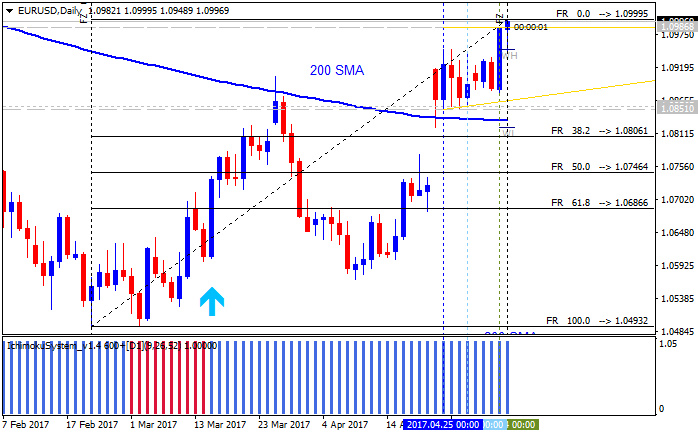

EUR/USD edged higher ahead of the second round of the French elections. Does it have more room to the upside? Apart from the elections, we have GDP and other events from the old continent.

- French elections round 2: Sunday, exit polls are at 18:00 GMT and real results will trickle around the market open.

- German Factory Orders: Monday, 6:00.

- Sentix Investor Confidence: Monday, 8:30. This business survey has advanced nicely in recent months, reaching 23.9 in April, beating expectations for the fourth consecutive month.

- German Industrial Production: Tuesday, 6:00.

- German Trade Balance: Tuesday, 6:00.

- French CPI (final): Tuesday, 6:45.

- French Industrial Production: Tuesday, 6:45.

- French Trade Balance: Wednesday, 6:45.

- ECB Economic Bulletin: Thursday, 8:00. Two weeks after Draghi was optimistic about growth but unsure about inflation, we will get more data from the central bank, the data they used for making their assessments.

- EU Economic Forecasts: Thursday, 9:00.

- German GDP: Friday, 6:00.

- German CPI (final): Friday, 6:00.

- French Non-Farm Payrolls: Friday, 9:00.

- Industrial production: Friday, 9:00.

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks