Credit Suisse, Barclays, UBS, SocGen: Where To Sell EUR/USD

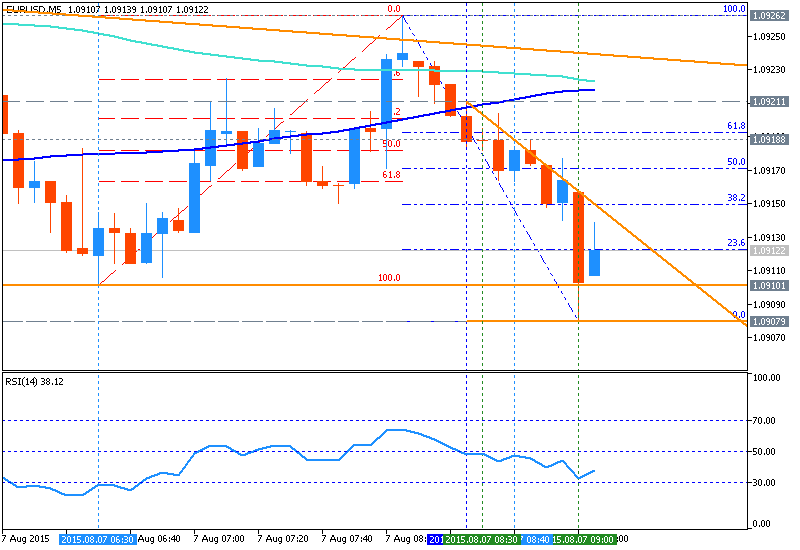

- Credit Suisse: "EURUSD has been capped below the 50% retracement of the recent fall and the 55-day average at 1.1117/32, and reversed lower. Beneath 1.0925 can open up a retest of the more important price lows at 1.0819/09. Near-term resistance moves to 1.1022. Above 1.1080/85 is needed to retest 1.1117/32."

- Barclays: "The move below nearby support in the 1.0925 area encourages our bearish view towards the 1.0810 lows. A break below 1.0810 would signal lower towards our next targets near 1.0675 and then the 1.0460 year-to-date lows."

- UBS: "We think the market will be keen to sell any rallies. We recommend a short closer to 1.0990, with a stop above 1.1120/30."

- SocGen: "EUR/USD has formed a probable double top at 1.1450/1.1536. Weekly RSI is retracing after testing 50% graphical level which highlights 1.1450/1.1536 as key. The pair looks poised to head towards confirmation level of the pattern at 1.08/1.0780, a break below which will signal a revisit of 1.05/1.04 with intermittent support at 1.07."

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks