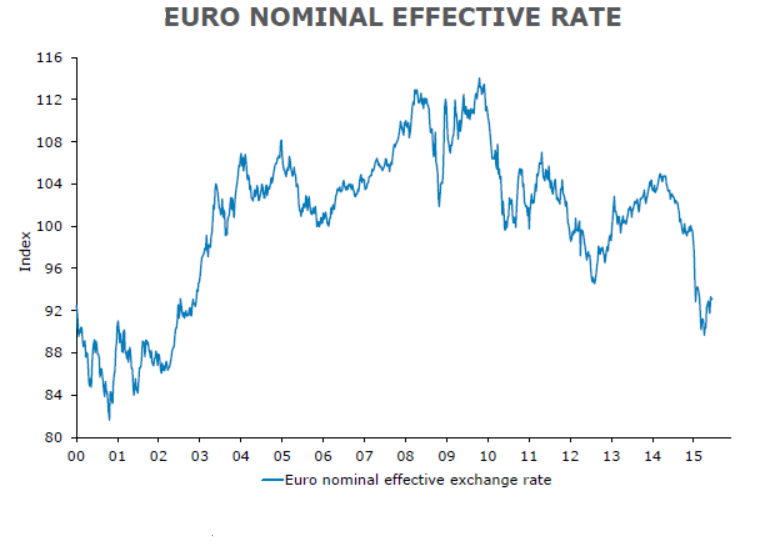

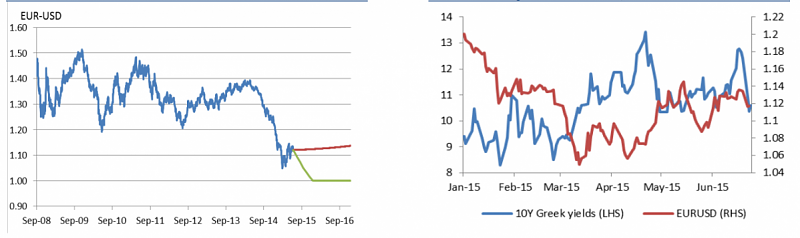

Australia and New Zealand Banking Group - the EUR/USD consolidating in a 1.10-1.15 range

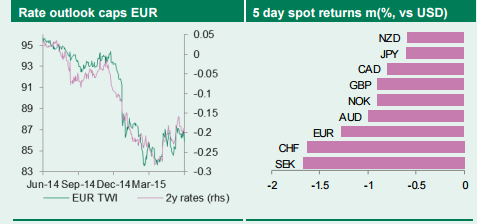

"A resolution to Greek debt negotiations may reduce downside risks, but a weak currency is needed to underpin the recovery...If anything, the risks to monetary policy are for additional QE as the current ECB forecasts are based on a full implementation of the existing program," ANZ argues.

"We therefore continue to see downside risks for the euro against the USD, especially as US growth is firming again and the FOMC seems closer to starting the interest rate normalisation process. We continue to advise selling rallies in EUR/USD," ANZ advises.

the source

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks