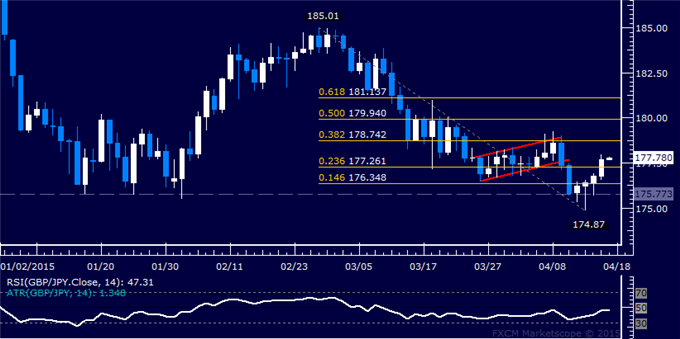

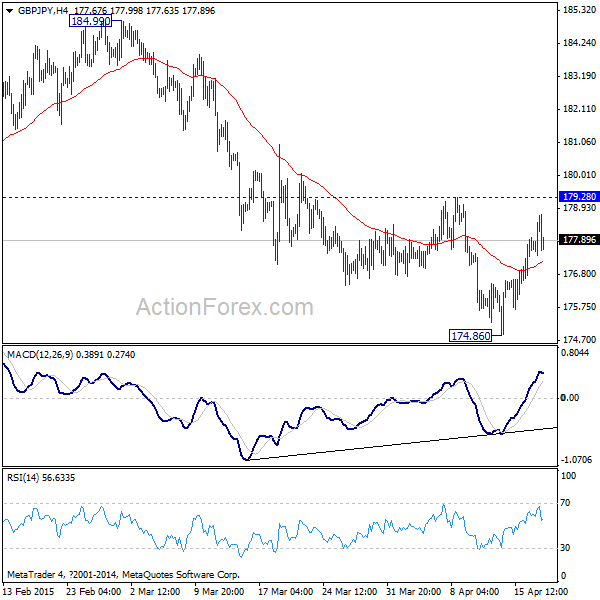

GBP/JPY Technical Analysis: Aiming Above 178.00 Figure

Talking Points:

- GBP/JPY Technical Strategy: Flat

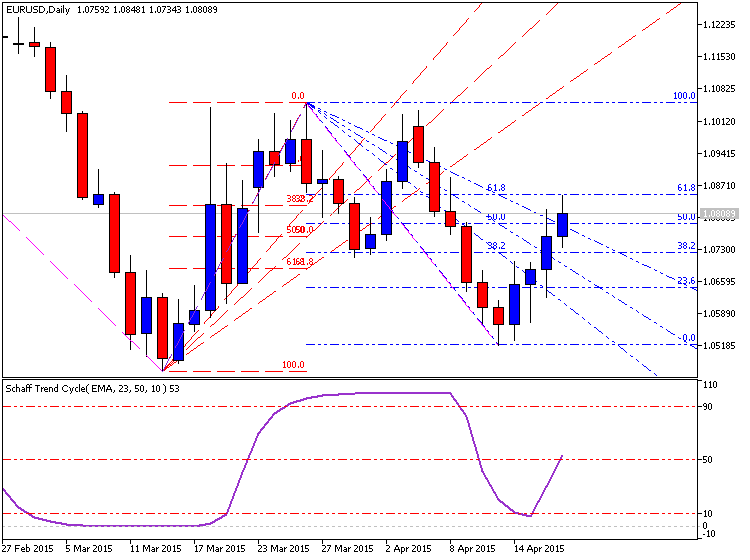

- Support: 177.26, 175.77, 174.87

- Resistance: 178.74, 179.94, 181.14

The British Pound rose for a fourth consecutive day against the Japanese Yen, with prices now eyeing resistance above the 178.00 figure. Near-term resistance is at 178.74, the 38.2% Fibonacci retracement, with a break above that on a daily closing basis exposing the 50% level at 179.94. Alternatively, a turn below the 23.6% Fib at 177.26 clears the way for a challenge of the 175.77-176.35 area (triple bottom, 14.6% retracement).

We see the overall GBPJPY trend as favoring the downside after last week’s break of the 12-month uptrend set from February 2014 lows. With that in mind, we will opt against entering long and treat on-coming gains as corrective, looking for the move to offer a selling opportunity once upside momentum is exhausted.

the source

LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks