GBP/USD: the pound does not want to decline

10/21/2019

The pound and GBP / USD have been rising since the beginning of this month and for the 4th week in a row, receiving support from the reduced risks of the “hard” Brexit. Despite the fact that Boris Johnson on Saturday failed to secure the support of the British Parliament regarding his Brexit deal, the pound did not lose a positive impulse. The members of parliament decided that a decisive vote can only be held after a thorough examination of all related legislation, which can take a considerable amount of time.

Johnson obeyed the decision of the Parliament, but in a separate letter addressed to the President of the European Council, Donald Tusk, asked the EU leaders to reject his own motion.

Despite the pound falling during the Asian session, at the beginning of the European session on Monday, the GBP / USD pair is growing again, rising to the level of 1.3011.

This week Johnson will again try to enlist the support of a sufficient number of legislators to approve the agreement. However, the likelihood of a hard Brexit is significantly reduced.

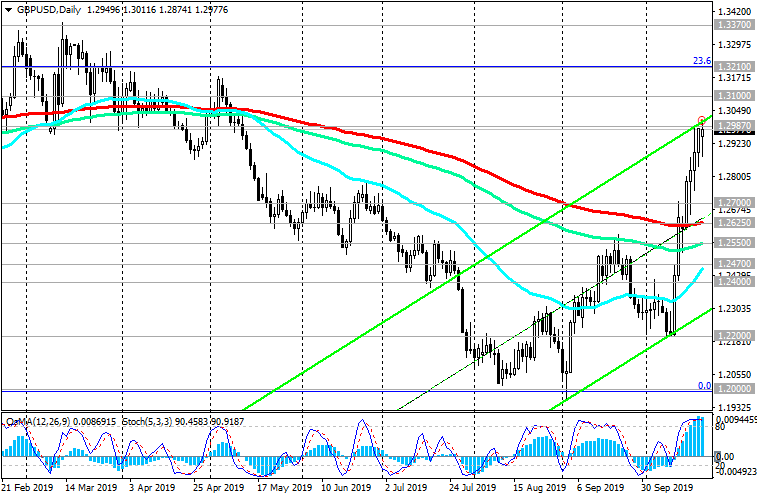

Earlier in October, GBP / USD broke through an important resistance level of 1.2625 (EMA200 on the daily chart) and today reached a new 5-month high near 1.3011,

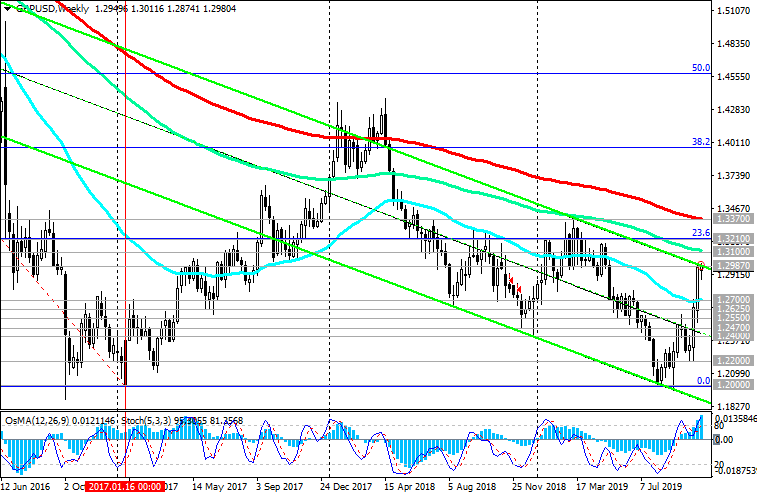

through which the upper boundary of the descending channel passes on the weekly chart.

A breakthrough of this resistance level will open the way for the growth of GBP / USD to the zone of resistance levels of 1.3100 (EMA144 on the weekly chart), 1.3210 (Fibonacci level 23.6% of the correction to the reduce the GBP / USD pair in a wave that began in July 2014 near the level of 1.7200) , 1.3370 (EMA200 on the weekly chart).

In an alternative scenario, a return to the zone below 1.2625 will indicate the resumption of the bearish trend of GBP / USD. The current goal of the decline is the support level of 1.2000 (2017 lows and the Fibonacci level of 0%).

So far, a positive impetus prevails, however, short positions below the support level of 1.2625 will again be preferred.

Support Levels: 1.2800, 1.2700, 1.2625, 1.2550, 1.2470, 1.2400, 1.2200, 1.2100, 1.2000

Resistance Levels: 1.3000, 1.3100, 1.3210, 1.3370

Trading Scenarios

Sell Stop 1.2870. Stop-Loss 1.3020. Take-Profit 1.2800, 1.2700, 1.2625, 1.2550, 1.2470, 1.2400, 1.2200, 1.2100, 1.2000

Buy Stop 1.3020. Stop-Loss 1.2870. Take-Profit 1.3100, 1.3210, 1.3370

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks