NZD/USD: Current Dynamics

15/07/2019

The US dollar continues to decline, while investors remain impressed by the statements of Fed Chairman Jerome Powell. Last week, Powell signaled the Fedís readiness to lower interest rates. Investors are waiting for such a decrease already at the Fed meeting on July 30-31. As Powell put it, the purpose of such a decline is to protect the American economy from the risks associated with a slowdown in global economic growth and the uncertainties created by conflicts in international trade.

Last Friday, another Fed official, President of the Federal Reserve Bank of Chicago and a member of the FOMC, Charles Evans, also spoke in favor of lowering interest rates in order to counteract inflation weakness. Evans expects two cuts in the federal funds key interest rate this year.

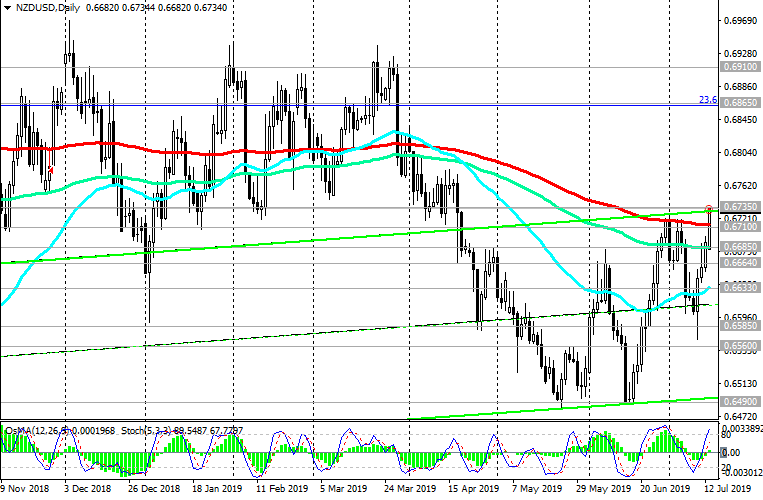

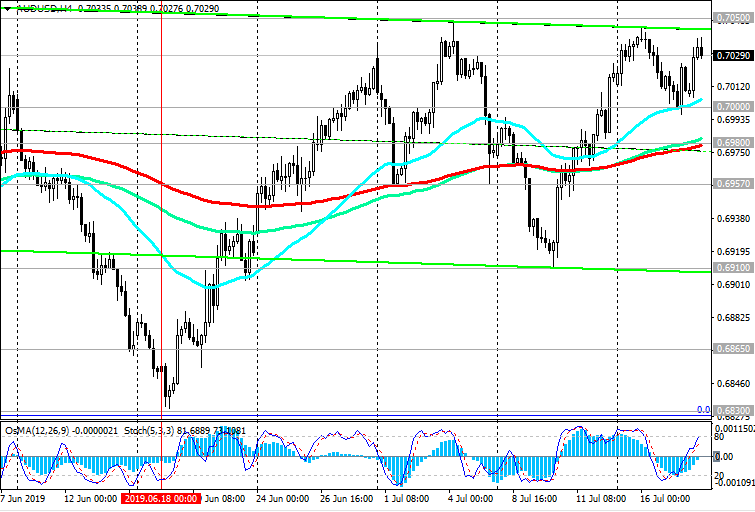

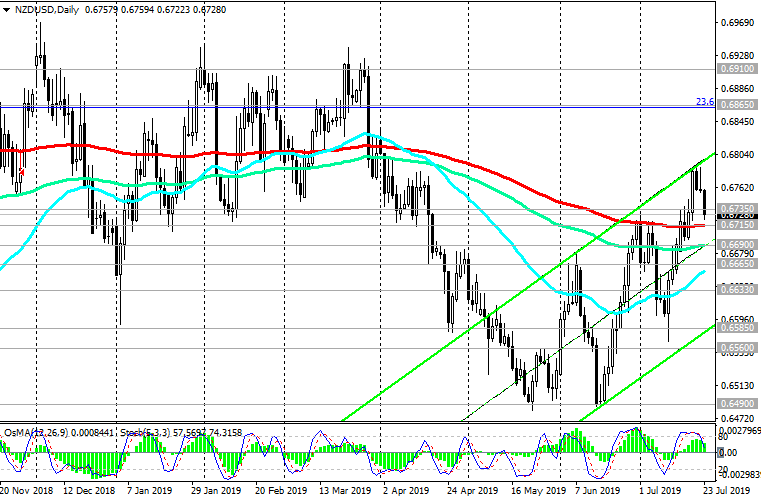

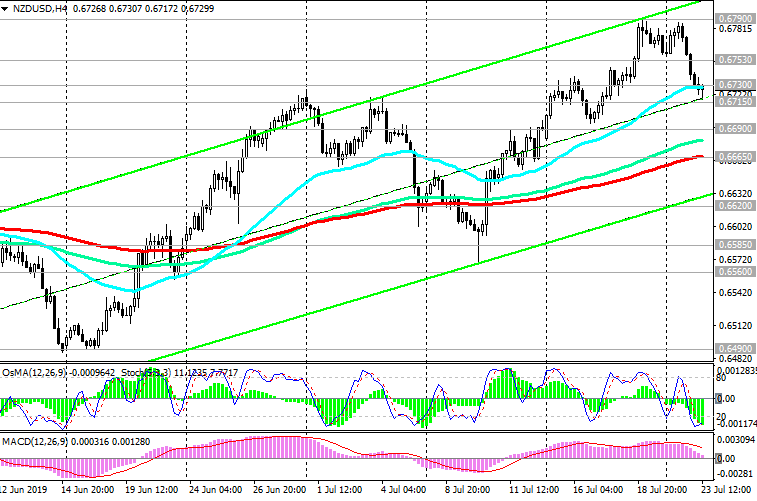

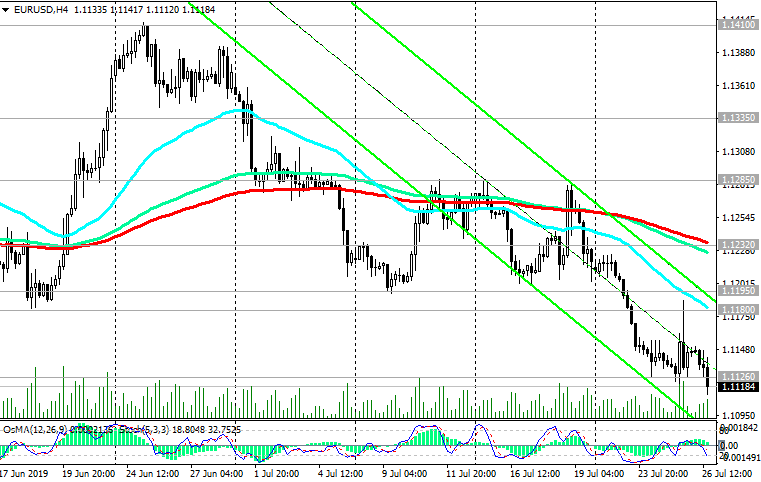

In the wake of the weakening of the US dollar, the NZD / USD pair broke through on Monday the key resistance level of 0.6710 (ЕМА200 on the daily chart) and continued to grow at the beginning of the European session, reaching another strong resistance level of 0.6735 (ЕМА50 on the daily chart).

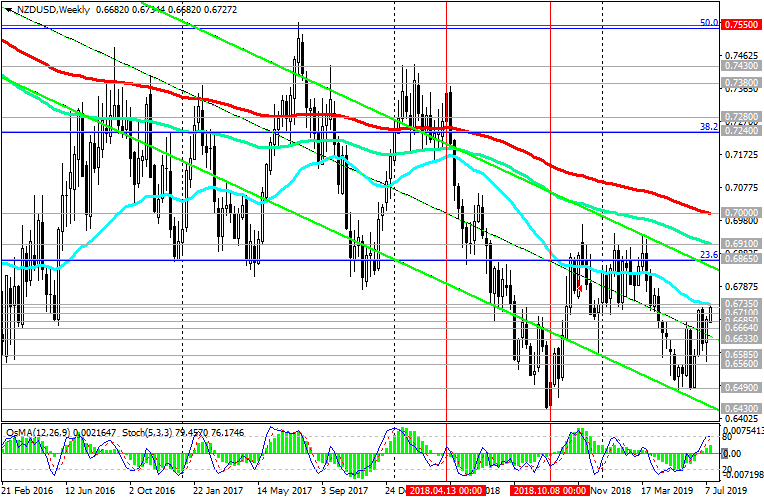

In case of consolidation in this zone, the growth of NZD / USD may continue towards the resistance levels of 0.6865 (Fibonacci level 23.6% of the upward correction in the global wave of the pair's decline from the level of 0.8820, which began in July 2014), 0.6910 (ЕМА144 on the weekly chart), 0.7000 (ЕМА200 on the weekly chart).

The signal for sales will be the breakdown of the support level of 0.6685 (EMA144 on the daily chart). Immediate targets of decline are at support levels of 0.6664 (ЕМА200 on the 1-hour chart), 0.6633 (ЕМА200 on the 4-hour chart).

The trigger for further NZD / USD movement may be the publication (at 22:45 GMT) of the consumer price index for New Zealand for the 2nd quarter, which is a key indicator for estimating inflation. If the forecast is confirmed (+ 0.6% against + 0.1% in the 1st quarter and + 1.7% against + 1.5% in the 1st quarter in annual terms)

the New Zealand dollar is likely to strengthen, including against the US dollar.

Levels of support: 0.6710, 0.6685, 0.6664, 0.6633, 0.6585, 0.6560, 0.6490, 0.6430, 0.6400, 0.6300, 0.6260

Resistance Levels: 0.6735, 0.6800, 0.6865, 0.6910

Trading Recommendations

Sell Stop 0.6680. Stop Loss 0.6745. Take-Profit 0.6664, 0.6633, 0.6585, 0.6560, 0.6490, 0.6430, 0.6400, 0.6300, 0.6260

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks