USD/CHF: Current dynamics_01/10/2018

Despite the decline against the Canadian dollar, the US dollar maintains a positive momentum in the foreign exchange market.

Futures on the dollar index DXY, which tracks the rate of the US currency against the basket of 6 other major currencies, is trading with a slight increase at the beginning of the European session, near the 94.77 mark.

This week, the attention of traders will be focused on the publication on Friday of data from the American labor market. According to the forecast, strong data is expected.

The average hourly wage of Americans increased by 0.3% in September, the number of new jobs created outside the agricultural sector increased by 188 00 (against +201 000 in August), the unemployment rate in September was 3.8% (against 3.9% in August). Forecasting the market reaction to the publication of indicators is often difficult. In any case, when these indicators are published, a surge in volatility is expected in the trades not only in USD, but throughout the financial market. Probably the most cautious investors will prefer to stay out of the market in this time period.

Nevertheless, if the data coincides with the forecast or will go better, then this will have a positive effect on the USD.

Last Wednesday, the Fed raised its benchmark interest rate by 0.25% to 2.25%, and Federal Reserve Chairman Powell confirmed the Fed's plans for another interest rate hike in 2018 and 3 rate increases in 2019.

The Fed, therefore, remains the world's single largest central bank, which is tightening monetary policy. And this, in the long run, should return to the dollar an upward trend.

At the meeting held in September, the Swiss National Bank kept its negative interest rates unchanged: the deposit rate was at -0.75%, the range for the 3-month LIBOR rate was between -1.25% and -0.25%. "The bank still considers it necessary to have a negative interest rate and is ready to intervene in the foreign exchange market, if the situation requires it",- the NBS said.

Frank still enjoys the status of a refugee currency, especially recently, amid a worsening trade conflict between the US and China.

Nevertheless, the increasing discrepancy in interest rates in the US and Switzerland will increase the investment attractiveness of the dollar against the franc, which will further increase USD / CHF.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

Support and resistance levels

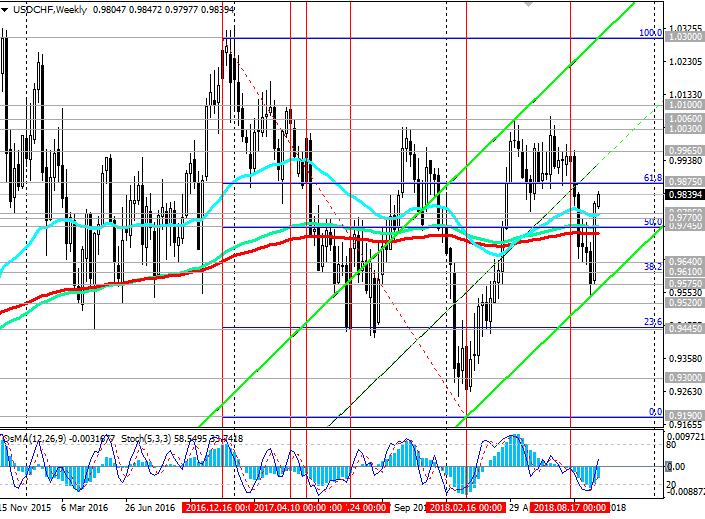

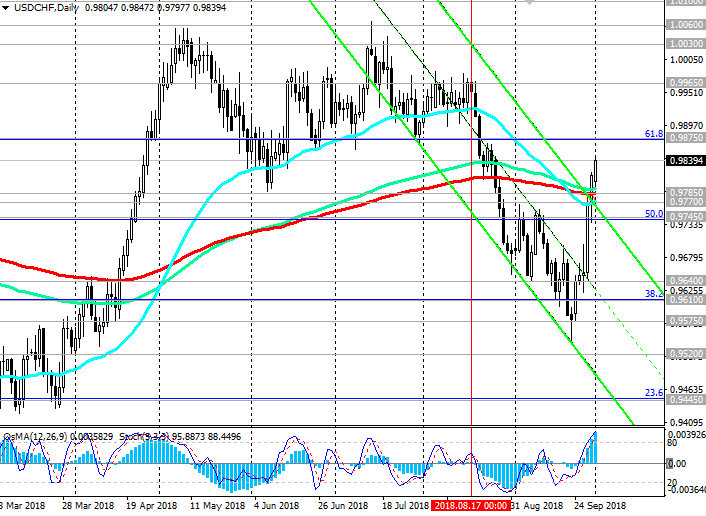

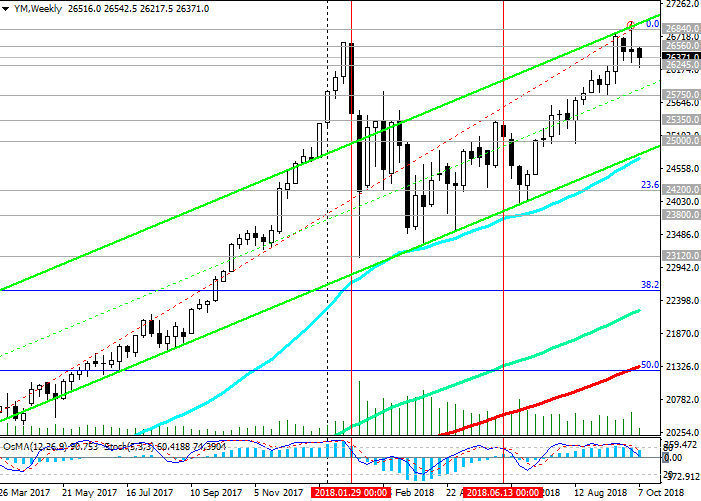

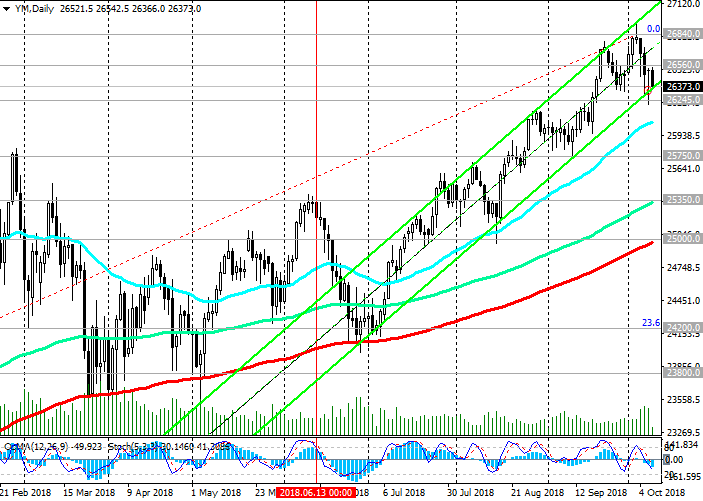

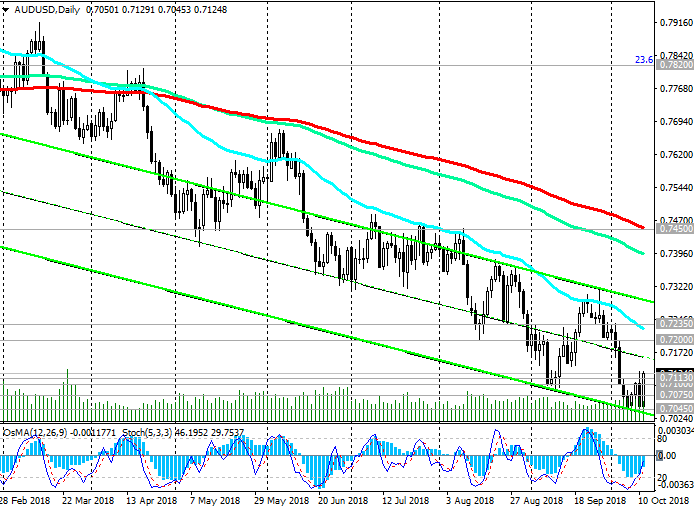

The pair USD / CHF broke through last week an important resistance level of 0.9785 (EMA200 on the daily chart) and continues to grow on Monday. The upper limit of the downtrend channel, in which the USD / CHF was declining since the middle of August USD / CHF, is also broken.

Thus, there was a strong signal, indicating a further increase in USD / CHF.

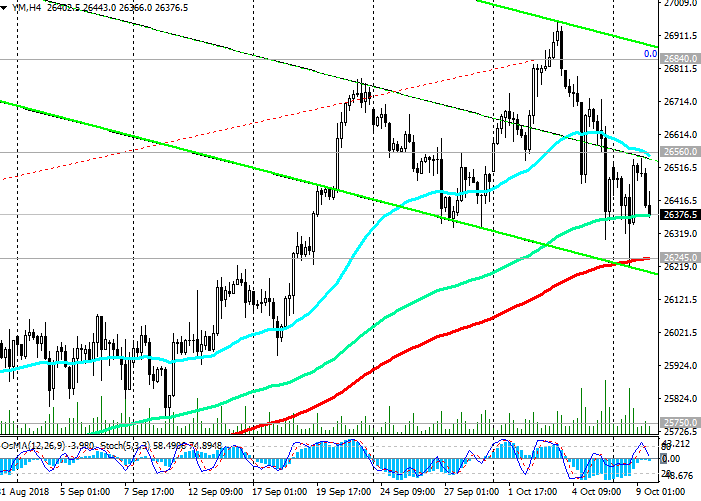

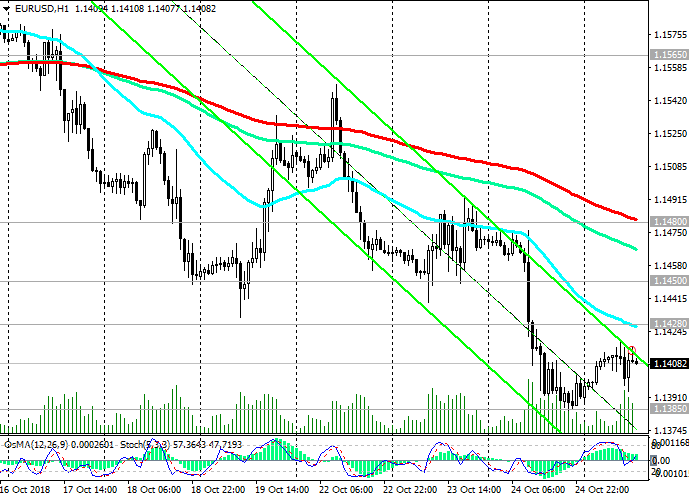

The OsMA and Stochastic indicators on the 4-hour, daily, weekly charts turned to long positions, confirming the rising dynamics of USD / CHF.

Break into the zone above the resistance level 0.9875 (the Fibonacci level of 61.8% of the upward correction to the last global wave of decline since December 2016 and from the level of 1.0300) will create prerequisites for further growth. The targets in this case will be the resistance levels 1.0100, 1.0300.

The signal for sales will be a return to the zone below the support level 0.9770 (EMA50 on the daily chart). The goals of the decline are 0.9575, 0.9520, 0.9445 (the Fibonacci level is 23.6%).

Support levels: 0.9785, 0.9770, 0.9745, 0.9640, 0.9610, 0.9575, 0.9520, 0.9445

Resistance levels: 0.9875, 0.9965, 1.0030, 1.0060

Trading Scenarios

Buy Stop 0.9850. Stop-Loss 0.9790. Take-Profit 0.9875, 0.9965, 1.0030, 1.0060

Sell Stop 0.9790. Stop-Loss 0.9850. Take-Profit 0.9770, 0.9745, 0.9640, 0.9610, 0.9575, 0.9520, 0.9445

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com

1Likes

1Likes LinkBack URL

LinkBack URL About LinkBacks

About LinkBacks

Reply With Quote

Reply With Quote

Bookmarks